Tesla is expanding its lower-cost offerings with the introduction of a pared-down all-wheel-drive version of the Model Y, while also simplifying how it names its vehicles — a move that underscores the company’s broader effort to reset its product strategy after months of softening demand.

The decision points to a tension at the heart of the company’s strategy: even as Elon Musk increasingly positions Tesla as a future-focused robotics and autonomy company, he continues to make incremental, pragmatic moves to stabilize and revive vehicle sales in the here and now.

The newly introduced pared-down Model Y AWD starts at $43,630, about $7,000 below the Model Y Premium AWD. As with Tesla’s other lower-cost trims, the model achieves its price point by stripping out features once considered core to the brand’s appeal, including leather seats, the panoramic glass roof, and rear climate-control screens. The approach mirrors the strategy used for the Standard Rear-Wheel-Drive Model Y unveiled three months earlier, which started at $41,630 and cut roughly $5,000 off the price of the RWD Premium variant.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

The AWD version slots between Tesla’s cheapest and most expensive offerings. It sacrifices range — at 294 miles per charge, it is the shortest-range Model Y — but delivers a notable performance boost. The car accelerates from zero to 60 mph in 4.6 seconds, significantly faster than the rear-wheel-drive model. For buyers balancing price, traction, and performance, the trim is designed to broaden Tesla’s appeal without a full redesign or new platform.

Alongside the pricing changes, Tesla has quietly simplified its branding by dropping the “Standard” label from its entry-level Model 3 and Model Y vehicles. The cheapest versions are now branded simply as “Rear-Wheel Drive,” while “Premium” and “Performance” remain for higher trims. The change reflects Tesla’s long-standing preference for minimal trim complexity, but it also suggests an effort to make its lineup easier to understand at a time when buyers are more price-sensitive, and competition is intensifying.

These moves come as Tesla works to arrest a sales slowdown. The company’s five-car lineup posted a 9% decline in sales, and Tesla lost its position as the world’s largest EV seller to BYD last year. In Europe, Volkswagen overtook Tesla in electric vehicle sales, underscoring how quickly the competitive landscape has shifted as legacy automakers and Chinese manufacturers scale up.

While Musk has repeatedly said Tesla’s long-term value will come from autonomy, AI, and robotics, the company is still overwhelmingly dependent on vehicle sales for revenue and cash flow. That reality helps explain why Musk continues to approve pricing tweaks, new trims, and lineup adjustments even as he talks up a post-car future.

During Tesla’s most recent earnings call, Musk confirmed the company would discontinue its oldest models, the Model S and Model X, describing the move as an “honorable discharge.” Those vehicles have become marginal contributors to Tesla’s business. In 2024, the Cybertruck, Model S, and Model X together accounted for just over 50,000 units — a little more than 3% of Tesla’s total deliveries of 1.64 million vehicles. Sunsetting the S and X allows Tesla to concentrate resources on higher-volume models like the Model 3 and Model Y, which remain critical to keeping factories running and margins afloat.

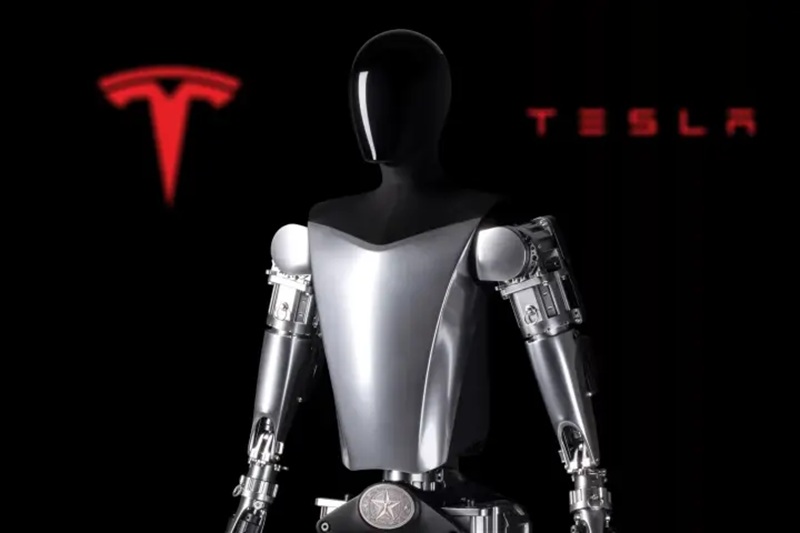

At the same time, Musk is steadily reframing Tesla’s identity. The company has launched a robotaxi service in Austin, is planning the release of its autonomous Cybercab, and is ramping up development of Optimus, its humanoid robot. Musk has argued that autonomy and robotics will ultimately dwarf the value of Tesla’s car business, positioning the automaker as an AI and robotics company rather than a traditional manufacturer.

Yet the introduction of a cheaper Model Y highlights a more grounded reality. Even as Tesla pivots strategically toward robotics, Musk appears unwilling to abandon near-term efforts to defend market share and stimulate demand in its core automotive business. The company has relied on price cuts, feature simplification, and targeted new trims rather than breakthrough new mass-market models, suggesting a cautious approach as it waits for autonomy and robotics to mature.

In that sense, Tesla’s latest lineup changes reflect a dual-track strategy. Publicly, Musk is selling a vision of a future dominated by self-driving systems and humanoid robots. Operationally, Tesla is still fighting a very traditional battle: keeping its cars affordable, competitive, and appealing in an EV market that is no longer forgiving. The cheaper Model Y is less a contradiction of Tesla’s robotics pivot than a reminder that, for now, cars still pay the bills.