Nine Deposit Money Banks (DMBs) that were set to be disconnected today from the Unstructured Supplementary Service Data (USSD) service have avoided this fate following a last-minute settlement of their accumulated debts.

The outstanding debts, which had reached N160 billion as of November last year, were cleared just before the deadline, preventing a major disruption in banking services for millions of Nigerians.

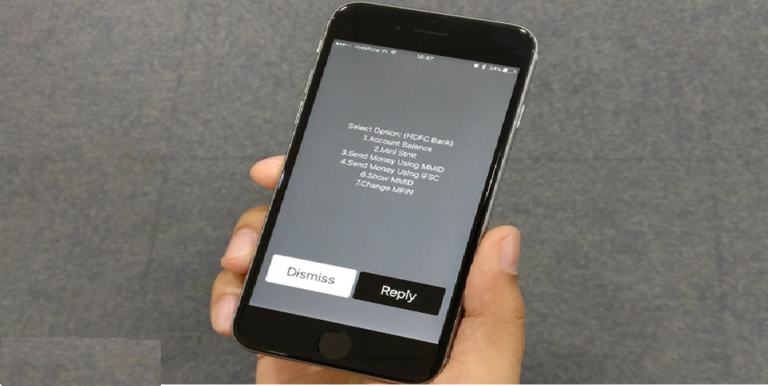

The USSD debt saga began in 2019 when telecom operators developed various USSD codes for financial transactions. Under an agreement with the Nigerian Communications Commission (NCC), banks were required to remit a fee of N6.98 for each successful transaction made via USSD codes. However, many banks failed to remit these payments, leading to the accumulation of significant debts. By October 2024, the total debt owed by banks had soared to over N200 billion, but by November, the outstanding balance had been reduced to N160 billion after several banks made partial payments.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

This reduction, however, still left nine banks with outstanding debts, prompting the NCC to grant approval to telecom operators to disconnect these institutions from USSD services. The disconnection was slated to take effect on January 27, 2025. However, in a surprising turn of events, the nine remaining banks cleared their debts just before the close of business last Friday, averting the planned disconnection.

Billing Time Controversy

Despite clearing their debts, these banks withheld part of the amount due, citing the issue of the 10-second billing time approved by the NCC and the Central Bank of Nigeria (CBN). The 10-second billing time stipulates that banks should begin billing customers only after the first 10 seconds of a USSD transaction. This provision, introduced as a shift from the previous 5-second rule, has become a point of contention between telecom operators and banks.

The 10-second billing time rule has been a bone of contention for several reasons. Telecom operators argue that it results in a loss of potential revenue for them, as they are only compensated after the 10-second mark of a transaction. On the other hand, banks have expressed concerns that the time frame may not accurately reflect the duration of a customer’s interaction with the USSD code, leading them to withhold part of their debt payment.

The relationship between Nigerian banks and telecom operators has been fraught with tension over the years, particularly when it comes to the USSD service. The service, which allows customers to perform banking transactions via their mobile phones without internet connectivity, has seen a rapid increase in usage, especially in rural and underserved areas.

Despite its growth, the service has also exposed the financial friction between the two sectors. Telecom operators argue that the debt owed by banks has stifled their growth and created a bottleneck in the sector, while banks, on the other hand, have maintained that the costs associated with USSD services are too high, further straining their financial resources.

The controversy has further been compounded by the role of the NCC and the CBN, both of which have intervened at various points to mediate the dispute. As it stands, the 10-second rule remains a key sticking point, with both parties set to revisit the issue soon to avoid further delays or disruptions in the service.

The Need for Permanent Resolution

While the nine banks have settled their debts for now, the issue is far from resolved. The USSD billing time continues to be a significant factor in the ongoing disagreement, and it seems likely that further discussions will be necessary to establish a more sustainable framework for USSD transactions.

Observers have noted that the resolution of the USSD debt crisis will require more than just financial settlements. It will necessitate a comprehensive review of the service’s pricing structure, a clearer understanding of the role of telecom operators, and a more transparent mechanism for debt resolution.

For now, the immediate crisis has been averted, and Nigerians can continue to access USSD banking services without interruption. The focus is expected to shift to the next steps in addressing the long-standing tensions between the banking and telecom sectors, with the hope that a sustainable resolution will eventually be found.