China’s Exports Beat Forecasts as Trade Deal with US Offers Temporary Relief

Quote from Alex Bobby on July 14, 2025, 9:24 AM

China’s Exports Beat Expectations as US Trade Deal Offers Breathing Room

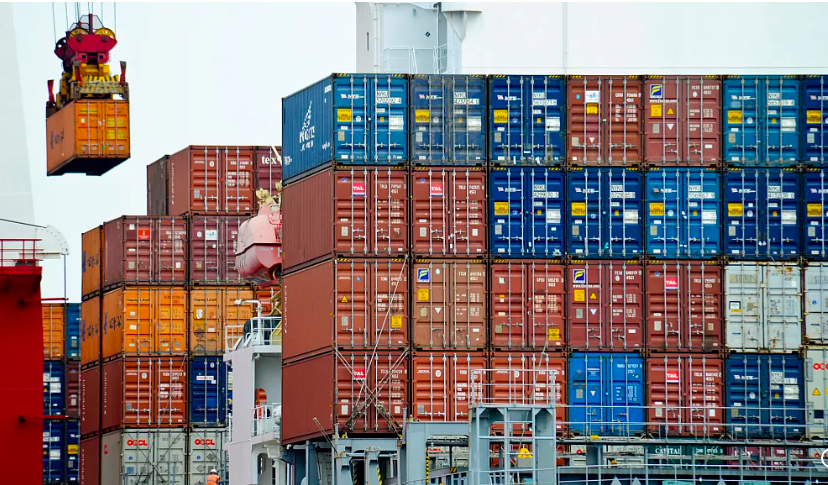

China's export engine is showing renewed strength, bouncing back in June with better-than-expected figures, despite ongoing tensions with Washington and a still-sluggish global economy. According to data released by the General Administration of Customs on Monday, China’s exports rose by 5.8% year-on-year in June to $325 billion, marking the first monthly export growth since March and beating market forecasts of 4.8%. Imports also saw a modest rebound, climbing 1.1% year-on-year after a steep 3.4% drop in May.

The encouraging data comes just weeks after Beijing and Washington reached a fresh trade agreement, offering hope that bilateral tensions might ease — at least temporarily — and inject some stability into global trade.

US Trade Deal: A Temporary Respite

After months of tit-for-tat tariff hikes, China and the United States finally agreed in late June to slash duties on each other’s goods, a move that analysts say helped boost market confidence and avoid a deepening trade standoff. Earlier in May, the US imposed a 30% tariff on a wide range of Chinese goods, prompting a 10% retaliatory duty from Beijing on US imports.

While the new agreement deescalates some of that tension, it hasn’t yet reversed the downward trend in US-China trade. Chinese exports to the United States fell 16.1% year-on-year in June — their third consecutive monthly drop. However, that figure is a significant improvement from the 34.5% plunge recorded in May, suggesting that the decline may be stabilizing.

In Chinese Yuan terms, exports to the US dropped 9.9% over the first half of the year, while imports fell by 7.7%.

Diversification Strategy Pays Off

China's improving export figures are largely credited to its strategy of diversifying away from dependence on the US market. Amid geopolitical uncertainty and rising protectionism, Chinese exporters have stepped up shipments to emerging and regional markets.

During the first six months of 2025, China recorded a noticeable increase in trade with countries in Africa, Latin America, and the European Union. In particular, trade with the Association of Southeast Asian Nations (ASEAN) — a bloc of 10 nations including Vietnam, Indonesia, and Thailand — offered a crucial cushion for China’s export sector.

This diversification push underscores Beijing's long-term goal of reducing exposure to the whims of US policy, especially as the 2024–25 trade conflict has highlighted just how vulnerable China remains to tariff shocks from its largest trading partner.

Tariff Risks Still Loom

Despite the recent agreement, the road ahead remains uncertain. President Donald Trump has signaled plans to impose “reciprocal” tariffs starting August 1, aimed at countries he accuses of unfair trade practices — including China. Under the proposed measures, goods transshipped through countries like Vietnam that are suspected of originating from China could face punitive tariffs of up to 40%, while Vietnamese exports directly will be subject to a 20% duty.

