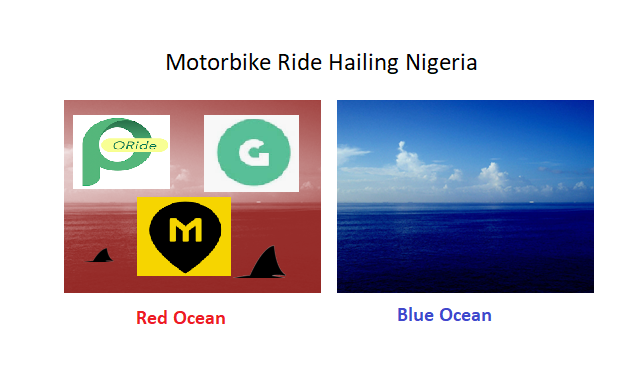

You might not be too familiar with those terms – blue ocean and red ocean – but I’d simplify them as I explain. Yesterday, I was reading through a post on Facebook; I’d say it was really insightful and I give kudos to the writer. He simply analysed the ride hailing market in Nigeria and how one brand takes over another brand. Matter of fact, I learnt from it because I haven’t been paying attention to the ride sharing industry in the country and I am beginning to see the positive side of it despite the fact that I had my issues and concerns about the sustainability of such an industry. Now, my mind is at rest so far.

In his article, he explained how Opera mini started ORide service with the game plan of having a huge share in the ride hailing market by tormenting the likes of Gokada and Max. I really love the strategy they implemented, and I must give kudos to them. However, he didn’t point out some cogent factors which is why I decided to write this post. From his analysis, ORide decided to charge the sum of two hundred naira for any trip around Lagos. Although, I’m not so sure if this is really true, however in such a location like Nigeria, people always want good value for cheaper prices. It happens in other countries though but Africans seem to like this a lot.

Here’s my point: ORide offers two hundred naira to a location that a startup like Gokada will charge five hundred naira. With time, you’d discover that people will quickly shift to using ORide service which will be a huge threat to the scaling of other ride hailing services. Good strategy, right?

But where’s the cash flow? You are trying to snuff out other start-ups, yet running at a loss; does it make sense? Yes, it does since ORide is owned by Opera with lots of capital. They can keep funding it from their other sources of revenue. Opera can be bleeding from that end, yet not run down, since it’s just one small arm of the company. They can continue till they own the market; then later adjust their prices.

However, this can not be possible if you’re a start-up. This post is addressed to start-ups on why it’s better to focus on a small blue ocean than dive in a red ocean.

Let me give a practical example and why I still do not see Bigi cola as a threat to Coca Cola even till date. Bigi Cola sells for a hundred naira while Coca-Cola sells for one hundred and fifty naira. It sounds quite intelligent that they used such opportunity to penetrate the market and are scaling. However, they are fighting a price war with Coca-Cola and a price war is a lost battle if you are a smaller company with lesser money.

Here’s why; Coca Cola is a big brand. Matter of fact, Coca Cola is in almost all countries in the world. They make their revenues from these countries altogether and they still penetrate more countries. Bigi Cola on the other hand is a Nigerian brand. It’s just developing in the market. Going on a price war is very risky. If they have a huge source of funding, fine, if they have other sources of revenue, fine. However, selling for hundred naira because Coca-Cola sells for one fifty over the same selling point is risky. Coca Cola can decide to go on a price war with Bigi Cola. They can reduce the price of their drinks to eighty Naira. Would it affect their brand value? Well, maybe but like I said, Africans always go for better product, cheaper quality.

Will Coca-Cola be running at a loss, definitely. However, it will be just be in Nigeria alone; they can at least balance it from other countries. The goal is to kill Bigi Cola. Will Bigi Cola want to go cheaper? Well, I don’t know how much money they do have.

Same thing with how Elon Musk started Tesla. He went on another different niche. He went for a blue ocean; uncontested all-electric car market. If you’re a startup, you don’t rush into a red ocean. Red ocean is full of competition. Your goal should be stability and cash flow not competition. How much do you have?

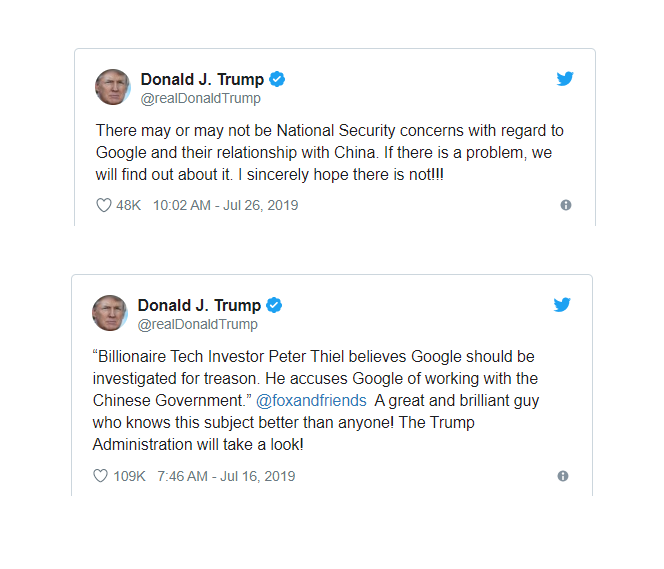

Did Jeff Bezos try the the low price strategy with Amazon? Yes, he did. He didn’t make money for years, he was acquiring customers. Microsoft also played monopoly. It’s possible to go heads on if you have the money. Luckily for you, you can displace the existing company or companies.

All Together

If you’re just starting, a small blue ocean is your best bet. This doesn’t mean you cannot scale in the red ocean where there are sharks and all. You might bleed to death if you don’t have what it takes to survive in the contested red ocean.

So just like ORide is trying to beat other ride hailing services, I think it has a good bet on the strategy since it has the capital and size. But that does not mean that the red ocean model can work for all startups.