The Federal Reserve stepped into a delicate balancing act on Wednesday, delivering a quarter-point rate cut while signaling two more before year-end — a move that underscores the growing tension between cooling job growth, persistent inflation, and political pressure from the White House.

The decision lowers the benchmark federal funds rate to 4.00%-4.25%, with the 11-to-1 vote showing less division than Wall Street expected. Governor Stephen Miran, appointed by President Donald Trump, cast the sole dissent, pushing for a steeper half-point cut, according to CNBC.

All three governors who were watched closely — Miran, Michelle Bowman, and Christopher Waller — were appointed by Trump. While Bowman and Waller backed the quarter-point move, Trump has not let up on his calls for aggressive cuts, arguing that borrowing costs must come down quickly to revive the housing market and reduce debt-servicing burdens.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

The political backdrop is striking for a central bank long known for its efforts to stay independent. Just a year ago, when the Fed approved a half-point cut, Trump accused the institution of tilting the election in favor of his Democratic rival, Kamala Harris. His continued hectoring — combined with Miran’s outspoken criticism of Powell — has once again fueled doubts over how insulated the Fed truly is.

The Fed’s statement highlighted the tricky crosscurrents at play: economic activity “has moderated,” job gains “have slowed,” and inflation “remains somewhat elevated.”

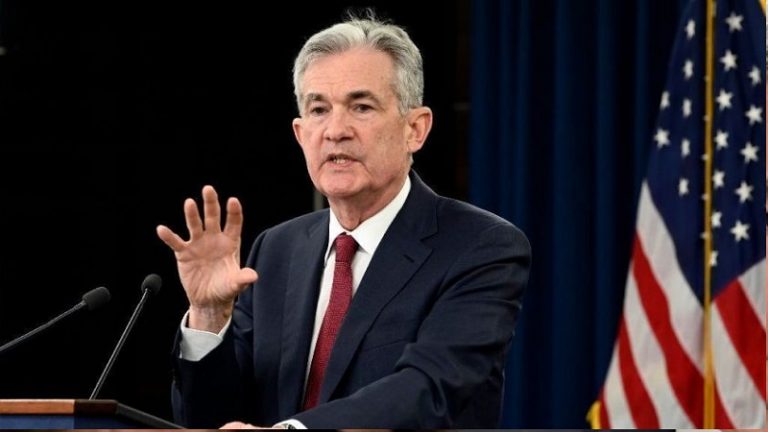

Chair Jerome Powell admitted that the U.S. labor market is losing steam. “The marked slowing in both the supply of and demand for workers is unusual in this less dynamic and somewhat softer labor market,” he said at his press conference, describing the cut as a form of “risk management.”

But not all economists agreed with Powell’s framing. Dan North, chief economist at Allianz Trade North America, argued the Fed is taking a more active role than it admits: “I don’t think that’s risk management. I think that’s steering the ship.”

The markets wavered on the announcement. Stocks swung between gains and losses, while Treasury yields fell on short-dated issues but rose further out, signaling mixed expectations on the economy’s direction.

Reading the Dots

The Fed’s quarterly “dot plot” — a map of policymakers’ rate expectations — pointed to two more cuts in 2025, most likely in October and December. But the projections also revealed deep divisions. Nine officials see one more cut, 10 want two, and at least one — likely Miran — is calling for 1.25 percentage points of reductions this year. Another participant opposed any cuts at all, including the one delivered on Wednesday.

Simon Dangoor, head of fixed income macro strategies at Goldman Sachs Asset Management, said the message is clear: “The doves on the committee are now in the driver’s seat. It would take a significant upside surprise in inflation or a labor market rebound to take the Fed off its current easing trajectory.”

Looking further out, officials projected just one cut in 2026 and another in 2027, suggesting a slow crawl back toward the long-run “neutral” rate of around 3%. That is far less aggressive than the path financial markets had priced in.

The day’s decision came against another swirl of controversy. Trump had sought to remove Governor Lisa Cook, a Biden appointee, accusing her of mortgage fraud tied to federally backed loans. But a court blocked the attempt, keeping Cook on the board — where she voted with the majority for the quarter-point cut. Cook has denied any wrongdoing and has not been charged.

The episode, coupled with Miran’s loyalty to Trump’s rate-cutting agenda, deepened concerns that politics are intruding into the Fed’s traditionally cautious policymaking.

The Economy’s Mixed Signals

The economic picture the Fed is responding to remains uneven. Growth is holding steady, and consumer spending is running hotter than expected, but the job market has softened noticeably.

Unemployment reached 4.3% in August, the highest since 2021, and the Bureau of Labor Statistics recently revised job growth figures downward by nearly one million for the year ending March 2025. That weakens one of the strongest narratives of the post-pandemic economy.

Inflation, while lower than in 2022, has ticked higher in recent months — complicating the Fed’s mission. Powell admitted the risks to employment have grown, while Governor Waller argued that easing now could prevent a deeper downturn later. Waller’s position is closely watched not just for policy signals, but because his name has surfaced as a possible successor to Powell when his term ends in 2026.

Looking ahead, the Fed’s next moves are expected to hinge on whether unemployment keeps rising or inflation resurges. If job losses accelerate, the two additional cuts penciled in for October and December will almost certainly materialize. If inflation proves sticky, Powell could slow the pace — risking pushback from both the markets and the Trump administration.

For now, the Fed is signaling a gradual easing cycle, hoping to stabilize the labor market without reigniting price pressures. But history suggests politically charged rate decisions often carry long-lasting consequences, both for the economy and for the central bank’s credibility.