Across most African capitals, a new movement is taking place. Young people with their chisels, laptops and hammers are congregating and working to grab the future in their own hands. They are the makers with enclaves of hackers, enthusiasts, hobbyists, artisans and indeed people with the mindsets to revolutionize Africa from within, by doing something […]

About the Author – Ndubuisi Ekekwe, PhD

Short Bio: Prof Ndubuisi Ekekwe invented and patented a robotic system used in minimal invasive medical robots. The United States Government acquired assignee rights to the technology in 2017. Dr Ekekwe holds two doctoral and four master’s degrees including PhD in electrical and computer engineering from the Johns Hopkins University, USA. He earned B.Eng electrical and electronics engineering from Federal University of Technology Owerri where he graduated as his class best graduating student.

While in Analog Devices Corp, he worked in the team that designed an accelerometer for the iPhone and he created the company’s first wafer level chip scale package for inertial sensors.

A recipient of IGI Global “Book of the Year” Award, a TED Fellow, IBM Global Entrepreneur and World Economic Forum Young Global Leader, Dr Ekekwe has held professorships in Carnegie Mellon University and Babcock University, and served in the United States National Science Foundation ERC E&D Committee.

The founder of Zenvus, a global leading precision ag tech company, and Chairman of Fasmicro Group, writes regularly in the Harvard Business Review. Dr. Ekekwe is a selection board member of the $100 Million Tony Elumelu Entrepreneurship Program.

Bio: Dr. Ndubuisi Ekekwe holds two doctoral and four master’s degrees including a PhD in electrical & computer engineering from the Johns Hopkins University, USA and MBA from the University of Calabar, Nigeria. He obtained BEng from Federal University of Technology, Owerri (Nigeria) where he graduated as his class’ best student.

A US semiconductor industry veteran, his working experiences include Diamond Bank, Analog Devices Corp and NNPC. In Analog Devices, he worked in the team that designed a generation accelerometer for the iPhone, and he created the company’s first wafer level chip scale package for inertial sensor.

He writes regularly in the Harvard Business Review, and previously served in the United States National Science Foundation Engineering Research Center E&D Committee for four years. He was also a PACE Chairman and Gold Chairman of IEEE Boston section. Prof Ekekwe is a Co-Chairman of JPL Financial Group, a California-based financial advisory firm which syndicates capital for projects in Africa.

An inventor, author, he held professorships in electrical & computer engineering, Babcock University, and Carnegie Mellon University electrical/computer engineering. He is the recipient of IGI Global 2010 “Book of the Year” Award. He is also a TED Fellow, IBM Global Entrepreneur and World Economic Forum “Young Global Leader”.

As the Founder/Chairman of Fasmicro Group, he controls companies like Zenvus, an agtech pioneer in Africa; First Atlantic Cybersecurity Institute (Facyber); Milonics Analytics, an IBM PartnerWorld member; First Atlantic Semiconductor & Microelectronics; among others. He recently co-founded Atlantic Americas, an engineering firm, handling major operations in most parts of northern Nigeria.

Dr. Ekekwe is a selection board member of the $100 Million Tony Elumelu Entrepreneurship Program. He has written many books, authored many technical papers, and invented technologies. The African Leadership Network has honored him as a “New Generation Leader for Africa”.

Preamble

For centuries, Africans devised means to survive. They mastered the herbs and cured the most poisonous snake bites, melted iron and made cutlasses and hoes, and formulated compounds and fixed broken bones. The Egyptians pioneered the field of geometry, out of the need to re-partition plots of land near River Nile, whenever it overflowed its banks. The Ethiopians invented an indigenous way of writing, and documented some of the earliest components of African history. The ancient trade routes from Accra through Kano to Khartoum were anchored on the ingenuity of Africans who dyed clothes, transformed hides into leather, and improved agricultural yields through self-taught farming mechanisms like fallow and erosion control. Yet, Africa had a dark period through the vagaries of slavery and self-inflicted tragedies of wars that destroyed a virtuoso system of innovation built and refined over generations.

