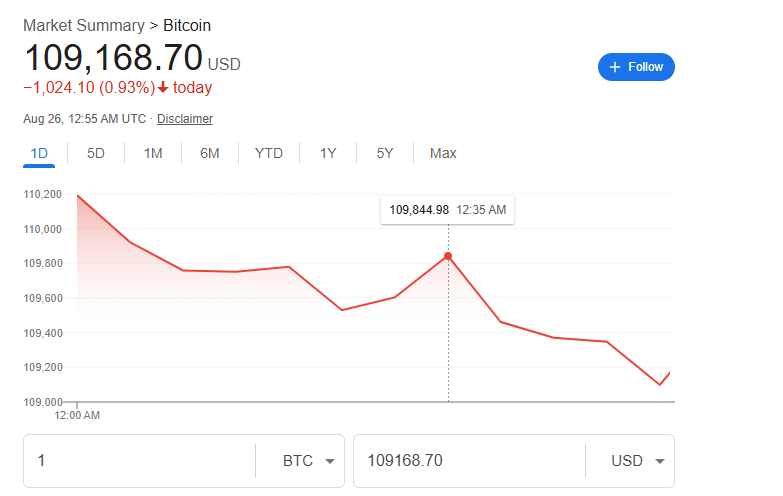

Bitcoin (BTC) sellers resurfaced on Monday, driving the price down to $110,300 and triggering massive liquidations across the cryptocurrency market.

The sharp decline followed Friday’s rally, which was fueled by Federal Reserve Chair Jerome Powell’s dovish comments at the Jackson Hole Economic Symposium, where he hinted at a potential rate cut.

Lower rates typically boost demand for risk assets such as stocks and digital assets. Still, Monday’s selloff showed that large holders or “whales” took advantage of the rally to unload substantial positions, deepening the pullback.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

Whale Rotation: BTC into ETH

Data from Blockchain.com highlighted a major whale offloading 24,000 BTC ($2.7 billion) into the decentralized platform Hyperliquid over the past nine days. Of that, 18,142 BTC worth $2 billion was already sold and rotated into 416,598 ETH, according to analyst MLM.

Another whale sold 670 BTC ($76 million) to open a leveraged long ETH position last Thursday, reinforcing a growing trend of whales swapping Bitcoin for Ether. ETH has rallied 220% since bottoming at $1,471 in April, narrowing the gap with Bitcoin and Solana (SOL), which led earlier phases of the bull cycle.

The retreat extended Bitcoin’s drawdown to 11% from its August 14 all-time high of $124,500. More than $642.4 million in long positions were liquidated, with BTC traders losing $235.5 million and Ether (ETH) traders another $155 million. Across the market, liquidations totaled $806.95 million in both long and short positions.

Heatmap data showed heavy bid orders clustered between $110,500 and $109,700, with further demand building down to $108,000. This suggests Bitcoin could continue sweeping liquidity lower before a recovery attempt.

“Bitcoin is still murdering leveraged traders around the range lows, and from the looks of it, the sharks are still hungry,” trader Jelle wrote on X. He added that holding above the monthly open of $111,900 was key to avoiding a deeper correction toward $100,000.

Also speaking, Analyst Captain Faibik echoed the warning, saying support near $111,800 was “getting weak” and that a breakdown could trigger another leg lower toward $107,000–$108,000. Despite the short-term weakness, some analysts remain optimistic about BTC’s bullish price action. Gert van Lagen argued that Bitcoin’s parabolic structure was still intact, with a long-term target of $350,000. However, he warned that a structural breakdown could open the door to a fall toward $95,000.

On-chain analyst Willy Woo pointed to long-time “OG whales” as a source of pressure on the market. “BTC supply is concentrated around OG whales who peaked their holdings in 2011,” Woo explained. Having acquired Bitcoin at $10 or lower, these whales can sell at massive profits, but their activity means it now takes over $110,000 of fresh capital to absorb every Bitcoin they release.

While whales continue to reshuffle holdings, institutional demand for Bitcoin remains a powerful tailwind. David Bailey, entrepreneur and Bitcoin adviser to U.S. President Donald Trump, argued that the market is entering a long phase of adoption, downplaying a possible bear market.

He wrote on X,

“There’s not going to be another Bitcoin bear market for several years. Every Sovereign, Bank, Insurer, Corporate, Pension, and more will own Bitcoin. The process has already begun in earnest, yet we haven’t even captured 0.01% of the total addressable market. We’re going so much higher. Dream big.”

Institutional Demand Still Rising

Institutions have steadily built exposure through exchange-traded funds (ETFs) and corporate treasuries, with collective holdings surpassing $100 billion largely in Bitcoin.

Strategy, the world’s largest public holder of Bitcoin, added to its stack last week, purchasing 3,081 BTC for $356.9 million as the price fell to $112,000. According to SEC filings, the company has accumulated 3,666 BTC in August, a sharp slowdown compared to July’s 31,466 BTC purchase.

With Strategy’s buying pace cooling, markets are watching to see if the firm ramps up acquisitions again in the final week of August or opts for a more cautious approach.

Bitcoin Outlook

For now, Bitcoin sits at a crossroads. Short-term technicals warn of potential dips toward $107,000–$108,000 or even $100,000 if critical support fails. Yet long-term bulls argue institutional adoption, ETF inflows, and global interest will continue pushing Bitcoin toward new highs.

Whether Bitcoin retests six figures on the downside or breaks higher again, the coming weeks may prove decisive in shaping the next phase of the bull market.