Intel Corp. has entered early talks with Apple over a potential investment and expanded cooperation, according to a Bloomberg News report on Wednesday that cited people familiar with the matter.

The discussions are preliminary and may not yield a deal, but the development alone lifted Intel’s stock by 6% at Wednesday’s close.

The iPhone maker and Intel are exploring ways to work more closely together, Bloomberg reported, with the potential investment coming at a time when Intel has been drawing billions in support from an unusual coalition of backers ranging from government to foreign investors — and even industry rivals.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

Just days earlier, Nvidia announced a $5 billion investment in Intel for roughly a 4% stake. That pact involves collaboration on PC and data center chip development, though it notably stops short of involving Intel’s foundry division manufacturing chips for Nvidia — an area where Intel has struggled to compete. The Nvidia tie-up drew widespread attention not only because it brought fresh capital to Intel, but because it represented a striking shift: the world’s most valuable chipmaker and Intel’s fiercest rival injecting funds into the very company it has outpaced in the artificial intelligence boom.

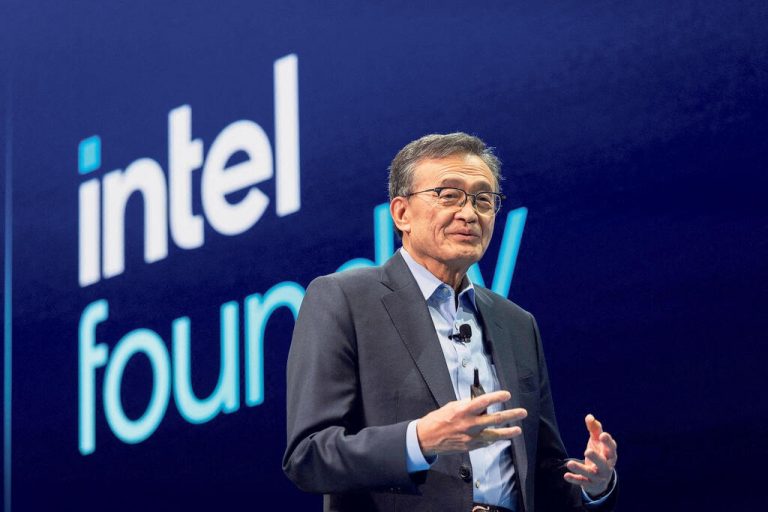

Intel CEO Lip-Bu Tan has been aggressively seeking such alliances as part of his plan to revive the Santa Clara-based company. Once the undisputed leader that “put the silicon in Silicon Valley,” Intel has steadily lost ground to faster-moving competitors like Nvidia and Advanced Micro Devices, particularly in AI and high-performance computing.

The dealmaking frenzy around Intel reflects a broader rescue effort that has seen billions of dollars flow into the company in just the past two months. The Trump administration took the most extraordinary step, converting $11.1 billion in Chips Act funding into a 9.9% government equity stake in Intel. The unusual arrangement, unveiled in August, effectively made U.S. taxpayers partial owners of the company while ensuring Intel receives around $10 billion to build or expand factories on American soil.

The administration framed it as a move to secure U.S. leadership in critical chipmaking at a time of geopolitical tension with China.

Following that, Japan’s SoftBank Group injected $2 billion into Intel last month, further fueling momentum. The combined support has pushed up investor sentiment, helping Intel’s shares surge more than 40% since mid-August.

Apple’s potential participation would mark another major vote of confidence. The company was once one of Intel’s biggest customers before abandoning Intel chips in 2020 for its own custom-designed silicon, manufactured primarily by Taiwan Semiconductor Manufacturing Co. (TSMC). For Apple, an investment in Intel could serve a dual purpose: diversifying its supplier base away from overreliance on TSMC, and shoring up its U.S. chip ties amid growing concerns that China could destabilize Taiwan.

The move would also dovetail with Apple’s domestic commitments. Though its supply chain remains largely global, Apple has pledged about $600 billion to U.S. initiatives over the next four years. An Intel partnership on American soil would strengthen the company’s alignment with the Trump administration, which has placed semiconductor security at the heart of its economic agenda.

Responding to a Reuters query on whether the Trump administration had conversations with Intel or Apple regarding the talks, White House spokesperson Kush Desai said: “The U.S. Government is not involved in Intel’s day-to-day operations. The taxpayer has an equity stake in Intel succeeding, and the Administration supports iconic American companies like Intel doing what’s best to cement American tech dominance.”

Analysts note that Intel’s revival hinges on two fronts: attracting external partners willing to use and fund its factories, and restoring its credibility in advanced chip design. To that end, Intel has been in contact with several potential investors and partners, according to Bloomberg. Apple’s involvement, if it materializes, would be the most symbolic yet — signaling that Silicon Valley’s most valuable hardware maker sees a future role for Intel in a rapidly consolidating semiconductor race.