But the good news is that Africa is emerging again, stronger. It is a land of Sankofa innovation where legends painstakingly reach back, pick old ideas on processes, concepts and tools, and improve on them, while applying new techniques. In the east, west, north and south, the spirit of innovation is being rekindled in the continent. There are sparks of African innovators who want to drive Africa’s future in their hands. They have noticed that years of mining metal and drilling hydrocarbons have not accelerated the welfare of the citizens. For them, the best roadmap for sustainable and equitable economic development, where GDP growths correlate with better living standards with better jobs and opportunities, will be African-driven and Africa-led. They envision a future where homegrown common sense policies that understand the African realities are enacted to drive trade and entrepreneurship. The results are triple helix partnerships across the continent with governments reforming, industry innovating and training being revamped.

Sankofa is a word in the Twi language of Ghana that translates as “Go back and get it” (san – to return; ko – to go; fa – to fetch, to seek and take) and also refers to the Asante Adinkra symbol represented either with a stylized heart shape or by a bird with its head turned backwards carrying a precious egg in its mouth. Sankofa is often associated with the proverb, “Se wo were fi na wosankofa a yenkyi,” which translates as: “It is not wrong to go back for that which you have forgotten.” (Wikipedia)

Indeed from Lusaka to Dakar, new innovation ecosystems are being formed. These are innovation spaces where Africans are congregating to create products and services that solve local problems. The players are students, makers, artisans and grassroots innovators. Some want to transform consumers of increasingly foreign obfuscated technology that permeate daily lives of Africans, into producers and creators of what they use. It is a movement, and the world is paying attention; investors are opening their wallets, the press is writing about them, and more African diasporas are coming home to join them.

While it is very early to assess the impacts, it is already clear that these innovators offer a platform for a new economic system that taps into the brainpower of Africans to seed shared prosperity. If they succeed in replicating the wonders of Kenya’s financial sector, through mPesa, that enables a mother to pay a child’s school fees on her way to the farm instead of spending a day in the bank in other business areas, Africa will exert greater influence in the world. The continent is already seeing marks of relative pre-eminent technology production cities with Nairobi in East Africa, Lagos in West Africa and Cape Town in Southern Africa.

Though there are challenges in infrastructure, education and property rights, which need to be fixed for the effervescence of change in the makerspaces and hackerspaces around the continent to become anchor firms, with capacities to provide thousands of jobs and other opportunities, the future is one of hope. The resilience of the African people is unprecedented because when the world called them “hopeless”, “dark” and “forgotten”, they persevered and today no other people can take the credit of the progress in Africa than Africans. All the challenges are opportunities for young Africans, and they will lead in fixing them.

In this book, we share inspiring stories of innovation in Africa. We chronicle the redesign taking place in the innovation ecosystem of the continent. We provide analyses on how the continent can strengthen its march to greatness by connecting the rich informal sector into mainstream ones for scalability. These analyses are not just our ideas; we tapped into the rich knowledge base of African innovators and innovation enablers.

Around the world, the study of innovation has a unique methodology and format: R&D data and patents are usually the reference points for understanding innovations in science and technology, especially in developed nations. Their numbers always correlate to inclusive domestic economic growth and participation in the global economy. By looking at the data, one can appraise the strengths of knowledge creation, R&D impacts and economic innovation. R&D data in Africa is patchy while patent data is limited for any major inference and deduction. So, we devised different ways to assess the innovation ecosystems in Africa.

We designed a survey[1] which was sent through different networks to innovators and innovation enablers across Africa. The survey was designed to understand the perspective of thought-leaders and innovators on the state of S&T innovation in the region, the form and its trajectory. It was not structured for the data gathered to be extrapolated to represent any population through sampling. We merely sought for opinions and insights. More than 1,000 participants completed the surveys —administered in three languages (English, Portuguese and French) — and spoke with our team. Participants from 32 countries participated. Supporting the survey was extensive desk research and interviews with technology thought-leaders. Insights from these surveys and interviews were used in different chapters of this work.

The African Institution of Technology (AFRIT) has an in-depth database of African innovators and innovation enablers. The surveys were sent to the contacts, social media and Africa-focused news sites. It was also promoted in an article in the Harvard Business Review. The survey data was collected, analyzed and then incorporated into the book.

