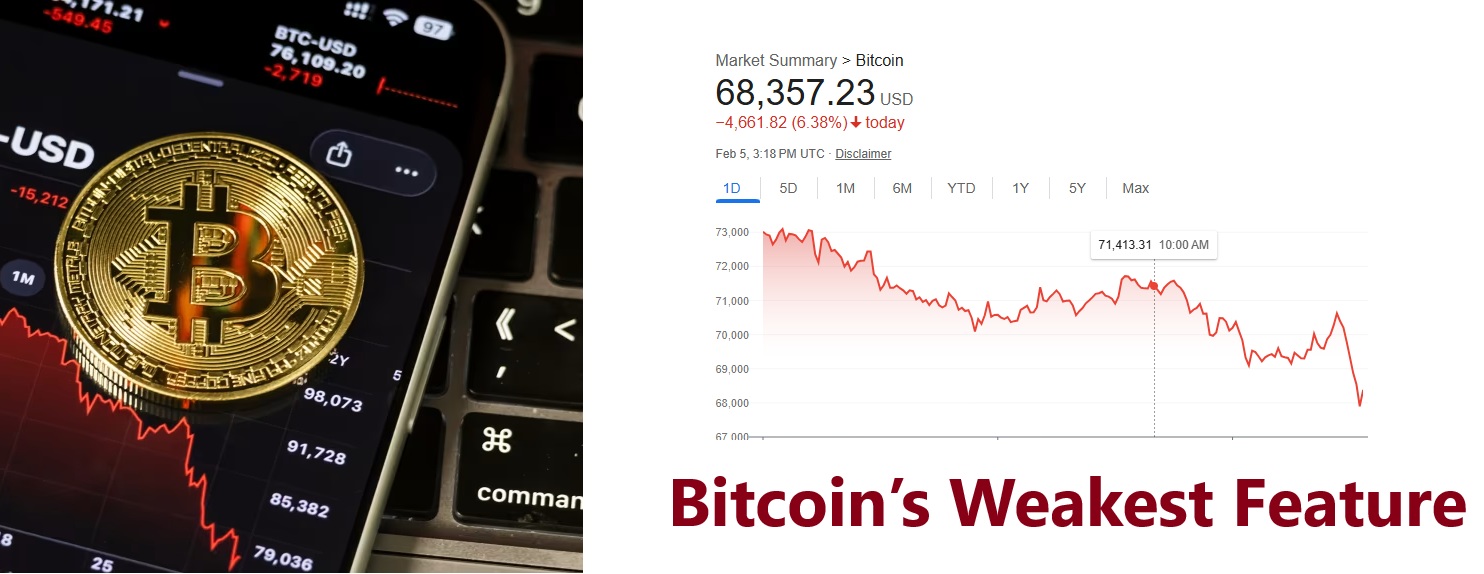

Bitcoin's Weakest Feature Is Destroying it Now

Quote from Ndubuisi Ekekwe on February 5, 2026, 10:44 AM

Bitcoin is having a very difficult new year. And unlike a company, it has no balance sheet to lean on, no income statement to reassure the market, and no earnings call to slow the bleeding. When companies struggle, they can publish results, explain strategy, cut costs, or point to future cash flows. Bitcoin cannot do any of that.

Its only defense mechanism is belief. That dependency on collective faith is its weakest link.

Let me be clear: fiat currencies have serious issues. But those issues are anchored in real systems like balance of payments, trade flows, tax revenues, productivity, and economic output. Governments can be inefficient or reckless, but currencies are tied to economies that produce goods, services, and value.

Bitcoin is different. It is a floating construct with no life vest. When belief weakens, it does not adjust, it sinks. If confidence disappears, there is nothing underneath to keep it afloat.

So, yes, good luck to the hodlers. In Bitcoin, faith is not just important, it is everything. I get you...it will rise again. It does indeed and I will celebrate it here.

Comment on Feed: I am wondering if Gold has its own balance sheet. Is price of Gold not determined by "belief" too? I really want to know.

My Response: Everything, at some level, is shaped by belief. That includes fiat currencies and even company stocks. There is no debate there. Markets run on confidence. But the critical distinction is that, in most systems, belief is not the only lever available.

Take fiat currencies. Yes, belief matters, but outcomes can be influenced through policy, trade, taxation, productivity, and economic activity. Governments can act, sometimes well, sometimes poorly, but action exists. Company stocks are similar. When belief fades, firms can respond: improve operations, cut costs, innovate, generate cash flows, or restructure. There are levers beyond sentiment.

Gold is different still. It is anchored in physical reality like mines, production capacity, and industrial and ornamental uses. If gold prices collapse, the metal does not become useless. It can be turned into jewelry, industrial components, or stored as a physical asset. Utility provides a floor.

Now consider Bitcoin. When belief weakens, what exactly can be done to change the outcome? There is no policy response. No productivity lever. No alternative use. No industrial demand. No cash flow. No balance sheet. In Bitcoin, belief is not just a component of value, it is the entire system. And when belief becomes the only pillar, fragility becomes the defining feature.

Bitcoin is having a very difficult new year. And unlike a company, it has no balance sheet to lean on, no income statement to reassure the market, and no earnings call to slow the bleeding. When companies struggle, they can publish results, explain strategy, cut costs, or point to future cash flows. Bitcoin cannot do any of that.

Its only defense mechanism is belief. That dependency on collective faith is its weakest link.

Let me be clear: fiat currencies have serious issues. But those issues are anchored in real systems like balance of payments, trade flows, tax revenues, productivity, and economic output. Governments can be inefficient or reckless, but currencies are tied to economies that produce goods, services, and value.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

Bitcoin is different. It is a floating construct with no life vest. When belief weakens, it does not adjust, it sinks. If confidence disappears, there is nothing underneath to keep it afloat.

So, yes, good luck to the hodlers. In Bitcoin, faith is not just important, it is everything. I get you...it will rise again. It does indeed and I will celebrate it here.

Comment on Feed: I am wondering if Gold has its own balance sheet. Is price of Gold not determined by "belief" too? I really want to know.

My Response: Everything, at some level, is shaped by belief. That includes fiat currencies and even company stocks. There is no debate there. Markets run on confidence. But the critical distinction is that, in most systems, belief is not the only lever available.

Take fiat currencies. Yes, belief matters, but outcomes can be influenced through policy, trade, taxation, productivity, and economic activity. Governments can act, sometimes well, sometimes poorly, but action exists. Company stocks are similar. When belief fades, firms can respond: improve operations, cut costs, innovate, generate cash flows, or restructure. There are levers beyond sentiment.

Gold is different still. It is anchored in physical reality like mines, production capacity, and industrial and ornamental uses. If gold prices collapse, the metal does not become useless. It can be turned into jewelry, industrial components, or stored as a physical asset. Utility provides a floor.

Now consider Bitcoin. When belief weakens, what exactly can be done to change the outcome? There is no policy response. No productivity lever. No alternative use. No industrial demand. No cash flow. No balance sheet. In Bitcoin, belief is not just a component of value, it is the entire system. And when belief becomes the only pillar, fragility becomes the defining feature.

Share this:

- Click to share on Facebook (Opens in new window) Facebook

- Click to share on X (Opens in new window) X

- Click to share on WhatsApp (Opens in new window) WhatsApp

- Click to share on LinkedIn (Opens in new window) LinkedIn

- Click to email a link to a friend (Opens in new window) Email

- Click to print (Opens in new window) Print