By Nnamdi Odumody

Seamfix is a technology company founded by Chimezie Emewulu, Chibuzor Onwurah and two other partners in 2007. They began with N75,000 to solve some of the frictions in identity management in Nigeria. With offices in Lagos, Calabar and Enugu, and staff strength of over 100, they have provided cutting edge solutions which are used in diverse industries. Over the years, they have built systems with footprints in Identity Management, Digitization, Lending, Business Solutions and Customized Services. You can call this entity a digital conglomerate.

Seamfix provides solutions that enable organizations to seamlessly capture, onboard, verify and digitize identities of customers and their documents in real time

These Seamfix solutions include:

BioSmart KYC Suite: This is a SIM registration solution for Telcos. It is an integrated, enterprise scalable, robust and highly dynamic platform for end to end Know Your Customer(KYC) processes which range from Capture of Customer Details, Customer Identification, Customer|User Management, Customer Detail Validation, Robust Management & Reporting. BioSmart KYC Suite is a proprietary, innovative and first-in-industry compliant tool which automates the entire KYC process for both new and existing customers. Data on the BioSmart KYC client and remote servers are encrypted to enhanced security. BioSmart KYC Suite is developed primarily for businesses interfacing with large number of customers or subscribers (Telcos)

BioRegistra: BioRegistra is a proprietary innovative and state of the art online platform developed primarily for individuals or business owners to enable them capture and store any form of information. It provides the convenience, flexibility and dynamism which allow the set up and configuration of information to be captured with the sole purpose of achieving a customer desired end requirements. The platform enables easy capture and convenient access of data at any time and from anywhere.

Autotopup.ng: Autotopup.ng operates independently as a standalone intelligent solution developed to strictly adhere to instructions given by you; to monitor your account balance for when it is running low and automatically recharge your phone with sufficient airtime directly from your bank account to make sure you never run out of airtime. Other services include scheduled airtime and instant recharge.

ITranscript: This is a web application platform for managing online requests and processing of requested transcript. This web application has two major components; the transcript request and verification platform. It makes the processing of transcript easier, faster and more convenient saving alumni the hassles of travelling down to their schools to apply for their transcripts.

Verified.ng is an online identity validation service developed to solve the challenge of validating the authenticity of an individual’s identity. It runs on a robust engine that connects to multiple sources of variable data to meet the identity validation requirement of businesses in Nigeria. The usage of this platform spans across businesses, government and individuals with the purpose of bridging the infrastructural gap with regards to identity security.

FuelVoucher is an alternative means of purchasing fuel without the use of cash, cards or paper vouchers. It completely automates and provides a management interface of the fueling process to organizations. With FuelVoucher, you can remotely send electronic FuelVouchers to drivers and or stranded employees or friends without having to worry about sending them physical cash. The vouchers can then be easily redeemed at the nearest participating station.

LoanPair is an online platform that connects borrowers and lenders for the sole purpose of performing loan transactions. This platform cuts out the traditional protocols and establishes a modernized way of getting loans. The platform does not provide the funds but acts as facilitators to both the loan seeker and loan giver. It offers an Automated Payback Process, Identity validation through their user validation process, Negotiation in real time between the lender and borrower with no third party, Activity analysis that monitors your activity on LoanPair, Instantaneous information on request dealings and The Pro-Lender feature.

PrimePayroll: PrimePayroll is an enterprise cloud service for payroll and human resource management. It is safe, efficient and simple to use with zero upfront investment. Its payroll system gives you the freedom and flexibility required to grow your business

Like this:

Like Loading...

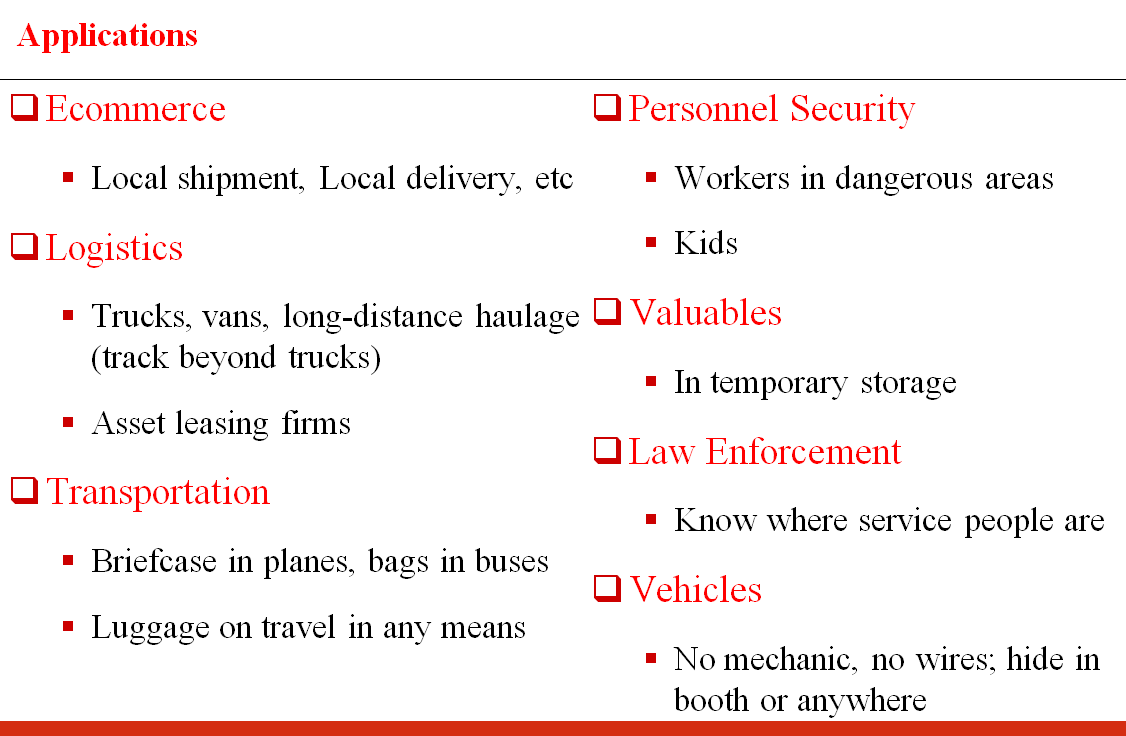

Zenvus Loci application areas

Zenvus Loci application areas