Also, in our analysis, we looked at a recent survey conducted by African Science Technology and Innovation Indicators initiative (a program of Africa Union’s New Partnership for Africa’s Development) that covered 19 African countries: Angola, Burkina Faso, Cape Verde, Egypt, Ethiopia, Gabon, Ghana, Kenya, Lesotho, Malawi, Mali, Mozambique, Namibia, Senegal, South Africa, Tanzania, Togo, Uganda, and Zimbabwe[2]. They focused on R&D data with two key R&D indicators — gross domestic expenditure on research and development (GERD), and human resources devoted to R&D to assess innovation outlook in Africa. R&D data collected included those from business enterprise, government, higher education and private non-profit sectors. The work underpinned that by measuring science, technology, and innovation indicators, comparisons at national and regional levels can be made. Also it noted that indicators are critical for policy formulation, performance assessments, accountability, and market participations as investors can use such insights to evaluate ecosystem development. The perspectives from this important NEPAD work were important in our efforts in understanding governments’ innovation strategies across the continent.

Though we have used Africa in the broad sense, it is very evident that recommendations cannot be universally applied, without customizations, across countries. Also, while a continental innovation plan will be important, a regional one will serve Africa better owing to the disparity in the levels of development. We envisage a more actionable roadmap to accelerate the pace of reforms and development so that Africa can take advantages of the present economic optimism.

Finally, I thank individuals, entrepreneurs, innovators, companies, government agencies, universities and thought-leaders who took our surveys, offered their time via interviews, or assisted in this work. The reality is that my LinkedIn page is my most important source of real-time insights on Africa and its position in the world. I sincerely thank those that comment on my page for the daily perspectives which continue to shape my understanding of the continent and the world. I close by thanking my family, especially my wife Ifeoma, for being the best friend possible.

I hope you will enjoy this book.

Ndubuisi Ekekwe, PhD

African Institution of Technology

September 2017

[1] The African Institution of Technology has relationships with more than 100 universities and institutions in Africa

[2] NEPAD (2014), African Innovation Outlook II

Beyond Samsung Galaxy, Apple Attacks The Root Of The Competition

This is a Short Note.

Apple wants to have a plan B on its business relationship with Samsung Electronics. It is working with Bain Capital to buy Toshiba’s flash memory business which is on sale. Toshiba is selling the business to help it manage debt stemming from its investments in the US nuclear sector which went terribly bad.

The iPhone maker is in talks with Bain Capital to bid for the Tokyo-based company’s unit, in competition with a group that includes KKR & Co. and Western Digital Corp., according to people familiar with the matter. Bain had previously submitted a 2.1 trillion yen ($19 billion) offer with another group of backers that included state-backed Innovation Network Corp. of Japan and Development Bank of Japan.

Apple depends on flash memory from Toshiba in its iPhones and iPods, and wants a continued supply so it’s not dependent on rival Samsung Electronics Co. “There are supply shortages of that type of memory,” Michael Walkley, an analyst with Canaccord Genuity. “They’re always looking to work closely with key suppliers and lock in long-term supply agreements.”

What Apple is planning makes sense because Samsung is clearly its main smartphone competitor. By sending the money to Samsung, for supplies of chips, it is arming the opponent. I see three ways why this deal is good for Apple:

- Apple will be the new Toshiba flash business main customer. That means Apple is buying a business where it will be the biggest customer. That is a good strategy especially when that means not sending money to Samsung, a competitor

- In the short-time, this is a huge capex, but over time, Apple will benefit. The price of flash memory will likely come down when Samsung knows that Apple is no more in the market to source. So in a scenario where the new Toshiba flash business cannot meet Apple’s demand in volume, Apple could end up buying from Samsung at a more competitive rate. Samsung cannot sell to Apple at more than market rate, by law, even though Apple is a competitor.

- Apple has billions of dollars stocked outside United States. It does not want to pay taxes on this fund and continues to leave them outside U.S. The implication is that it can use some of those funds and do this deal.

