Money Without Exposure: The New Privacy in the Digital Age

Rachel was never just a journalist; she was the kind of investigative reporter whose work threatened oppressive governments in Africa. One day, while trying to verify an upcoming transaction, she noticed some discrepancies in her accounts. At that point, it dawned on Rachel that her bank accounts were under surveillance. The government had partnered with several centralized authorities to monitor her inflows and outflows so as to trace her donors and sabotage her.

In order to resolve this problem, Rachel turned to Bitcoin. She wanted a technology that would protect her from tyrants. However, her expectations were soon shattered when one of her donors’ identities was revealed. For someone new to the decentralized world, fears leaked through her guts until she was perplexed, hoping that God or whatever energy behind the universe sprinkled some surprises to dissipate the career ache she was battling.

Unknowingly to Rachel, some on-chain analysts had agreed to assist the government. From senders to receivers to withdrawals were all publicly available to trace on the blockchain. So, the technology she employed for a solution became a tool for exposure.

All over the world, several investigative journalists, humanitarian aid supporters, whistleblowers, etc., are being sabotaged by their digital imprints. Traditional banks expose them, and crypto, which is meant to protect them, also fails them. So, people like Rachel become the oppressed whom they constantly agitate for. And without privacy, the freedom fighters and peace enablers today and in the future remain targets.

The Privacy Problem in Cryptocurrency

Cryptocurrency, pioneered by an anonymous programmer named Satoshi Nakamoto, is digital money aimed at making transactions distant, accessible, and fair. Bitcoin, the first-ever cryptocurrency, was launched in 2009 to address the foundational problem of a non-native payment layer and centralized authority over one’s personal funds. Beyond that, there was no way to verify banks’ claims about their internal records. So, whatever the big banks said was final. These critical problems spurred Satoshi to create something verifiable by everyone.

Blockchain technology was developed to keep transaction records intact and verifiable by a global network of computers known as nodes, each having a synchronized copy of all transactions. That makes it impossible to tamper with these transactions without public evidence. And since there’s no foundational user, you would have to hack into various computer networks before you can manipulate the system. Eventually, the strength of blockchain makes it traceable by everyone.

While Bitcoin’s introduction eliminated the middlemen in the traditional finance sector by introducing decentralization through computer-based peer-to-peer systems, there’s no way you can utilize the technology without exposing your financial imprint online. That means all your transfers, including crypto net worth, and how many of your wallets are interconnected, can be broadcast online. So, the concept of anonymity is just another facade.

Why Most ‘Private’ Crypto Isn’t Actually Private: The Four Privacy Tiers

Anonymity in crypto is the level of untraceability required for privacy. There are four privacy tiers in cryptocurrency.

Pseudonymity: Pseudonymity means using a nickname or a different identity rather than using one’s real name. In cryptocurrency, wallet addresses maintain pseudonymity, contrary to traditional banks that only allow real and verified names. However, information and transaction records are all traceable publicly via on-chain activity.

Set Anonymity: Unlike pseudonymity, set anonymity is a step ahead in privacy. Instead of having a public record of data on the blockchain, set anonymity makes the data more private by making it anonymous to a group of people known as participants, but not everyone. This means that it’s not completely private, but the more users the data is protected from, the tougher its traceability.

Full Anonymity: Full anonymity ensures complete anonymity by concealing every referential detail that can lead to traceability on the blockchain. This means that every detail of a transaction is hidden to provide complete privacy.

Confidential Transactions: Blockchain may assist in keeping a transaction confidential. In confidential transactions, the transaction amount is kept private while other information remains public.

The Cryptographic Breakthrough Bitcoin Was Missing

In 2010, Satoshi Nakamoto, the founder of Bitcoin, publicly discussed Bitcoin’s flaws alongside other developers on the Bitcoin Talk Forum. According to Satoshi, blockchain transactions require encryption for privacy reasons. However, that would only be achievable if the encrypted transactions were still accurate. Satoshi then alluded to a technology that could be used to provide a solution called Zero-Knowledge Proofs (ZK Proofs).

Zero-Knowledge Proofs help to validate the authenticity of information without revealing the information itself. They are fundamental to making transactions private on the blockchain.

How ZK Proofs Work

ZK-Proofs ensure that the transactions you perform follow specific rules. For example, they ensure that a sender’s funds are available and authorized to send. Once confirmed, the transaction will be approved and encrypted. After encryption, the transaction will remain private on the blockchain. While such transactions may seem hidden, the validation stamp is known as a ZK-Proof.

ZK-Proofs prove the correctness or authenticity of a blockchain transaction without revealing any information inside. They are usually sent to the blockchain for verification after encryption. Once verified, they are anonymously saved on the blockchain.

The Rise of Privacy Coins: From Monero and Dash to Zcash

Privacy coins are cryptocurrencies created primarily as a digital payment method with more anonymity than Bitcoin.

Dash was the first-ever privacy coin. It was launched on January 18, 2014, by Evan Duffield, a software engineer, as a fork of the Bitcoin blockchain, that is, a minor tweak to the existing Bitcoin blockchain to make Dash faster, more private, and reduce fees. It was initially named XCoin before rebranding to Dash in March 2015. The cryptocurrency uses masternodes, which are transaction performers and top treasury decision-makers, and miners, who are transaction validators, to make transactions faster and anonymous.

