Crypto markets are heating up as investors position early for tokens capable of delivering the next wave of millionaire-making gains. Analysts highlight Ozak AI, Dogecoin, and Shiba Inu as the three assets attracting the strongest attention heading into the new cycle.

DOGE and SHIB continue to dominate the meme-driven landscape with explosive volatility potential, yet Ozak AI stands out as the clear leader due to its exponential intelligence-based growth model. With AI emerging as crypto’s fastest-moving narrative, the Ozak AI trajectory is already pulling ahead of meme assets that rely on sentiment cycles.

Ozak AI’s Intelligence Edge

Ozak AI leads millionaire-maker projections because its value increases through nonstop computation rather than hype. The system is powered by HIVE’s ultra-fast 30 ms market-signal engine, which reads liquidity movements, volatility shifts, and cross-chain patterns far faster than manual tools. Its SINT-driven autonomous agents monitor multiple blockchains simultaneously and adjust instantly as new data flows in.

Perceptron Network’s 700K+ distributed nodes feed continuous cross-chain intelligence into the system, making Ozak AI more accurate with every hour of operation. This creates a compounding loop that strengthens regardless of market mood. Analysts note that with the Ozak AI Presale surpassing $6.1 million, demand is accelerating sharply and mirrors early-stage patterns seen in some of the strongest long-term winners of past cycles.

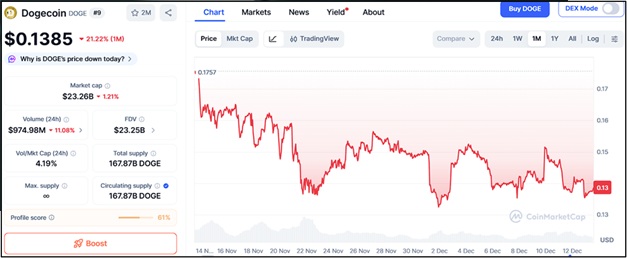

Dogecoin (DOGE)

Dogecoin trades near $0.1385 and continues to show solid accumulation as traders rotate back into high-volatility meme assets. Strong support appears at $0.130, $0.124, and $0.118, levels that repeatedly attract buyers during pullbacks. On the upside, DOGE faces resistance at $0.149, $0.164, and $0.179, all zones that typically ignite momentum surges once broken.

Analysts believe DOGE could produce powerful multi-x gains during a full meme rotation thanks to its massive community and historical performance during euphoric phases. Yet they also point out that its growth resets between cycles because DOGE relies heavily on sentiment instead of evolving technology.

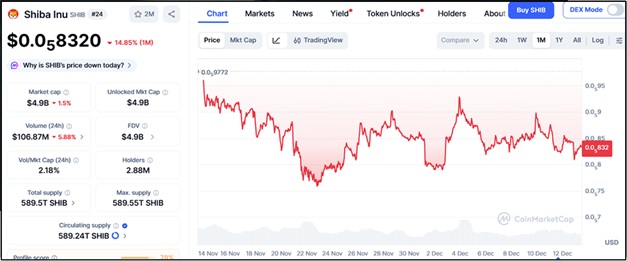

Shiba Inu (SHIB)

Shiba Inu remains one of the strongest meme-ecosystem tokens as Shibarium activity grows and long-term holders accumulate. Trading around $0.000008320, SHIB maintains solid support at $0.00000810, $0.00000785, and $0.00000760. Resistance sits at $0.00000858, $0.00000894, and $0.00000921, areas traders watch closely for breakout signals. SHIB has a proven history of delivering massive gains during strong market peaks.

Its upside remains significant thanks to a large global community and expanding ecosystem, but analysts note that SHIB’s performance is still tied to sentiment spikes and ecosystem milestones rather than a compounding technological foundation.

Why Ozak AI Leads Millionaire-Maker Rankings

Dogecoin and Shiba Inu remain top meme contenders with strong explosive potential, but their growth is cyclical. Ozak AI grows continuously. Every signal processed through HIVE, every autonomous decision executed by SINT, and every data stream supplied by Perceptron makes Ozak AI smarter and more powerful. This creates an exponential trajectory that meme tokens cannot match. Analysts consistently rank Ozak AI as the strongest millionaire-making crypto heading into the next cycle, with the potential to outpace both DOGE and SHIB by a wide margin as the AI narrative accelerates.

About Ozak AI

Ozak AI is a blockchain-based crypto project that provides a technology platform that specializes in predictive AI and advanced data analytics for financial markets. Through machine learning algorithms and decentralized network technologies, Ozak AI enables real-time, accurate, and actionable insights to help crypto enthusiasts and businesses make the correct decisions.

For more, visit:

Website: https://ozak.ai/

Telegram: https://t.me/OzakAGI

Twitter: https://x.com/ozakagi