Despite being only days old, Maxi Doge’s presale is attracting strong interest, particularly from traders who still see potential in community-powered tokens that move fast and aim high. The surge in early demand has caught attention across several retail-focused channels, hinting that some parts of the market may be warming up to the kind of speculative energy that once defined the memecoin surge of previous years.

The project is designed for participants who are not looking for utilities or roadmaps with years of projections. It speaks to those who enjoy fast-paced cycles, meme-driven campaigns, and daily participation in a market that rewards timing and volume. For anyone watching the early traction closely, this presale could be the first visible signal of a larger change in sentiment among small-cap traders.

The Return of Meme Culture with Trader Instincts

Maxi Doge has been launched with a clear identity and an even clearer tone. This is a token created for high-volume participants who take part in cycles where branding, repetition, and energy matter more than narratives about solving anything specific. The project leans fully into the idea of a meme-first coin, but it does so with structure and coordination.

The design features a buff version of the Doge figure, styled to reflect the kind of persona that has become common in parts of the trading community. There is humor, of course, but it is directed toward traders who spend their time tracking short-term setups, sharing charts, and rotating positions daily. Maxi Doge presents itself as their token. Not a mascot, not a parody, but a reflection of the way they operate.

Where older “degen” memecoins relied entirely on community numbers to grow, Maxi Doge layers that with scheduled activity. There are staking pools, leaderboard events, and daily distribution mechanics designed to reward early involvement. From the way its campaigns are structured to how it promotes engagement, the project makes its intention clear that it is not here to chase attention through nostalgia. It is here to build momentum using systems that keep users participating and reacting.

The token, as per the whitepaper, was created for traders who already understand the risks and are willing to take positions early if they believe the setup is right. This is not a new take on the meme genre. It is a continuation of the degen crypto theme that was once popular, repackaged for a sharper, more active audience in the current bull market.

Supply, Allocation, and Planned Progression

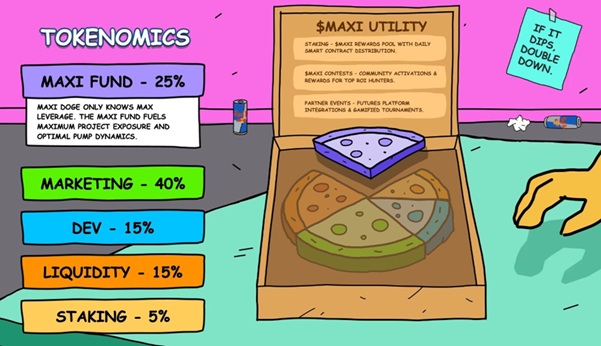

Maxi Doge has a total token supply of 150,240,000,000. The way it is allocated indicates a strong emphasis on visibility and daily activity. 40% is set aside for marketing, which includes promotions, community rewards, and outreach campaigns. 25% goes to the project’s treasury fund, meant to support growth efforts, future listings, and any strategic moves required in the months following launch.

15% is assigned to development, while another 15% is locked for liquidity, ensuring smooth trading once the token is active on exchanges. The remaining 5% is dedicated to staking, with rewards distributed through a live smart contract system that users can access once they hold tokens.

The roadmap also takes a different approach compared to more traditional projects. It is framed as a sequence of trader-focused events rather than corporate updates. The first stages included smart contract audits, social setup, and the rollout of the presale. Next comes a phase centered on trading competitions, influencer engagement, and daily campaign activity.

Following that is the listing stage. Both decentralized and centralized exchanges are part of the plan, along with promotional pushes timed to coincide with launch announcements. The steps are paced closely, with the intention of keeping attention on the project without long periods of silence. This is a model built on presence, where every phase is designed to keep holders watching, sharing, and participating, essentially making it a completely community-oriented initiative.

Why Maxi Doge Token Looks Interesting Right Now

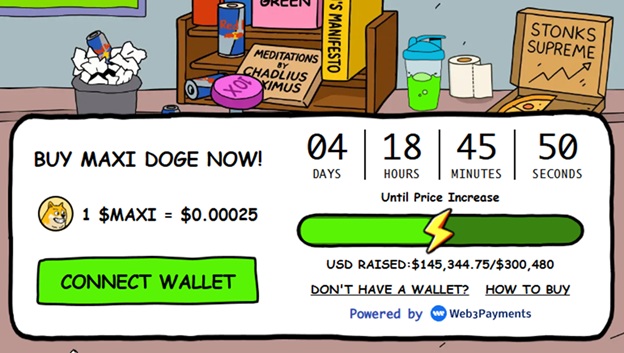

At a presale price of $0.00025 right now, Maxi Doge offers access to the project at a stage where traction is still forming. However, that in itself is not unusual for new projects. What makes this case different is how fast the presale has moved. The project has already raised more than $140,000, and that has happened without the backing of major platforms or long-form campaigns.

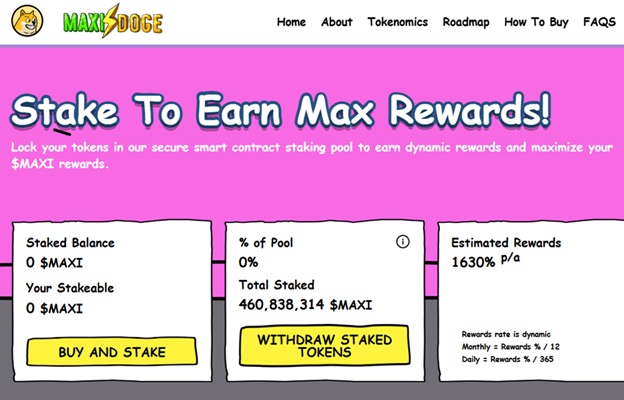

The incentive structure for early buyers is also worth noting. The staking system begins working before listings, with daily rewards distributed to those who commit their tokens early. This creates a situation where investors do not need to wait for price movement to start gaining from their position. For those who are quick to get into the presale, rewards exceeding 1000% p/a can be expected for every token staked.

Maxi Doge is also placing significant resources into visibility. With 40% of the supply tied to marketing, the chances of strong post-listing activity are higher than usual. Once listings go live and more users begin tracking the project, the added exposure could bring fresh buyers into the fold. That potential for wider reach is part of what makes the current entry point appealing to those who understand how these cycles play out.

There is no attempt here to hide what the token is. It is a direct, aggressive memecoin with a fast-moving structure and a team that seems to understand what kind of activity sustains a trader-led community.

For those watching the current string of presales and wondering whether Maxi Doge may be a good fit, consider checking out the project’s social media channels on Twitter and Telegram. This will help to get an idea of the community interest the project has been enjoying, and prove its position as an exciting investment for the degen investors looking for their next big bet.