USDC, the world’s second largest stablecoin by market value, continues to make new moves to address the crisis, as it continues to struggle to gain the trust of users. Circle has signed the biggest USDC burn ever to repair broken trust.

USDC Burning increases new steps continue to be taken to restore lost trust in USDC, stablecoin issuer Circle’s stablecoin backed against the dollar.

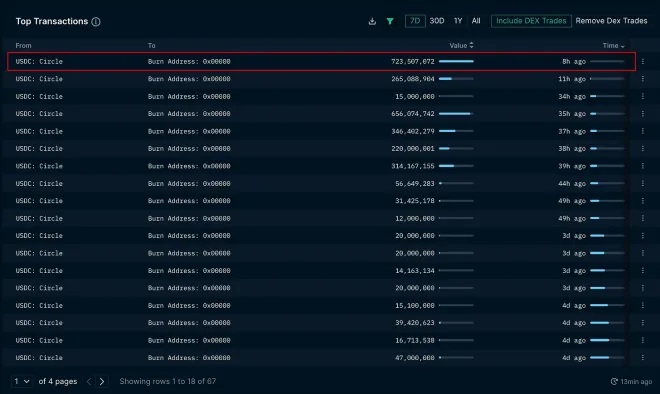

According to data from blockchain analysis firm Nansen, the biggest burn, a record in the USDC burn, was when $723.5 million was sent to an empty address and burned.

Register for Tekedia Mini-MBA edition 18 (Sep 15 – Dec 6, 2025) today for early bird discounts. Do annual for access to Blucera.com.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment.

More than $6.2 billion USDC has been burned since Friday. In addition, approximately over 3 billion dollars were printed. After these events, the net amount of USDC burned was approximately 4.5 billion dollars.

With the USDC-backed assets that is stuck in failing US banks, Circle began a burn to regain confidence. United States regulators, Silicon Valley Bank and Signature Bank had guaranteed full refunds of customer deposits. With Circle CEO Jeremy Allaire claiming that the stablecoin issuer has “access” to the $3.3 billion in funds held by the insolvent Silicon Valley Bank.

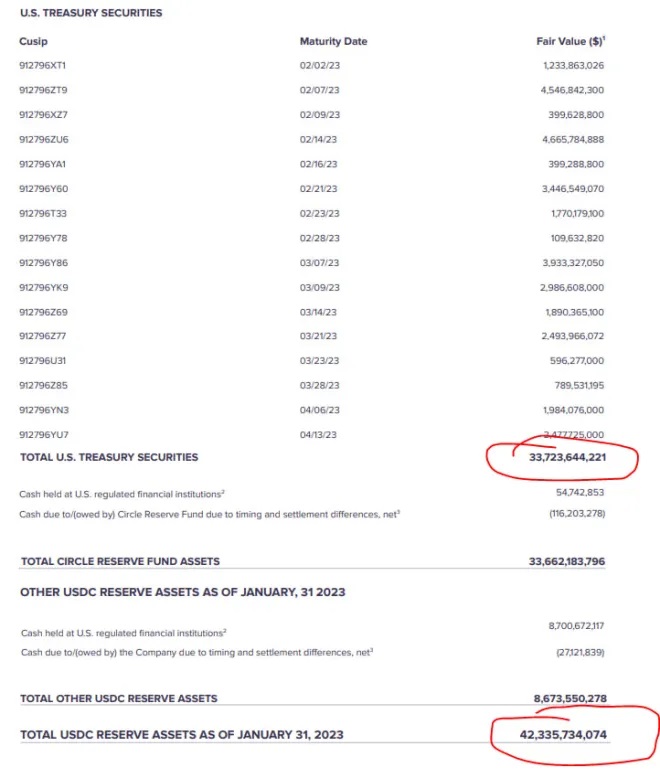

Circle holds 77% of their reserves in 1-4 month T-Bills. These T-Bills are held at BNY Mellon and managed by Blackrock. This provides an absolute floor on USDC of 0.77.

The remaining 23% is all held in cash at various entities. Approximately 1/3 of that cash was held at SVB. SVB is going to liquidate all assets over the next couple months and most estimate will return no less than 10-20% of total asset value.

Dante Disparte, chief strategy officer and head of global policy at Circle highlighted the issues faced by crypto companies due to the lack of confidence in banks, noting that the shutdown of Silicon Valley Bank (SVB) and Signature Bank, two major lenders to the crypto industry, demonstrates the risks that traditional financial institutions pose to the crypto ecosystem.

“The bank failures in the United States have demonstrated that banks themselves are introducing risk to crypto assets, versus the inherent direction of travel of risk, that a lot of the regulators were concerned about, is that crypto would introduce risk to banking,” said Disparte.