In April of the same year, Monero was launched by anonymous developers. It was forked from Bytecoin, a protocol built on CryptoNote. Monero ensures privacy using Stealth Addresses, which generate a one-time address for each transaction to protect the receiver’s real address; Ring Signatures, which mix transactions among multiple users to conceal the sender; and RingCT, which hides transaction amounts from the public blockchain.

Zcash introduced advanced privacy in crypto. In 2013, four scientists named Matthew Green, Ian Miers, Christina Garman, and Aviel Rubin published a research paper, Zerocoin. It was an academic study that proposed a cryptographic extension to Bitcoin for anonymity.

Two years later, the Zerocoin team decided to launch Zerocash, a protocol that would implement ZK-Proofs to transcend their existing solution beyond a critical paper. To achieve this, the team reached out to Zooko Wilcox-O’Hearn, a privacy advocate and developer, to implement it. Zerocash created a company called Zerocoin Electric Coin Company (later renamed Electric Coin Company, ECC) and made Zooko Wilcox the protocol lead (CEO).

In 2016, Zooko Wilcox took the idea further by launching Zcash, a cryptocurrency that uses the existing protocol (Zerocash) to ensure full anonymity on the blockchain without jeopardizing integrity through zk-SNARKs.

What Are zk-SNARKs?

zk-SNARKs are cryptographic proofs that allow validation of information without revealing the underlying data. In this cryptographic system, the cryptography between the prover and the verifier is succinct; that is, it runs quickly (verified within a few milliseconds) and is non-interactive, using only a single request and response instead of constant messages.

Zcash: A Different Privacy Proposition

While privacy coins provide anonymity on-chain, they all differ in various ways. Zcash has a competitive edge among them with its privacy model.

Dash, for instance, mixes multiple transactions together through PrivateSend to make transactions harder to trace rather than hiding the data itself. Zcash, on the other hand, encrypts data through mathematical models such as polynomial equations (QAPs) over elliptic curves in a zk-proof system in a succinct and non-interactive way.

Although Monero provides complete anonymity, Zcash empowers users with its user-choice privacy approach, which is absent on Monero. On Zcash, users can decide whether or not to make their transactions private by choosing between transparent or shielded addresses.

The Recent Surge of Attention on Zcash’s Privacy Features

Zcash gained attention in the crypto ecosystem beyond market speculation. Its shielded address system demonstrates the capability of privacy in a digital world. Zashi, Zcash’s mobile app and extension, also makes it easy to switch between shielded and transparent addresses, perform on-chain transfers, and swap funds.

The rise in agitation for digital surveillance in recent times among governments and other institutions has increased the demand for online privacy. In Kenya, for instance, Amnesty International’s 2024/2025 report noted that the government had facilitated online threats and harassment against activists. Although the government denied these claims, such incidents reveal the risks associated with digital exposure.

Privacy in crypto puts users in control of their financial data. Angel investor Naval Ravikant highlighted on October 1, 2025, via X that “Bitcoin is insurance against fiat. Zcash is insurance against Bitcoin,” framing privacy as a protective measure in a highly monitored digital environment.

Zcash’s privacy features didn’t appear overnight. They are the results of several upgrades. Sapling (2018) enabled faster private transactions. Heartwood followed in (2020), allowing miners to receive rewards privately. In the same year, Canopy was introduced, restructuring how development is funded. NU5 (2022) introduced Halo 2 proofs and unified addresses to simplify private use, and NU6 (2024) improved the security of development funds. These changes matter not for branding, but because each one made privacy more usable and accessible on-chain.

The Future of Privacy in The Digital Age

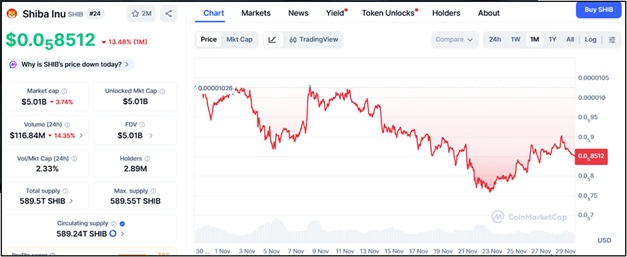

Privacy is important for protecting digital identity in a world where online activities are actively monitored. According to CoinGecko statistics, privacy coins hold approximately $15.3 billion in market capitalization as of this writing, down from a $24 billion surge in November. The pullback reinforces the unpredictability of the cryptocurrency market.

Even with these fluctuations, privacy coins are facing regulatory scrutiny for Anti-Money Laundering (AML) and compliance. The back-and-forth with legal frameworks shows the rigorous environment in which privacy coins operate.

At the same time, the demand for privacy is growing in response to digital surveillance. Beyond transactions, privacy is rising in the blockchain ecosystem. For instance, Aztec, an Ethereum Layer-2 blockchain, launched Ignition Chain to provide full and verifiable privacy on Ethereum through ZK-proofs.

Web3 digital identity solution (DID) is also reshaping how data is verified and stored online. Instead of exposing personal data to big tech companies or the government, where it is vulnerable to breaches and surveillance, projects like Mina Protocol use zero-knowledge proofs (ZK-Proofs) to verify data without revealing it.

A future privacy world means that individuals like Rachel, working in an oppressive environment, can contribute to social and economic development without the fear of digital exposure through external interference.

As privacy debates spike in interest, privacy coins can gain momentum. While blockchain serves as a technological tool for reshaping online data, it is not a “solve-it-all” solution. Online digital identity, NGOs, activists, and privacy enthusiasts must all contribute to safeguarding the digital economy.

NB: This article is for educational purposes only and not financial advice.

Like this:

Like Loading...