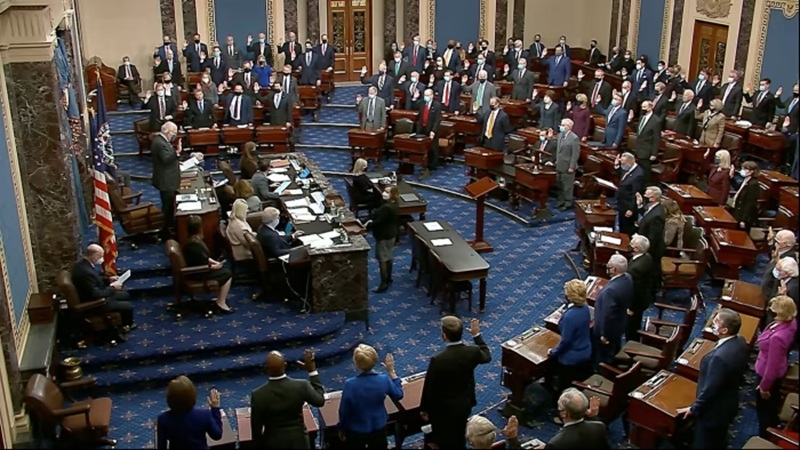

Recent developments indicate strong momentum for U.S. cryptocurrency regulation, with the Senate Banking Committee advancing a comprehensive market structure bill.

Senate Banking Chair Tim Scott (R-SC) announced plans for a committee markup and vote in December 2025, paving the way for a full Senate floor vote in early 2026. This timeline aligns with bipartisan efforts to clarify oversight between the SEC and CFTC, potentially allowing President Trump’s administration to sign it into law soon after.

The legislation, evolving from the House-passed FIT21 (H.R. 3633) and incorporating elements of the CLARITY Act and Responsible Financial Innovation Act, aims to define digital assets as commodities or securities, reduce regulatory overlap, and foster innovation while protecting consumers.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

Key sticking points remain, including Democrat concerns over consumer safeguards and enforcement, but Scott expressed optimism for passage amid accusations of partisan delays. Industry advocates see this as a stabilizing force for the crypto market, potentially unlocking billions in institutional investment.

Google Releases Gemini 3

Google unveiled Gemini 3 marking its most advanced AI model to date and intensifying competition with rivals like OpenAI. The release, coming about eight months after Gemini 2.5, emphasizes “state-of-the-art reasoning” across text, images, audio, and video, with breakthroughs in coding, multimodal processing, and creative tasks like generating user interfaces.

Gemini 3 Pro is now rolling out via the Gemini app, Google Workspace, Vertex AI, and the Gemini API, with enterprise access available immediately for developers and businesses. Highlights include enhanced search integration dubbed “Google Antigravity” for intuitive querying, improved software creation capabilities, and tools to “bring any idea to life.”

Early benchmarks position it as a leader in complex problem-solving, though real-world testing will reveal its edge over competitors. Access starts free in the Gemini app, with premium features for Workspace users.

At its core, the legislation seeks to delineate regulatory authority between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), classifying most cryptocurrencies as “digital commodities” under CFTC oversight while reserving securities-like tokens for the SEC.

This bifurcation aims to end the “turf wars” that have plagued enforcement, as seen in high-profile cases against Coinbase and Ripple. Regulatory clarity could unleash a surge in institutional capital, with estimates suggesting up to $5-10 billion in inflows from traditional finance players like BlackRock and Fidelity, who have hesitated amid uncertainty.

Bitcoin and Ethereum prices have already shown preemptive bullish momentum, rising 5-7% on news of the December committee markups, signaling market anticipation of reduced compliance costs and faster product launches via pot ETFs for altcoins.

For startups and developers, the bill outlines a “defined path for token creation,” potentially spurring innovation in DeFi and NFTs by exempting certain assets from stringent state-level protections—though critics warn this could amplify systemic risks, echoing the 2022 FTX collapse.

Globally, alignment with frameworks like the EU’s MiCA could position the U.S. as a competitive hub, preventing an “exodus” of firms to friendlier jurisdictions like Singapore. The bill’s trajectory intersects with the 2026 midterms, where voting records on crypto could sway “crypto voters”—a demographic now exceeding 50 million U.S. adults, per advocacy groups like Stand With Crypto.

Bipartisan support 90% alignment reported under Senate Banking Chair Tim Scott and Agriculture Chair John Boozman reflects a shift from partisan gridlock, but Democrats’ push for stronger consumer safeguards (e.g., anti-fraud measures) may delay passage amid shutdown aftereffects.

If signed by President Trump, it could cement crypto as a mainstream asset class, but failure risks prolonged SEC dominance, stifling growth and fueling accusations of overreach. Clear CFTC rules for spot markets accelerate DeFi and Web3 apps; new entrants gain infrastructure paths.

Gaps in DeFi regulation could enable unchecked leverage, heightening volatility. Unified framework reduces overlap, with stablecoin safeguards mirroring GENIUS Act. Exemptions from state laws may weaken retail defenses against scams.

U.S. leadership prevents offshoring; boosts GDP via $100B+ sector growth by 2030. Midterm delays or veto could cede ground to China/EU, eroding dollar dominance in crypto. Passage would mark a “turning point” for U.S. crypto, fostering a mature market but demanding vigilant oversight to balance innovation with stability.

Implications of Google’s Gemini 3 Release

With benchmarks topping leaderboards like the MMMU-Pro for multimodal tasks and a 1M-token context window, it outperforms predecessors like Gemini 2.5 by 20-30% in complex problem-solving, positioning Google to reclaim AI primacy from OpenAI’s GPT series and Anthropic’s Claude.

The immediate integration into Google Search via AI Overviews, now serving 2B monthly users, Workspace, and Vertex AI accelerates enterprise adoption, with early users like Geotab reporting “force multiplier” gains in data analysis and code migration.

This “sweeping rollout” contrasts with rivals’ phased launches, potentially capturing 13M+ developers via the new Google Antigravity platform for agentic coding—enabling autonomous task execution like UI generation or legacy system overhauls.

For the broader AI sector, it intensifies the “arms race,” pressuring OpenAI and Meta to innovate faster, while commoditizing tools like chatbots into “true thought partners.” Revenue-wise, Alphabet eyes near-term boosts from premium subscriptions and cloud services, with AI-driven search queries up double-digits year-over-year.

Gemini 3’s “Deep Think” mode and reduced sycophancy (e.g., delivering “genuine insight” over flattery) enhance usability for education and creativity, but raise autonomy concerns—agentic features could automate jobs in coding up to 30% efficiency gains and content creation, displacing roles in media and software.

Safety evaluations via partners like UK AISI mitigate risks like prompt injections, yet multimodal prowess amplifies deepfake potentials, necessitating stricter governance. In search, interactive visualizations for queries like physics problems could democratize knowledge but challenge publishers via synthesized results.

Multimodal integration streamlines workflows; 70% spike in visual search aids businesses. Job displacement in creative/tech fields; over-reliance on AI for decision-making. Free tiers expand reach 650M Gemini app users; excels in multilingual tasks. Digital divide widens if premium features lock advanced tools behind paywalls.

Antigravity enables “vibe-coding” for robotics/gaming; tops benchmarks for adaptability. Ethical lapses in agentic AI could erode trust; intensifies compute arms race, hiking energy demands. This release cements Google’s ecosystem advantage, driving AI toward seamless human collaboration.