This policy shift is designed in part to target Chinese firms that reroute goods through third countries to avoid US tariffs, a practice Washington is now aggressively trying to curtail.

Adding to China’s export woes, the United States last week announced a steep 50% tariff on copper, joining an expanding list of levies already imposed on Chinese goods including automobiles, aluminum, and steel. Sector-specific tariffs are expected to increase in the coming months, making long-term export growth to the US increasingly difficult.

Domestic Challenges Persist

While foreign trade is recovering, China’s domestic economy remains under pressure. The country’s property sector crisis continues to suppress consumer confidence and spending. Economists expect China’s second-quarter GDP — due to be released on Tuesday — to hover near the government’s 5% annual growth target, thanks in part to stronger exports offsetting weak domestic demand.

The Chinese government is hoping that sustained export growth can provide a much-needed lifeline for an economy still grappling with structural problems. However, analysts caution that exports alone cannot carry the full weight of economic recovery, particularly as global demand slows and trade tensions remain unpredictable.

Outlook: Cautious Optimism

The June export figures offer a welcome boost for China, especially in the face of persistent geopolitical and economic headwinds. The latest US-China trade agreement provides a temporary reprieve, but underlying tensions remain, and new tariff threats could reverse recent progress.

China’s ability to expand trade ties beyond traditional partners will be key in the months ahead. If Beijing can successfully deepen its relationships with ASEAN, Latin America, and Africa — while also managing relations with Washington — its exporters may continue to weather the storm.

For now, the message from Beijing is clear: the global environment may be turbulent, but China is adapting — and determined to chart a more resilient path forward.

Conclusion

China’s stronger-than-expected export growth in June signals resilience in the face of global economic uncertainty and ongoing trade tensions with the United States. While shipments to the US remain in decline, the recent trade agreement between Beijing and Washington has helped ease some immediate pressure and created room for further negotiations.

However, looming tariff threats from the US — including reciprocal duties and new sector-specific levies — mean that challenges are far from over. China’s strategic pivot toward diversified markets like ASEAN, Africa, and Latin America is clearly paying off, but it remains only part of the solution.

As domestic demand continues to lag and the global trade environment remains volatile, China will need to balance careful diplomacy with structural economic reforms. The coming months will be critical in determining whether export strength can translate into sustained recovery — or if new geopolitical rifts will once again disrupt the fragile progress made.

Meta Description:

China's exports rose 5.8% in June, beating expectations, as a new US trade agreement eases pressure. Diversification to ASEAN, Africa, and EU drives growth amid looming tariff threats.

China’s Exports Beat Expectations as US Trade Deal Offers Breathing Room

China's export engine is showing renewed strength, bouncing back in June with better-than-expected figures, despite ongoing tensions with Washington and a still-sluggish global economy. According to data released by the General Administration of Customs on Monday, China’s exports rose by 5.8% year-on-year in June to $325 billion, marking the first monthly export growth since March and beating market forecasts of 4.8%. Imports also saw a modest rebound, climbing 1.1% year-on-year after a steep 3.4% drop in May.

The encouraging data comes just weeks after Beijing and Washington reached a fresh trade agreement, offering hope that bilateral tensions might ease — at least temporarily — and inject some stability into global trade.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

US Trade Deal: A Temporary Respite

After months of tit-for-tat tariff hikes, China and the United States finally agreed in late June to slash duties on each other’s goods, a move that analysts say helped boost market confidence and avoid a deepening trade standoff. Earlier in May, the US imposed a 30% tariff on a wide range of Chinese goods, prompting a 10% retaliatory duty from Beijing on US imports.

While the new agreement deescalates some of that tension, it hasn’t yet reversed the downward trend in US-China trade. Chinese exports to the United States fell 16.1% year-on-year in June — their third consecutive monthly drop. However, that figure is a significant improvement from the 34.5% plunge recorded in May, suggesting that the decline may be stabilizing.

In Chinese Yuan terms, exports to the US dropped 9.9% over the first half of the year, while imports fell by 7.7%.

