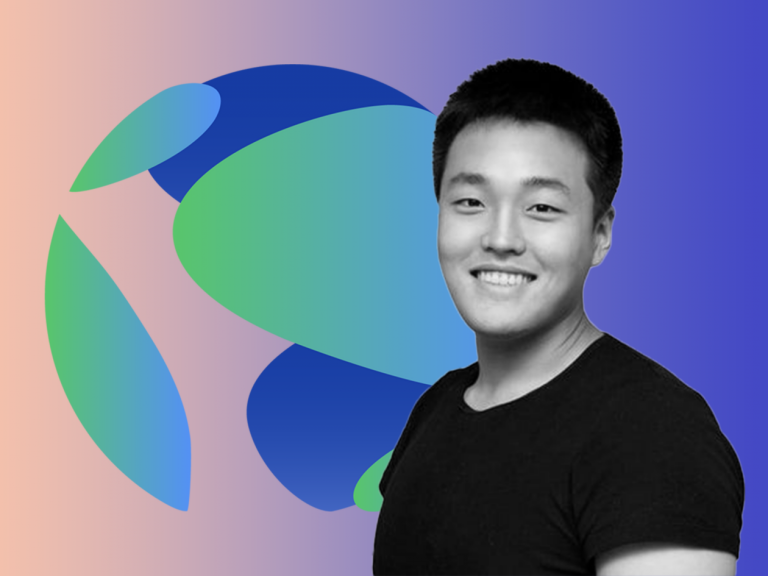

Do Kwon, the South Korean cryptocurrency entrepreneur whose TerraUSD and Luna tokens imploded in 2022 and erased an estimated $40 billion in market value, is scheduled to be sentenced on Thursday in a New York federal court.

The hearing before U.S. District Judge Paul A. Engelmayer is set for 11 a.m. local time (1600 GMT) in Manhattan, marking a decisive moment in one of the largest crypto fraud cases to reach the U.S. courts.

Kwon, 34, co-founded the Singapore-based Terraform Labs and developed TerraUSD, a so-called algorithmic stablecoin that he claimed would hold its $1 value even in volatile markets. He also created Luna, the token that was designed to help maintain TerraUSD’s peg. He previously pleaded guilty to two criminal counts — conspiracy to defraud and wire fraud — and admitted he misled investors about the stability mechanisms supporting the coin.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

“I made false and misleading statements about why it regained its peg by failing to disclose a trading firm’s role in restoring that peg,” Kwon said in court. “What I did was wrong.”

The sentencing follows a sweeping set of charges filed by U.S. prosecutors in January, which originally included nine counts covering securities fraud, wire fraud, commodities fraud, and money laundering conspiracy. Prosecutors say Kwon’s actions inflicted massive losses on investors around the world and set off a chain reaction in the crypto market. When TerraUSD collapsed in 2022, the shockwave contributed to the downfall of some of the industry’s most prominent firms and accelerated a slide in digital asset prices that wiped out tens of billions more.

Kwon’s case sits at the center of a broader crackdown on cryptocurrency executives after the market’s dramatic downturn. Multiple companies failed in rapid succession in 2022, and several top industry figures have since faced criminal prosecution or regulatory action. The Justice Department has argued that these cases demonstrate the extent to which fraud had spread across the sector during its boom years.

Prosecutors have asked the court to impose a sentence of at least 12 years, saying the magnitude of the losses and the market disruption justify a substantial prison term. They argue that Kwon’s manipulation of TerraUSD’s value in 2021 — when he told investors that a computer algorithm known as the Terra Protocol had restored the coin’s peg, even though a high-frequency trading firm had secretly been enlisted to buy millions of dollars’ worth of tokens — was a deliberate and calculated deception.

Kwon’s lawyers are pushing for a sentence of no more than five years, saying he needs to return to South Korea to face separate criminal charges there. As part of his plea agreement, U.S. prosecutors said they would not oppose a request for Kwon to be transferred abroad after he serves half of his U.S. sentence.

His legal problems extend beyond the criminal case in New York. In 2024, Kwon agreed to pay an $80 million civil fine and accept a ban on crypto-related activities as part of a sweeping $4.55 billion settlement reached with the U.S. Securities and Exchange Commission alongside Terraform Labs. He also remains wanted in South Korea, where authorities have pursued him since the crash and accused him of violating financial laws.

The sentencing marks the culmination of a saga that reshaped global attitudes toward digital assets. TerraUSD’s collapse became a turning point for regulators worldwide, prompting tighter scrutiny over stablecoins, greater demands for transparency, and mounting pressure on exchanges and crypto issuers to prove the legitimacy of their reserves and business models.

For many investors burned in the collapse, Thursday’s hearing is the closest step yet toward accountability in a market that operated for years with minimal oversight.