Yet, it is not likely that Apple/Bain Capital will get this business. It is not certain Western Digital will give up as it continues to fight for this prized asset.

Western Digital Corp’s (WDC.O) CEO apologized to his counterpart at Toshiba Corp (6502.T) for strained ties after the U.S. firm sued to keep their chip joint venture from being sold to rival bidders, according to an Aug. 11 letter

The embattled Japanese conglomerate has put its chip unit, – worth between $17 billion to $18 billion, up for sale as it scrambles to cover liabilities at its bankrupt U.S. nuclear unit. Relations between Western Digital and its chips partner quickly frayed, however, as Toshiba entertained other bids.

While the Western Digital consortium can fight, to get the business, it is not clear that Japan will like to see Toshiba flash business disappear in this way. So, it is possible the government could mount a bailout.

All Together

Generally, the lesson is this: it does not make sense for any person to fund an army that will attack it. Apple has funded Samsung, providing the cash which continues to make the company better through innovation and scale. As that happens, Samsung is empowered, challenging Apple the more. If Apple begins to find a way out of that, it could be the factor that may decide who wins the smartphone market. Most have seen this from the smartphone angle, but what is happening goes beyond iPhone and Galaxy. Sure, Apple has its exclusive hardware massively differentiated by its software, unlike Samsung Galaxy, which is based on the open source Android. There are may ways the basis of competition diverges. Yet, without Apple, Samsung will not be as financially sound as it is, and without Samsung, Apple may not have had the supply chain efficiency it has enjoyed in chip sourcing. But if Apple breaks this relationship, at least partly, that is when the competition will begin.

Kobo Is Nigeria’s Best Logistics Company, Using Aggregation Construct

I like Kobo, a logistics startup that operates from Lagos, Nigeria. It is a very fine company deepening its capacity as a network orchestrator through aggregation. Kobo is positioning itself as a company of the future in the broad logistics sector.

A global logistics platform right from the heart of Africa, leveraging technology and efficient processes to serve its citizens and the rest of the world. Putting transportation in the hands of every individual. Facilitating the movement of your goods and packages by guaranteeing, safety, speed and affordability.

Kobo has partnerships with DHL, UPS and other global logistics giants. Co-founded by Obi Ozor, the company uses technology to streamline shipping for clients. In an interview with CFA, Obi noted some of the challenges in the industry.

Obi stated that the Logistic industry, from the African market perspectives, is worth about $300 billion. He further emphasised that the industry has different branches, such as the e-courier, trucking and air and sea freight, but in Nigeria, we are more into the e-courier and trucking branches of the Logistic industry. “The trucking branch of the industry is about $80 billion across Africa, while in Nigeria, it is about $18 billion. The e-courier projection is about $2 billion”, he maintained.

Obi is of the opinion that, although, the reward derived from the Logistic industry is huge, so are the challenges therein, because, it is a tough line of business to venture into. He said that he decided to venture into the Logistic business because, it is the heartbeat of any economy. He alluded to the importance of transporting the products from one point to the other, citing the example of the fact that the building of the railways in the USA, aided, in no small measure, the movement of goods during the industrial revolution. He maintained that the Logistic is the foundation of economic development. “We know, of course that, if e-commerce and the new technology industry will flourish n our continent, we actually need to solve that underlying factor,” he stated.

Obi is right but what he did not say is that his platform is not the one directly challenged. Kobo is an aggregator which relies on its partners to serve its customers. It is like Uber which aggregates drivers and riders to deliver two-sided markets products. It works like Airbnb which links landlords and travelers. Yes,come rain, come sun, Kobo will always find value. The risks are handled by the partners, not Kobo. That is why I like Kobo business model. It operates under the Aggregation Construct which I have written extensively.

