Amazon announced plans to invest up to $50 billion in AI infrastructure and supercomputing capabilities specifically for U.S. government customers, sparking a sharp rally in cryptocurrency mining stocks.

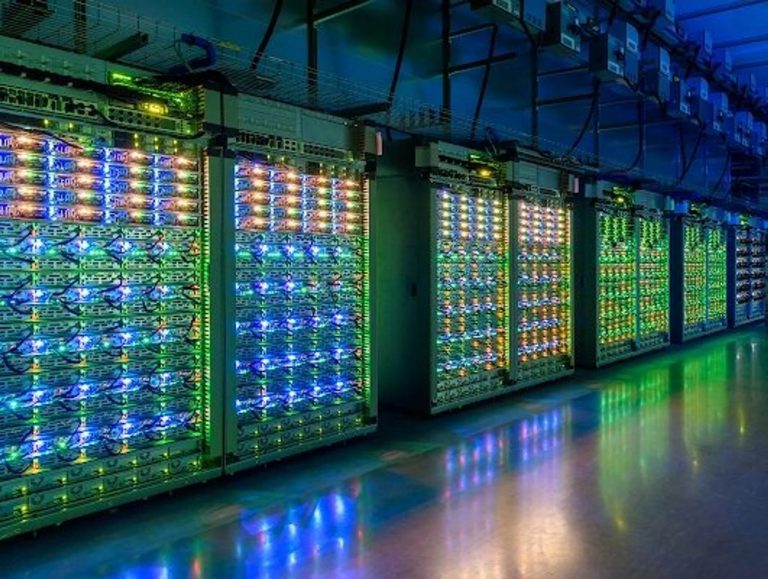

This move underscores the escalating energy demands of AI development, where tech giants like Amazon, Microsoft, and Alphabet are racing to build out massive data centers—often leveraging existing power-heavy infrastructure from the crypto mining sector.

Miners, facing post-2024 Bitcoin halving profitability squeezes, are pivoting to AI hosting, turning their grid-connected sites into valuable assets for rapid AI deployment.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

Key Stock Movements

The announcement triggered immediate gains, with several mining firms seeing double-digit jumps in a single session. BMNR ~20% led the rally, benefiting from its immersion cooling tech suited for AI workloads.

Cipher Mining; 18-20% +360% fresh off a $5.5B, 15-year AWS deal for AI power supply; shares hit $22.37 in pre-market. IREN; ~13% +580% rebranded focus on AI; secured $9.7B Microsoft deal earlier this year.

CleanSpark; ~13% strong in sustainable energy mining, aligning with AI’s green push. TeraWulf; +160% emphasizes low-cost, renewable power sites.

Riot Platforms— RIOT; +100% major U.S. player with 14 GW aggregate sector capacity now eyed for AI. Hut 8; Canadian miner expanding U.S. AI partnerships. These gains pushed the broader crypto market higher, with Bitcoin briefly surpassing $87,000 amid renewed investor appetite.

Coinbase (COIN) and other ecosystem plays like Galaxy Digital rose 4-5%. AI training and inference require enormous electricity—far outpacing traditional grid growth. U.S. Bitcoin miners alone control about 14 gigawatts of ready-to-use power capacity, often in remote, energy-rich locations with direct grid access.

This “plug-and-play” setup lets hyperscalers like AWS bypass years of permitting delays. Examples include: Apple’s recent federal nod to wholesale electricity trading for AI needs.

Miners adopting 52% renewable energy mixes, contrasting AI’s reliance on new gas/nuclear plants, creating hybrid energy solutions. The rally has cooled slightly but holds gains above 10% for leaders, with analysts watching for follow-on deals.

This convergence signals a “new era” where ex-crypto infrastructure fuels the AI boom, potentially reshaping energy markets. On X, the story trended with quick hits from crypto alert accounts, amplifying the buzz.

The Amazon/Cipher deal, marks first direct partnership with a major hyperscaler and accelerates its strategic pivot from cryptocurrency mining to high-performance computing (HPC) and AI infrastructure hosting.

The agreement leverages Cipher’s expertise in power-intensive data centers, providing AWS with dedicated capacity for AI workloads amid surging demand for energy-efficient computing resources.

Cipher will deliver 300 megawatts (MW) of turnkey data center space and power, equipped with both air and liquid cooling systems to support AWS’s AI training and inference needs.

Phase 1 begins in July 2026, with initial capacity coming online. Lease rentals commence in August 2026, generating predictable, long-term revenue for Cipher over the contract’s duration.

The hosting will occur at Cipher’s Barber Lake site in Colorado City, Texas, a strategic location with access to low-cost, grid-connected power ideal for rapid AI deployment.

This deal builds on Cipher’s prior AI-focused agreements, including a 10-year, 168 MW hosting contract with Fluidstack backed by a $1.4 billion guarantee from Google announced in September 2025, which included Google acquiring a 5.4% equity stake in Cipher.

Combined, these contracts represent $8.5 billion in total AI hosting lease payments, underscoring Cipher’s growing role in the AI ecosystem. Cipher’s move aligns with broader industry trends where Bitcoin miners, post-2024 halving, are repurposing their 14+ GW of U.S. power capacity for AI hyperscalers facing grid constraints and permitting delays.

CEO Tyler Page described the quarter as “truly transformative,” noting the company’s 3.2 GW project pipeline and confidence in Texas as a hub for non-traditional AI sites. To fund expansions, Cipher completed a $1.3 billion convertible note offering in Q3 2025.

Simultaneously, Cipher unveiled a joint venture to develop the “Colchis” site—a 1 GW HPC data center in West Texas—with a fully executed Direct Connect Agreement with American Electric Power (AEP) for dual interconnection.

Energization is targeted for 2028, and Cipher will finance the majority, securing ~95% equity ownership.Q3 2025 Financial SnapshotThe AWS announcement coincided with Cipher’s Q3 earnings release, highlighting operational momentum despite a modest net loss.

CIFR shares surged 19-34% in trading on November 3, 2025, closing up ~19% at $22.24 from $18.65, with intraday highs pushing toward $24.81. Year-to-date gains exceeded 360% pre-announcement, reflecting investor enthusiasm for AI diversification.

Broader sector peers, such as Iris Energy (IREN) with its $9.7 billion Microsoft deal, saw similar rallies, signaling a “new era” for mining stocks in AI power plays. This partnership positions Cipher as a “power + compute factory” for the AI revolution.

With analysts raising price targets based on enhanced balance sheet strength and revenue visibility. CIFR trades around $22-24, with ongoing buzz about potential follow-on hyperscaler deals.