Diversification Strategy Pays Off

China's improving export figures are largely credited to its strategy of diversifying away from dependence on the US market. Amid geopolitical uncertainty and rising protectionism, Chinese exporters have stepped up shipments to emerging and regional markets.

During the first six months of 2025, China recorded a noticeable increase in trade with countries in Africa, Latin America, and the European Union. In particular, trade with the Association of Southeast Asian Nations (ASEAN) — a bloc of 10 nations including Vietnam, Indonesia, and Thailand — offered a crucial cushion for China’s export sector.

This diversification push underscores Beijing's long-term goal of reducing exposure to the whims of US policy, especially as the 2024–25 trade conflict has highlighted just how vulnerable China remains to tariff shocks from its largest trading partner.

Tariff Risks Still Loom

Despite the recent agreement, the road ahead remains uncertain. President Donald Trump has signaled plans to impose “reciprocal” tariffs starting August 1, aimed at countries he accuses of unfair trade practices — including China. Under the proposed measures, goods transshipped through countries like Vietnam that are suspected of originating from China could face punitive tariffs of up to 40%, while Vietnamese exports directly will be subject to a 20% duty.

This policy shift is designed in part to target Chinese firms that reroute goods through third countries to avoid US tariffs, a practice Washington is now aggressively trying to curtail.

Adding to China’s export woes, the United States last week announced a steep 50% tariff on copper, joining an expanding list of levies already imposed on Chinese goods including automobiles, aluminum, and steel. Sector-specific tariffs are expected to increase in the coming months, making long-term export growth to the US increasingly difficult.

Domestic Challenges Persist

While foreign trade is recovering, China’s domestic economy remains under pressure. The country’s property sector crisis continues to suppress consumer confidence and spending. Economists expect China’s second-quarter GDP — due to be released on Tuesday — to hover near the government’s 5% annual growth target, thanks in part to stronger exports offsetting weak domestic demand.

The Chinese government is hoping that sustained export growth can provide a much-needed lifeline for an economy still grappling with structural problems. However, analysts caution that exports alone cannot carry the full weight of economic recovery, particularly as global demand slows and trade tensions remain unpredictable.

Outlook: Cautious Optimism

The June export figures offer a welcome boost for China, especially in the face of persistent geopolitical and economic headwinds. The latest US-China trade agreement provides a temporary reprieve, but underlying tensions remain, and new tariff threats could reverse recent progress.

China’s ability to expand trade ties beyond traditional partners will be key in the months ahead. If Beijing can successfully deepen its relationships with ASEAN, Latin America, and Africa — while also managing relations with Washington — its exporters may continue to weather the storm.

For now, the message from Beijing is clear: the global environment may be turbulent, but China is adapting — and determined to chart a more resilient path forward.

Conclusion

China’s stronger-than-expected export growth in June signals resilience in the face of global economic uncertainty and ongoing trade tensions with the United States. While shipments to the US remain in decline, the recent trade agreement between Beijing and Washington has helped ease some immediate pressure and created room for further negotiations.

However, looming tariff threats from the US — including reciprocal duties and new sector-specific levies — mean that challenges are far from over. China’s strategic pivot toward diversified markets like ASEAN, Africa, and Latin America is clearly paying off, but it remains only part of the solution.

As domestic demand continues to lag and the global trade environment remains volatile, China will need to balance careful diplomacy with structural economic reforms. The coming months will be critical in determining whether export strength can translate into sustained recovery — or if new geopolitical rifts will once again disrupt the fragile progress made.

Meta Description:

China's exports rose 5.8% in June, beating expectations, as a new US trade agreement eases pressure. Diversification to ASEAN, Africa, and EU drives growth amid looming tariff threats.

Share this:

- Click to share on Facebook (Opens in new window) Facebook

- Click to share on X (Opens in new window) X

- Click to share on WhatsApp (Opens in new window) WhatsApp

- Click to share on LinkedIn (Opens in new window) LinkedIn

- Click to email a link to a friend (Opens in new window) Email

- Click to print (Opens in new window) Print