Under the aggregation construct, the companies that control the value are not usually the ones that created them. Google News and Facebook control news distribution in Nigeria than Guardian, ThisDay and others. Because the MNCs tech firms “own” the audience and the customers, the advertisers focus on them, hoping to reach the readers through them. Just like that, the news creators have been systematically sidelined as they earn lesser and lesser from their works. But the aggregators like Facebook and Google smile to the bank. The reason why this happens is because of the abundance which Internet makes possible. Everyone has access to more users but that does not correlate to more revenue because the money goes to people that can help simplify the experiences to the users who will not prefer to be visiting all the news site to get any information they want. They go to Google and search and then Google takes them to the website in Nigeria with the information. Advertisers understand the value created is now with Google which simplifies that process.

The Magic of Network Orchestration via Aggregation

Kobo operates under the principle of Aggregation Construct which depends on network orchestration where it works as an arbiter for many partners and customers. With this model, the customer experience becomes a key part of its business. It does not have ships, planes and trucks delivering services from U.S. to Nigeria and beyond. But it has a technology to simplify trade and commerce. It has got happy customers who do think its services are even better than firms like DHL. Interestingly, companies like DHL make it possible for Kobo to serve those customers.

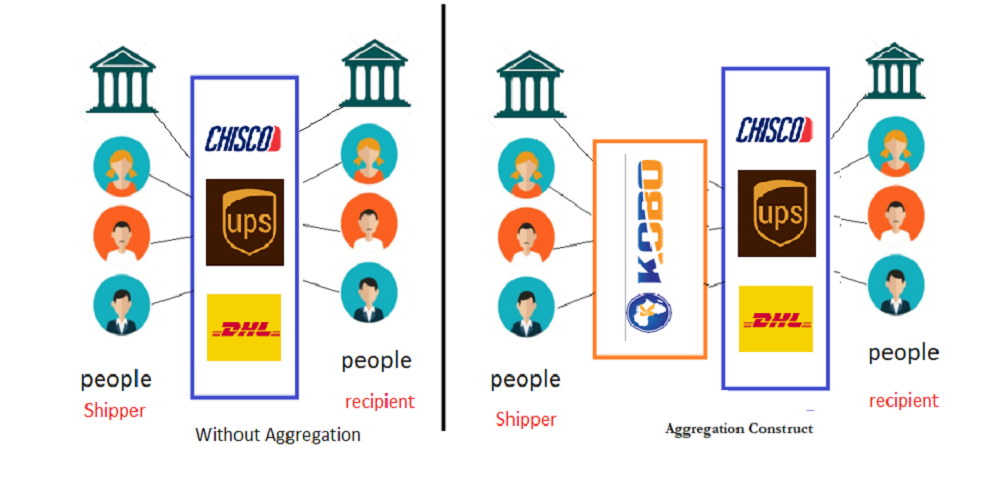

In the diagram below, I explain what Kobo is trying to do. It inserts itself between the shippers and the logistics firms. Largely, under most cases, it may not have direct contacts with the recipients of the goods. That is a weak link in its business as it cannot manage all faces of the two-sided business. But not doing that saves it money, since we cannot expect it to go and retrieve the goods, from the logistics firms, at destination cities, just to deliver to the end customers. That will be a mistake and it is doubtful if the firm will have that level of capacity. So, I will call this aggregation a Semi-Aggregation Construct: Kobo is fully invested in the shipper which originates the transactions and pays for them.

All Together

Kobo has a big challenge ahead of it. Its success will be dependent on the number of partners it can command in its portal. These are the companies that will help it move the items, from one location to another. It has a few like DHL, UPS, and Chisco, a luxury bus company. It has to add more partners to improve its network orchestration through aggregation. The partnership will be win-win as it will help these logistics firms to mop business opportunities across cities, before they begin to move them to destinations. Doing this effectively will involve scaling the operation, so that more users can use Kobo over going directly to DHL and UPS.

I see the model the airline industry uses with online ticketing companies like Wakanow to be relevant here. Kobo can get 20% discount on what a typical customer gets directly from DHL provided Kobo meets certain metrics on volume.If Kobo transfers 5% of that value to customers and then delivers better experience, compared with DHL, it could have a huge opportunity ahead of it. This is a very brilliant company, and has the capacity to become a leading African brand: it is asset-light, fixing a big market friction, and structured in a way that its scalable advantage is unbounded and unconstrained.