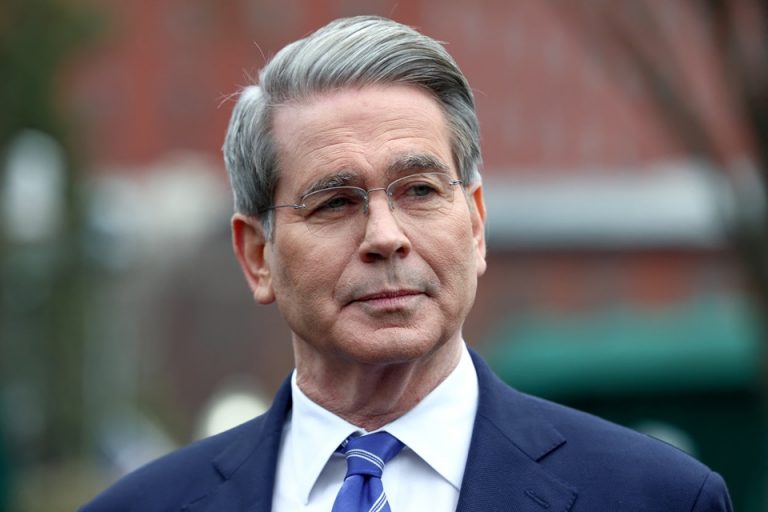

Treasury Secretary Scott Bessent on Tuesday urged Federal Reserve Chair Jerome Powell to stay away from upcoming Supreme Court arguments tied to President Donald Trump’s effort to remove one of the central bank’s governors, warning that Powell’s presence could further politicize an already volatile dispute over the Fed’s independence.

Speaking to CNBC’s Joe Kernen on the sidelines of the World Economic Forum in Davos, Bessent said Powell attending the oral arguments would be a misstep at a time when the central bank is under intense political scrutiny.

“I actually think that’s a mistake,” Bessent said. “If you’re trying not to politicize the Fed, for the Fed chair to be sitting there trying to put his thumb on the scale, that’s a mistake.”

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

The comments follow a CNBC report that Powell plans to attend Supreme Court arguments in a case challenging Trump’s authority to fire Federal Reserve governor Lisa Cook. The case has become a flashpoint in a broader confrontation between the White House and the central bank over governance, accountability, and the limits of presidential power.

At the center of the legal fight is Trump’s August announcement that he was firing Cook from the Fed’s Board of Governors over allegations of mortgage fraud. Cook has denied wrongdoing and has remained in her post, setting up a direct constitutional and statutory clash over whether a sitting president can remove a Fed governor outside the narrow “for cause” protections that have historically shielded the central bank from political interference.

The Supreme Court case is widely seen as a potential landmark ruling. A decision affirming broad presidential removal powers could weaken the institutional independence of the Fed, while a ruling against Trump would reinforce long-standing legal precedents that insulate monetary policy from the executive branch.

Economists and legal scholars say the stakes extend far beyond Cook’s tenure. The outcome could reshape how future administrations interact with independent agencies, including the Federal Reserve, the Federal Trade Commission, and other bodies designed to operate at arm’s length from day-to-day politics.

Powell caught in the crossfire

Powell himself has repeatedly been a target of Trump’s criticism. The president has threatened on multiple occasions to fire the Fed chair, accusing him of mismanaging interest rate policy and undermining economic growth. While no president has ever successfully removed a Fed chair over policy disagreements, Trump’s public threats have heightened anxiety in financial markets about the durability of central bank independence.

Bessent’s warning reflects concern that Powell’s physical presence at the Supreme Court could be interpreted as an attempt by the Fed to influence the judiciary, even if Powell does not speak or participate directly.

The controversy has intensified following Powell’s rare video statement earlier this month, in which he disclosed that he is under criminal investigation. Powell said the investigation was unrelated to his testimony to Congress last June or to oversight of the Federal Reserve’s building renovation project, dismissing those issues as “pretexts.”

“This new threat is not about my testimony last June or about the renovation of the Federal Reserve buildings,” Powell said in the January 11 statement. “Those are pretexts.”

Powell’s decision to go public underscored the severity of the pressure he faces and marked an unusual step for a Fed chair, who typically avoids public comment on legal or political disputes.

Markets watching closely

Investors are closely monitoring the unfolding confrontation. Any perception that the Fed’s independence is eroding could unsettle bond markets, weaken confidence in U.S. monetary policy, and complicate the Fed’s ability to anchor inflation expectations.

So far, markets have remained relatively calm, but analysts say that could change quickly if the Supreme Court signals a willingness to revisit long-standing protections for independent agencies.

Analysts believe the major issue hinges on whether the Federal Reserve can continue to operate without fear of political retaliation.

However, Bessent’s intervention highlights the delicate line the Fed must walk: defending its institutional integrity without appearing to insert itself into partisan or legal battles. Whether Powell ultimately attends the Supreme Court arguments or not, the case is shaping up as one of the most consequential tests of central bank independence in decades, with implications that could outlast both the current administration and Powell’s tenure at the Fed.