I run a Practice in Fasmicro Group through which we help clients redesign their organizations, via technology. My work helps clients make technology work for them, We ensure that IT not just run your organization, but also transforms it. I work, usually, at the level of senior IT leadership, Executive Management, and Board, on technology-driven strategy, in Africa, and beyond, across different sectors. Our clients include leading African banks, governments, insurers, and more. Below is a synthesis of some of the things we will help you handle.

- IT Strategy: Conduct a review of the Firm’s current IT strategy, and identify the current gaps considering the business needs and market best practices and make recommendations to implement the strategic gaps with fit for purpose solutions in line with Global Best practices and local realities

- IT Governance: Conduct a review of the current IT Governance practices in all areas in line with International and Local Regulatory standards like COBIT and identify the gaps in implementation/Compliance to standards. Recommend the necessary detailed steps to align with the International standards. Review the IT Organogram for HQ and at Country level and recommend an Effective Governance Framework to effectively manage the HQ and Country technology Organizations interface

- IT Skill Capabilities: Conduct an IT capability and competency mapping of key IT Tasks/roles against available skills in the Firm and make recommendations where there are shortages or excess capacities. This should be done using acceptable frameworks like Skills Framework for the Information Age (SFIA). Establish how to appropriately deploy the human resources to have an agile IT Organization. Produce a framework that will help the Firm to develop and retain the core IT skills required by the Firm. Recommend a Robust Outsourcing strategy and in key areas to complement inhouse skills and a governance framework to manage the Outsourced Vendors.

- IT Value Realisation: Conduct a detailed Benefits Realisation assessment of the Firm’s Key IT investments in Software and Hardware Projects. Make specific recommendations on how to measure Benefit/value realised from IT and identify and recommend the Key Levers for Value Realisation of the Existing IT investments. Develop a framework for the establishment of IT Value realisation practices for future projects and investments.

- IT Projects: Conduct an assessment of all IT Projects in the Firm during the last three years. Determine how many of them were delivered on time, how many are still ongoing, how many are failed, etc. Identify the Strategic reasons for their failures and recommendation for successful execution of projects. Make recommendations on how to better handle ongoing IT projects and develop an enterprise project management and governance framework for managing the Firm’s IT projects in a cost effective and timely manner.

- IT Process Documentation and Performance Management: Conduct a review of all IT and Cross Functional process in the Firm against available documentations and make recommendations. Identify the key gaps in the processes leading to failures in IT Operations service delivery. Assist to align the IT processes with specific business processes and produce a report showing the mappings of IT process against business processes. Create Standard templates for the creation of Standard Operating Procedures (SOP) for IT Processes. Identify the Key Vital Performance Metrics which IT operations should monitor to manage the service delivery and operations of IT. Identify the Specific and Measurable Key Leading and Lagging Indicators KPIs for all the units in IT organization.

- IT Processes Documentation:Document the Firm’s IT processes to improve change/succession management, build IT knowledge base and institutionalize the Firm’s processes by making them individual-agnostic.

- Center of Excellence: Assist the IT Organization to develop and implement a framework for the development of the Centre of Excellence (CoE) concept within the IT Organisation in the Key Domains consisting of best practices standards in Solution Delivery, Governance, Service Management, Project Management, Data Centre Practices, etc. Develop a CoE Maturity framework. Assess the current state and identify the gaps and benchmarks required to move towards Journey of Excellence.

