India’s Adani Group is positioning itself at the center of the country’s surging artificial intelligence infrastructure boom, with plans to invest as much as $5 billion in Google’s massive AI data center project in Andhra Pradesh.

The move, outlined Friday by Adani Group CFO Jugeshinder Singh, marks one of the conglomerate’s most aggressive commitments yet to the data infrastructure sector. Singh said the Google partnership would fall under Adani Connex, the joint venture between Adani Enterprises and U.S. data center operator EdgeConneX.

“This project could mean an investment of up to $5 billion for Adani Connex,” Singh told reporters, adding that interest goes far beyond Google. “There are a lot of parties that would like to work with us, especially when the data center capacity goes to gigawatt and higher.”

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

The comments come as Alphabet-owned Google prepares a $15 billion investment over five years to build an artificial intelligence data center campus in Visakhapatnam, in the southern state of Andhra Pradesh. Announced in October, it stands as Google’s largest-ever investment in India and one of its biggest data infrastructure projects globally.

Google alone has committed about $85 billion this year to expanding its data center footprint, an enormous outlay driven by accelerating demand for AI services.

A Data Arms Race Driven by AI

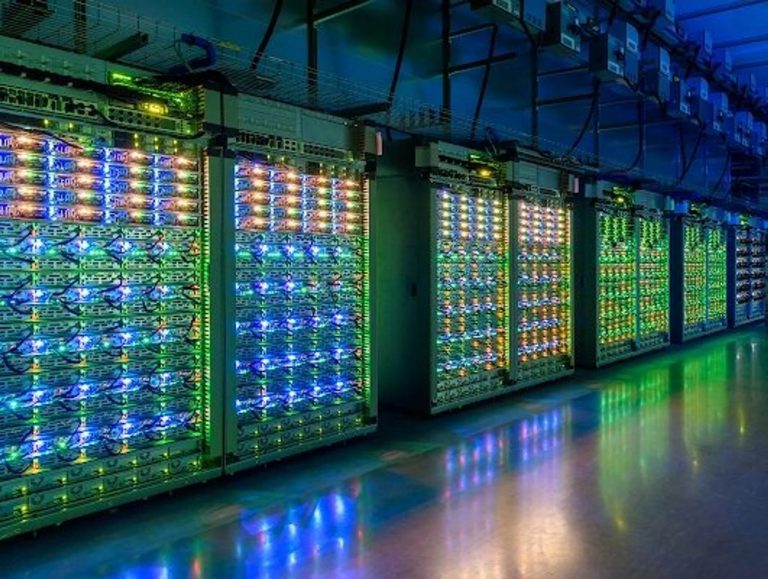

AI workloads demand extraordinary computing power, and these projects require vast, specialized data centers capable of linking tens of thousands of chips in tight clusters. Tech companies worldwide are locked in a race to build and electrify such facilities at an unprecedented scale.

This global surge has rippled through India, where internet usage, smartphone penetration, digital payments, and government digitalization programs have made the country one of the most data-heavy ecosystems in the world. The rollout of AI is intensifying that growth.

India’s billionaire industrialists—most notably Gautam Adani and Mukesh Ambani—have each sketched out multi-billion-dollar strategies to dominate the data infrastructure landscape, a sector they now view as central to future economic influence.

Why Andhra Pradesh Matters

The Visakhapatnam campus gives both Google and Adani a strategic foothold on India’s east coast. The facility’s initial 1 gigawatt power capacity signals the ambition behind the venture. Very few data center projects in Asia begin at that scale.

Andhra Pradesh is positioning itself as a rising digital infrastructure hub, offering both land and power availability—two constraints that limit data center construction in megacities like Mumbai and Bangalore.

For Adani, already active in ports, power, airports, renewables, copper, cement, and now AI infrastructure, this partnership reinforces its strategy to build the foundational infrastructure for both India’s physical and digital economies.

Singh hinted at a broader ecosystem play. If hyperscalers want tens of gigawatts of power, India will need industrial groups capable of building highly complex, energy-intensive campuses quickly and at scale.

“It’s not just Google,” he said. “There are a lot of parties that would like to work with us.”

That statement highlights how India’s emerging AI infrastructure market has shifted from a niche corner of the tech sector into a major commercial battleground attracting global players.

India’s Broader Data Centre Boom

India’s data-center expansion has moved from a gradual build-out to a fast, sustained surge. A few forces are driving this shift.

India has become one of the world’s most active data markets. Affordable smartphones, widespread 4G use, the expansion of fiber backbones, and platforms built around payments, logistics, and entertainment have driven an unprecedented rise in data creation and storage needs. Every major cloud provider — Amazon Web Services, Google Cloud, Microsoft Azure, Oracle — is scaling up capacity.

The next leap is being fueled by AI. Large-scale model training, inference workloads, and enterprise automation have pushed demand for high-density data centers far higher than traditional cloud workloads.

Several Indian states are now competing to become data-hub destinations. They are offering packages that include:

- low-cost land

- long-term power supply agreements

- renewable-energy access

- special industrial zones with pre-approved permits

Maharashtra, Tamil Nadu, Uttar Pradesh, Telangana, and Karnataka have all announced dedicated policies to attract hyperscalers. Andhra Pradesh, where Google is building its new campus, has joined that list with aggressive land-allocation and electricity-availability promises.

However, high-power availability is becoming the dividing line between states that can host next-generation AI data centers and those that cannot. India’s planned AI campuses are already moving toward capacities of 500 megawatts to 1 gigawatt per site, which requires grid overhauls and access to renewable power.

Companies like Adani and Reliance have a structural advantage here because they already run major electricity, renewables, and transmission businesses. Their ability to integrate power production with data-center construction is a big part of why they are emerging as anchor players.

Rising Investments from Indian Conglomerates

Reliance is building out its multi-gigawatt data-center roadmap through partnerships with global firms, while Adani Connex has announced aggressive expansion plans across Chennai, Noida, Hyderabad, and Pune.

Both groups view data centers as long-term strategic assets — similar to telecom towers two decades ago — that will define the backbone of India’s digital and AI economy.

Google’s $15 billion AI build-out is the latest in a string of commitments from global players. Microsoft has accelerated projects in Maharashtra and Telangana. Amazon Web Services is expanding its clusters near Mumbai and Hyderabad. Oracle and IBM have been adding incremental capacity.

None of these projects is small. Many involve multi-billion-dollar anchor phases with room for further expansion.

With Google’s project moving ahead, Ambani’s Reliance scaling its data ambitions, and Adani Connex preparing for what could become one of its biggest bets yet, India’s AI-driven data-center race is entering a new phase — larger, more competitive, and increasingly central to global tech strategy.