You may be more important than your company in AI age

Quote from Ndubuisi Ekekwe on July 13, 2025, 7:09 AMAnother deal as Google goes after the CEO of Windsurf and the message is clear: it is about talent, and not the tech. The implication is that leading AI talent may be worth more than their firms.

Google will pay more than $2 billion to license the technology of AI coding startup Windsurf and hire some of its team, including CEO Varun Mohan, The Wall Street Journal reports, citing anonymous sources. News of the deal comes after OpenAI's planned $3 billion acquisition of Windsurf fell through. The group will focus on agentic coding at Google DeepMind, working primarily on Gemini. Windsurf will keep operating independently. Other tech giants have recently made similar massive payouts for talent as the AI race keeps intensifying. - LinkedIn News

I discussed this in Tekedia Daily: it is about the knowledge.

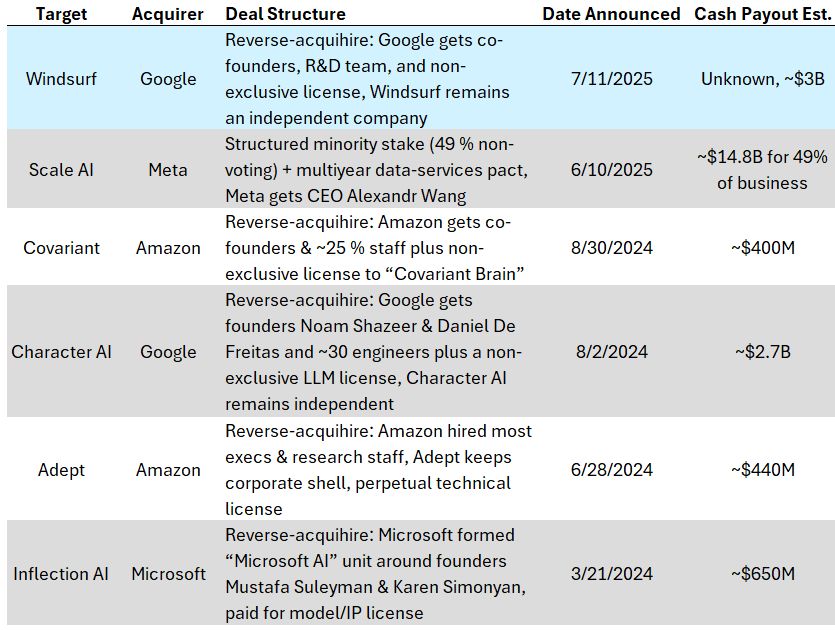

What is going on? After US regulators went after Meta, for buying WhatsApp, Instagram, etc, the big tech companies updated their playbooks, to comply with the latest law, and in the process resurrected something at scale. That is called "reverse acquihire".

What is reverse acquihire? A "reverse acquihire" is a deal where a larger company hires the talent and potentially some technology from a smaller company, essentially absorbing the team, but without the full acquisition of the company itself. It's a way to acquire valuable skills and innovation while potentially avoiding the regulatory hurdles and complexities of a traditional acquisition. In a standard acquihire, a company buys another company primarily for its employees' talent and expertise. The acquired company's assets, products, or services may not be the main focus.

The summary: Under this emerging reverse acquihire construct, founders need to understand that investors are investing in them, and not necessarily the companies, if exits involve reverse acquihire! In other words, the founders are the products and the companies since bigtechs are not interested in those products/companies anymore, but the knowledge. And with that knowledge, new codes could be created and products rebuilt.

This is a new territory where the reward of success in a startup could be met with the founders departing from the company, and in the process decapitate the firm. Expect new clauses* in term sheets on this reality.

*the good news is that so far, the founders have been great for the investors. In the Meta - Scale AI deal, it rained, and the investors smiled. Hope it stays that way.

Another deal as Google goes after the CEO of Windsurf and the message is clear: it is about talent, and not the tech. The implication is that leading AI talent may be worth more than their firms.

Google will pay more than $2 billion to license the technology of AI coding startup Windsurf and hire some of its team, including CEO Varun Mohan, The Wall Street Journal reports, citing anonymous sources. News of the deal comes after OpenAI's planned $3 billion acquisition of Windsurf fell through. The group will focus on agentic coding at Google DeepMind, working primarily on Gemini. Windsurf will keep operating independently. Other tech giants have recently made similar massive payouts for talent as the AI race keeps intensifying. - LinkedIn News

I discussed this in Tekedia Daily: it is about the knowledge.

What is going on? After US regulators went after Meta, for buying WhatsApp, Instagram, etc, the big tech companies updated their playbooks, to comply with the latest law, and in the process resurrected something at scale. That is called "reverse acquihire".

Register for Tekedia Mini-MBA edition 18 (Sep 15 – Dec 6, 2025) today for early bird discounts. Do annual for access to Blucera.com.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment.

What is reverse acquihire? A "reverse acquihire" is a deal where a larger company hires the talent and potentially some technology from a smaller company, essentially absorbing the team, but without the full acquisition of the company itself. It's a way to acquire valuable skills and innovation while potentially avoiding the regulatory hurdles and complexities of a traditional acquisition. In a standard acquihire, a company buys another company primarily for its employees' talent and expertise. The acquired company's assets, products, or services may not be the main focus.

The summary: Under this emerging reverse acquihire construct, founders need to understand that investors are investing in them, and not necessarily the companies, if exits involve reverse acquihire! In other words, the founders are the products and the companies since bigtechs are not interested in those products/companies anymore, but the knowledge. And with that knowledge, new codes could be created and products rebuilt.

This is a new territory where the reward of success in a startup could be met with the founders departing from the company, and in the process decapitate the firm. Expect new clauses* in term sheets on this reality.

*the good news is that so far, the founders have been great for the investors. In the Meta - Scale AI deal, it rained, and the investors smiled. Hope it stays that way.

Quote from Francis Oguaju on July 13, 2025, 12:29 PMA new law will be needed, else innovation will punted. This is not progress, it's rather about control.

A new law will be needed, else innovation will punted. This is not progress, it's rather about control.