Salesforce, the global leader in CRM, released its latest Connected Financial Services report, sharing insights from 9,500 financial services institution (FSIs) customers worldwide.

The report revealed that Financial institutions are growing under pressure to deliver better experiences, as customers show increasing willingness to change providers.

Over the past year, 25% of banking customers, more a third of insurance policyholders, and a significant portion of wealth management clients, have switched to competitors, in desire for a better digital experience.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

While digital convenience is the top driver of customer movement across these sectors, physical location remains a factor, especially in wealth management. Other considerations include customer service quality and seamless integration across financial products. However, the insurance industry stands out, with 25% of customers citing price as their sole reason for switching providers.

A great digital experience for customers is now a necessity, not a luxury. However, many financial service institutions (FSls) still fall short, leaving room for improvement. The most common source of digital frustration, include Poorly integrated unintelligent chatbots. As Al-powered solutions become industry standard, customers expect smart, efficient, and human-like digital interactions, yet many FSls fail to meet these expectations.

Other frequently cited digital pain points include, difficulty finding information online, Inconsistent customer service, Generic, impersonal interactions that make cust hers feel like just another number.

The report highlighted that today’s customers expect to handle the majority of their financial tasks online, from applying for credit and debit cards to managing insurance policies and investment accounts. In fact, 71% of customers want a seamless digital process for opening new accounts.

Personalization: The Key to Customer Retention

Personalization was highlighted as key to customers retention, revealing that majority of them want their financial service providers to understand their individual needs. Whether it’s securing the best mortgage rate, receiving tailored insurance recommendations, or planning for major life events. 73% of customers expect financial institutions to recognize their unique needs, up from 66% in 2020. 53% of customers would switch FSls if services felt impersonal.

Despite an increasingly digital world, people still crave human, often face-to-face, interaction. The majority of customers prefer non-digital interactions (over digital ones) across all three financial sectors. Banking and wealth management customers prefer to interact in person or by phone, and insurance customers largely prefer to interact by phone.

These preferences suggest a need to feel seen, known, and taken care of. Financial transactions can be complicated, making trust intrinsic to relationships between customers and financial providers. In-person and voice-based communications may help people feel they’re getting more “whole-person” individualized service.

Customers want proactive and timely communication with personalized services and relevant offers. In the case where an issue arises, it is essential that they are able to easily get in touch with their financial services providers. Fortunately, the majority of customers agree that they can contact their providers when issues arise and that they can do so on their channel of choice.

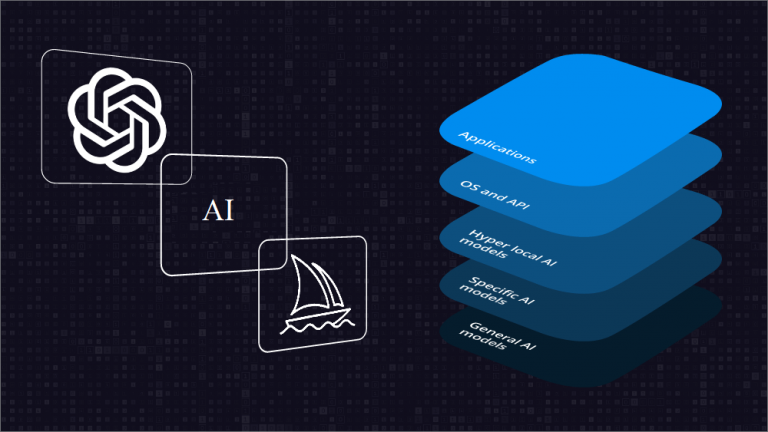

The Al Dilemma

Al-powered financial services are gaining traction, but customers remain uncertain about their benefits. While many recognize Al’s potential to improve efficiency, only 21% of customers fully trust it, 56% are neutral and 23% don’t trust at all, whether it will truly speed up financial transactions. This highlights a need for FSls to build customer trust and transparency around Al-driven services.

To thrive in an increasingly competitive landscape, Financial service institutions must evolve, innovate, and place customer experience at the core of their strategy.