In Nigeria’s fast-evolving digital ecosystem, influencers have become central figures in shaping conversations, public sentiment, and even policy narratives. Their voices travel through social media platforms, stirring reactions that range from enthusiastic support to intense backlash. This situation led a team of analysts at Infoprations to conduct an analysis of over 600 sentiment-labeled interactions curated from the social media handles of prominent business, social, and political influencers in Nigeria. In this piece, strategic insights into how these influencers engage with their followers across Facebook, LinkedIn, and Twitter—collectively referred to as the FALIT platforms are presented.

Who’s Speaking

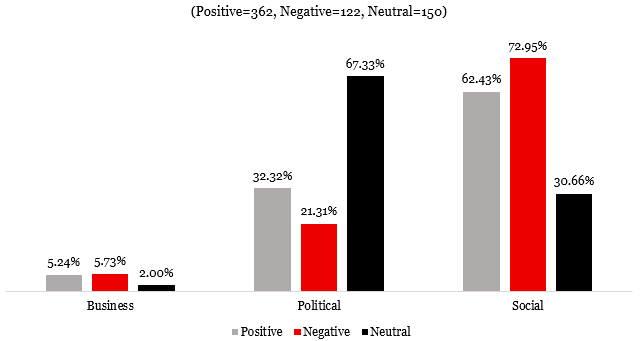

Among the influencers, business influencers seem to have the quietest footprint in the sentiment space. Their content accounts for just over 5 percent of both positive and negative sentiments, and an even lower percentage of neutral sentiment. This relatively low level of engagement suggests that business influencers are yet to fully harness the emotive power of digital platforms. Our analyst also notes that it may reflect the general public’s limited emotional investment in business-related content, or a tendency for business discourse to remain technical and reserved.

Exhibit 1: Influencer category by sentiment types

The largest share, over 67 percent, of interactions involving political content is neutral. While this suggests that political commentary in Nigeria is often presented in a factual or observational manner, it contrasts with the tense political atmosphere in physical settings across the country. However, positive and negative sentiments are still notable, with 32 percent being positive and over 21 percent negative. This blend reflects the complexity of political discourse in Nigeria, where influencers engage actively with governance issues but often with measured expression rather than emotional extremes.

It is social influencers, however, who mostly employ positive sentiment. Our data shows that more than 60 percent of the sentiment is positive, while an even higher 72 percent is negative. This striking polarity reveals the high stakes and the personal relevance of social issues for many Nigerians, as prioritized by these influencers. Topics such as gender, activism, religion, pop culture, and societal values dominate this space. Our analyst notes that the influencers align themselves with these subjects with the intention of provoking strong reactions and fostering communities of both passionate supporters and equally vocal critics.

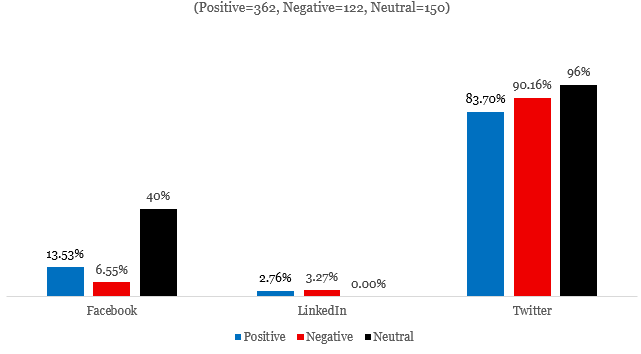

Exhibit 2: Sentiment type by platform type

Platform Dynamics: Twitter Reigns, LinkedIn Lags

Understanding where these conversations happen is equally important. Twitter emerges as the dominant platform for emotionally driven engagement. Over 83 percent of positive sentiment, 90 percent of negative sentiment, and an overwhelming 96 percent of neutral sentiment are generated on Twitter. This makes it the primary arena for public discourse in Nigeria. Twitter’s immediacy, openness, and viral potential make it ideal for rapid-fire commentary, trending debates, and social movements. Whether the topic is a political scandal, celebrity controversy, or human rights issue, Twitter is where Nigerian voices gather and clash.

Facebook, by contrast, appears more balanced and subdued. It accounts for about 13 percent of positive sentiment, 6 percent of negative sentiment, and 40 percent of neutral sentiment. This suggests Facebook serves as a platform for longer discussions, community-oriented interaction, and moderate debate. It remains important, particularly for reaching diverse demographics, but does not match the emotional velocity of Twitter.

LinkedIn is largely absent in this sentiment landscape. With under 3 percent for both positive and negative sentiment and virtually no neutral presence, LinkedIn has yet to establish itself as a significant space for emotional or value-driven discourse in Nigeria. The platform’s professional tone and content norms may explain this detachment. However, this also presents an opportunity for business and leadership influencers to carve a unique niche, offering thought leadership that blends expertise with personal insight.

What This Means for Influence and Strategy

For those involved in shaping public conversations, be it marketers, civil society organizations, political strategists, or entrepreneurs, these insights carry important implications. Emotional content is the engine of engagement, but its success depends on both the platform and the type of influencer delivering the message. Social influencers, especially on Twitter, are effective at creating viral conversations. Political influencers may find greater value in Facebook’s more deliberative environment. Business voices, while quiet now, have room to grow, especially on LinkedIn where credibility and professionalism are valued.

Editor’s Note: This article is a product of Infoprations’ Communicative Strategies of Nigerian Influencers Project, 2025. The team includes Abdulazeez Sikiru Zikirullah, Moshood Sodiq Opeyemi, Bello Opeyemi Zakariyha, and Oni Oluwaseun.