Intel is preparing to enter the graphics processing unit (GPU) market in a more serious way, a move that would pit the once-dominant chipmaker more directly against Nvidia in data centers.

This comes as the chipmaker’s chief executive, Lip-Bu Tan, sounds a note of urgency about China’s rapid progress in chip design despite U.S. restrictions.

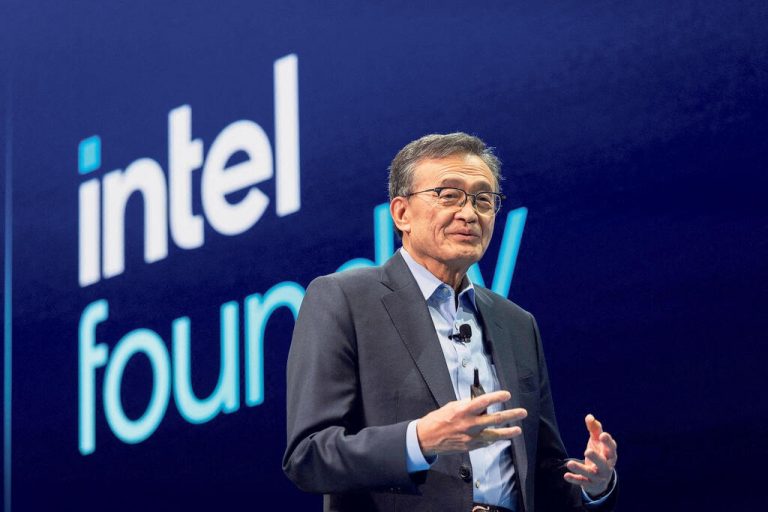

The renewed ambition marks a significant strategic pivot for a company that once defined the cutting edge of the global semiconductor industry but has spent much of the past decade playing catch-up. Comments from Lip-Bu Tan on Tuesday underline both the scale of Intel’s aspirations and the competitive pressures driving them, from Nvidia’s dominance in AI chips to China’s accelerating capabilities under export restrictions.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

Speaking at the Cisco AI Summit, Tan confirmed that Intel is actively developing GPUs, the class of chips that has become central to artificial intelligence workloads and the primary engine of Nvidia’s extraordinary growth. GPUs, originally designed for graphics rendering, are now the backbone of data centers used for training and running large AI models, an area where Intel has been notably underrepresented.

“I just hired the chief GPU architect, and he’s very good. I’m very delighted he joined me,” Tan said, adding that it took some effort to persuade him to come on board. While Tan did not disclose timelines or product specifics, the hire signals that Intel’s GPU push is no longer experimental but structural, anchored by senior technical leadership.

In an interview with Reuters on the sidelines of the event, Tan made clear that Intel’s GPU ambitions are tightly integrated with its data center strategy rather than aimed at consumer graphics or gaming, where Nvidia and AMD are also strong.

“It’s tied in with the data center,” Tan said. “We’re working with customers, and will then define what the customer needs.”

That customer-first framing reflects lessons Intel has learned the hard way. Nvidia’s success has been driven not just by powerful chips but by tight collaboration with hyperscalers and AI developers, alongside a mature software ecosystem. Intel, by contrast, has often been accused by customers and analysts of designing products in isolation and arriving late to fast-moving markets.

A key figure in Intel’s renewed effort is Eric Demmers, a senior executive who joined from Qualcomm last month. Demmers will report to Kevork Kechichian, Intel’s head of data center chips, reinforcing the message that GPUs are now a core part of Intel’s data center roadmap. Demmers’ move is notable because Qualcomm itself has been expanding its ambitions beyond mobile chips, and Intel’s ability to attract senior talent from rivals suggests a degree of renewed confidence under Tan’s leadership.

Beyond product development, Tan also highlighted early momentum at Intel Foundry, the contract manufacturing arm that sits at the heart of the company’s turnaround plan. Intel has bet heavily on becoming a leading alternative to Taiwan Semiconductor Manufacturing Company (TSMC), offering advanced manufacturing to external customers while also supplying its own chips.

Tan said “a couple of customers are engaging heavily” with Intel Foundry, particularly around its upcoming 14A process technology. He indicated that volume manufacturing on 14A could ramp up later this year, though he stressed that firm commitments depend on customers specifying volumes and products well in advance.

“In order to have a customer … they have to let us know what is the volume and which product, so that we can plan and take time to build the capacity,” Tan said.

This cautious tone reflects the reality that Intel’s foundry ambitions are still unproven at scale. While interest from customers is encouraging, Intel must demonstrate that it can deliver leading-edge manufacturing on time and with competitive yields, something it has struggled with internally in recent years.

Perhaps the most striking part of Tan’s remarks, however, was his warning about China’s progress, particularly at Huawei Technologies. Tan said he was “shocked” to discover during a recent hiring drive that Huawei had recruited around 100 highly skilled chip designers, despite U.S. restrictions that have cut the company off from advanced manufacturing tools and key design software.

When Tan asked Huawei engineers why they chose to work for a firm operating under such constraints, their answer was telling.

“They said, ‘Even though we don’t have access to the best tools, like electronic design automation tools from Cadence and Synopsys, we have the poor man way to do it, and we can do it,’” Tan said.

His conclusion was stark. “To me, they are just shortly behind us, and if you’re not careful, they will just leap forward ahead of us.”

The warning cuts to the heart of the global semiconductor race. U.S. export controls were designed to slow China’s technological progress, but Tan’s comments suggest that talent, ingenuity, and scale can partially offset restrictions on tools. This adds urgency to Intel’s efforts to rebuild leadership in advanced chips, not just as a commercial imperative but as part of a broader geopolitical competition.