Intel is in fresh talks with other major investors to secure an equity infusion at a discounted price, even after it received a $2 billion capital injection from Japan’s SoftBank, people familiar with the matter told CNBC’s David Faber.

The move underscores the chipmaker’s ongoing struggle to fund its turnaround strategy and regain ground in the booming semiconductor industry.

The company’s shares slid more than 7% on Tuesday, reversing a rally earlier this week sparked by the SoftBank deal and reports that the Trump administration is weighing new ways to get involved with the company.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

Commerce Secretary Howard Lutnick signaled that Washington expects to hold a direct stake in Intel, saying the government must receive equity in exchange for funds from the $39 billion CHIPS Act program.

“We should get an equity stake for our money,” Lutnick said on CNBC. “So we’ll deliver the money, which was already committed under the Biden administration. We’ll get equity in return for it.”

Faber reported that Intel is now seeking additional equity partners beyond SoftBank, but analysts warn that the structure of the CHIPS Act support complicates the company’s plans.

“They need money to build whatever it is that the customers may actually, ultimately want,” Faber explained on Squawk on the Street. “And having the CHIPS Act money, which is free, so to speak, no strings attached, become equity is not helpful to them because it’s dilutive.”

Intel has been working to reassert itself as a leader in advanced semiconductors, but so far has failed to capitalize on the artificial intelligence boom that has propelled rivals like Nvidia. Instead, the company has poured billions into a foundry business aimed at contract manufacturing, but has yet to secure a significant customer win.

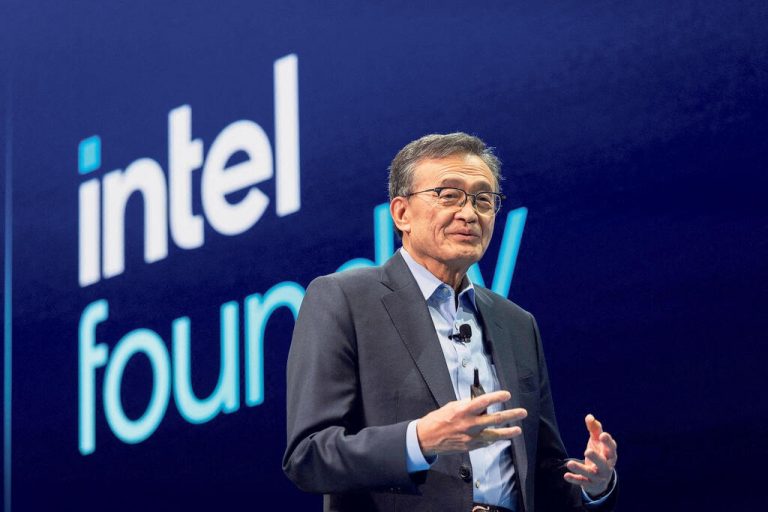

The leadership shake-up has also added to the uncertainty. Lip-Bu Tan, a longtime industry figure, took over as Intel’s CEO in March following the ouster of Pat Gelsinger in December. But his position has come under political pressure. Two weeks ago, President Donald Trump called for Tan’s resignation, saying he was “highly CONFLICTED.” However, the president’s stance softened after Tan personally visited the White House to discuss his background and future plans for the company.

The reasoning is that Intel has fallen behind global rivals like Taiwan Semiconductor Manufacturing Co. (TSMC) and South Korea’s Samsung Electronics in producing advanced chips, a shortfall that leaves the United States vulnerable in a world where semiconductor supply chains are increasingly caught in geopolitical crossfire. President Trump has repeatedly stressed the need to “make more chips and high-end technology in the U.S.” and lessen dependence on Asia.

Intel’s financial strain, its difficulties in AI chips, and the heightened political involvement have put the company at the center of a larger battle over U.S. semiconductor dominance. While SoftBank’s $2 billion injection offered temporary relief, the search for more investors at discounted terms highlights how urgently Intel needs capital to fund new plants and technology development.

Last week, Gil Luria, head of technology research at D.A. Davidson, told CNBC’s Squawk Box that government intervention in the struggling chipmaker is “essential.” While Luria acknowledged that U.S. economic tradition leans heavily toward free-market capitalism, he argued that Intel’s current condition poses too great a risk for Washington to sit on the sidelines.

“We’re all capitalists,” Luria said. “We don’t want government to intervene and own private enterprise, but this is national security.”

The outcome of the government’s push for an equity stake could reshape not just Intel’s balance sheet, but also the precedent for future relations between Washington and the semiconductor industry.