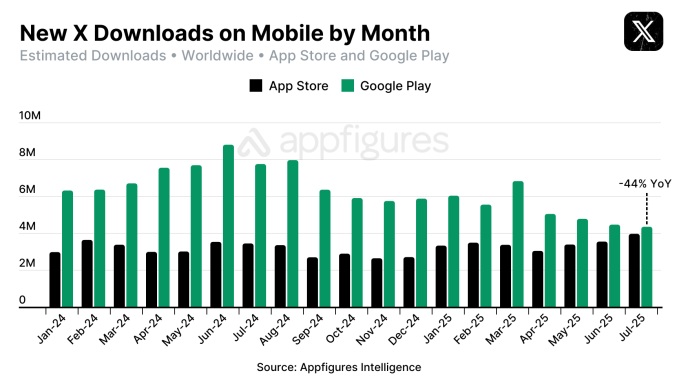

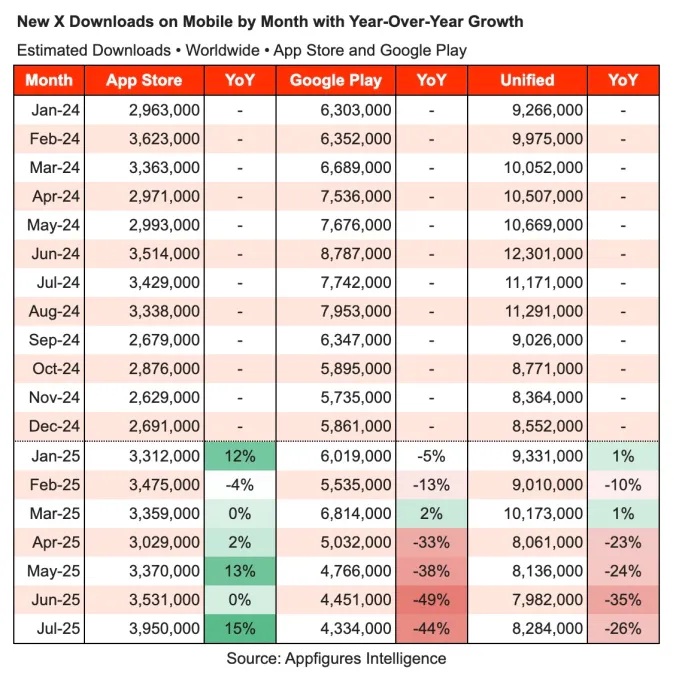

Elon Musk’s social media platform X is facing renewed struggles on Android devices, as fresh data reveals a sharp decline in new installs.

According to app intelligence provider Appfigures, X downloads on Google Play plunged by 44 percent year-on-year worldwide in July 2025, even as Apple’s App Store recorded a 15 percent increase in downloads during the same period.

The contrasting figures underscore a widening gap in user adoption across mobile platforms. While X continues to attract new users on iOS, the steep drop in Android installs is pulling down the platform’s overall performance. Total mobile downloads fell by 26 percent year-on-year in July, a slight improvement compared to June, when downloads had plummeted by 35 percent after Android installs nosedived by nearly half (49 percent).

Appfigures stopped short of fully explaining the decline on Android, but analysts have long flagged the poor state of X’s app on Google Play. The Android version is notorious for being buggy, unstable, and prone to frequent crashes, making it a sore point for the company.

In response, X’s recently appointed head of product, Nikita Bier, has hinted at major changes aimed at fixing the Android problem. Bier, best known for “growth hacking” social apps like Gas and TBH before selling them, announced that X was building what he called an “Android Dream Team” to completely rebuild the app. In a recent post on the platform, he claimed X’s iOS app had just recorded its best-ever week of installs, a move many observers interpreted as an effort to deflect attention from the Android slump.

The decline has also sparked questions about where disaffected Android users are going. Rival Bluesky, another Twitter alternative, has not capitalized meaningfully, as its own growth has slowed. Its Google Play app recorded just 119,000 downloads in July—tiny compared to the millions of monthly installs that X still attracts across platforms. However, Meta’s Threads appears to be gaining momentum, with its daily active users closing in on X’s figures, particularly on mobile. Some analysts suggest that a portion of Android users abandoning X may be moving to Threads.

Beyond user growth, X is also struggling to expand its subscription-based revenue. Appfigures data shows that in July, the company earned $16.9 million in net revenue from its premium services, down from $18.8 million in March 2025, though marginally up from $16.8 million in June. The stagnation underscores X’s difficulties in convincing users to pay for extra features.

A key factor in this revenue challenge is the rise of Grok, the AI chatbot built by Musk’s xAI startup and tightly integrated into X. While Grok was initially bundled into X’s subscription tiers, it now has its own standalone app that is drawing away users who had previously subscribed to X primarily for AI perks. This development has left X more reliant than ever on advertising for the bulk of its revenue—a business line that has been under pressure since Musk’s 2022 takeover, as advertisers pulled back over concerns about content moderation and brand safety.

The numbers paint a stark picture: X is enjoying growth among iOS users but is failing to capture or retain Android users at the same pace. The company’s hopes now rest on Bier’s team successfully revamping the Android app, even as it faces mounting competition from Meta and other emerging platforms.

With Musk’s ambitious push to transform X into an “everything app” still in motion, the latest figures highlight the structural hurdles the platform faces in its bid to remain central to online conversation.