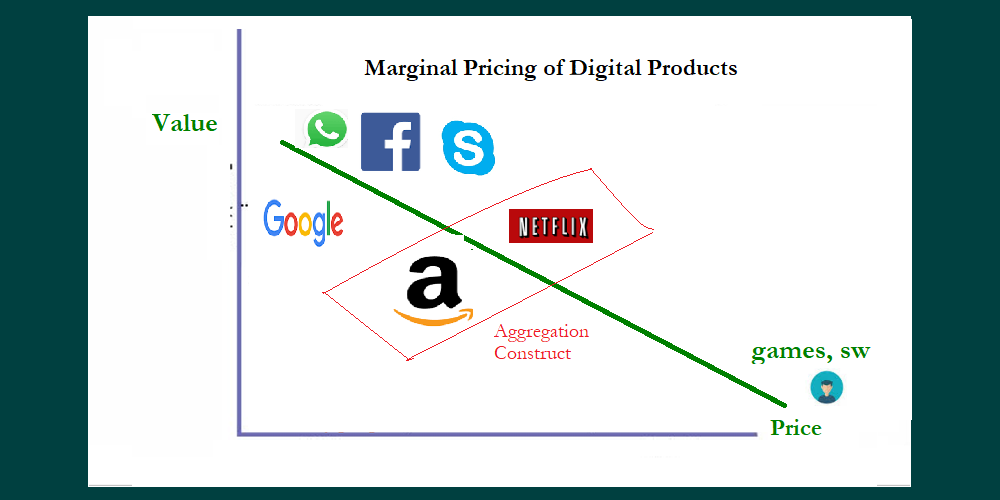

- Digital Products: Review the performance of the technology-enabled products against the uptake and value realized. Review the products/channels to recommend infrastructural and other changes needed to generate desired traffics for the products.

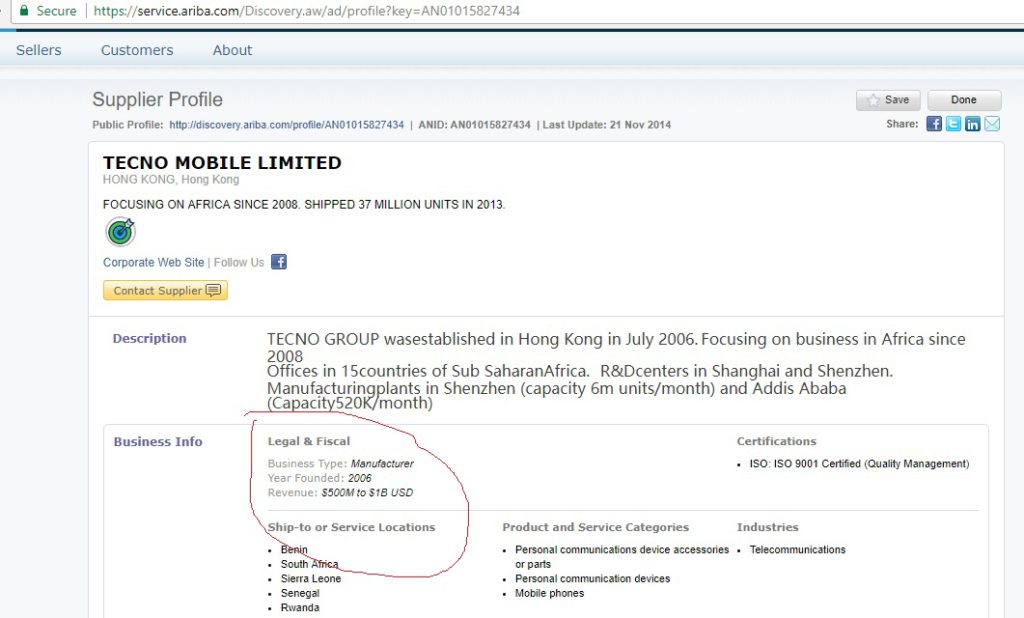

- IT Spend: Review the IT spend for last 3 years and provide strategic assessment of the Firm’s IT cost structures compared to global and Local benchmarks. Recommend Value add IT cost reduction approach that provides a competitive edge to business while reducing overall costs.

- Data Consolidation: Develop data governance and framework for the Firm to enable efficient management of the Firm’s data and ensure data is robust, accurate and reliable. Design and execute the Firm’s data consolidation plan.

I lead my team and we handle engagements with absolute commitment to quality. Our clients receive the highest level of value. Our pricing is industry-competitive.

If you would like a conversation on our service, please drop a line to info@fasmicrogroup.com or nekekwe1@jhu.edu

Thank you.

[Consider this a sponsored post, from me].