What began as a government-engineered lifeline for Intel has now drawn in the world’s most valuable chipmaker. Nvidia on Thursday announced a $5 billion investment in Intel, instantly becoming one of the embattled manufacturer’s largest shareholders and sending Intel’s stock soaring 25% in a single day.

The move is being widely read not just as a corporate gamble, but also as a quiet endorsement of U.S. President Donald Trump’s campaign to repatriate more semiconductor production.

The stake gives Nvidia roughly 4% of Intel after new shares are issued, coming just weeks after Washington took an unprecedented 10% government stake to stabilize Intel’s finances and leadership. Once seen as the company that gave Silicon Valley its name, Intel has struggled for years to recover lost ground to rivals in the data center, PC, and AI markets.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

A Strategic Bet, With Political Undertones

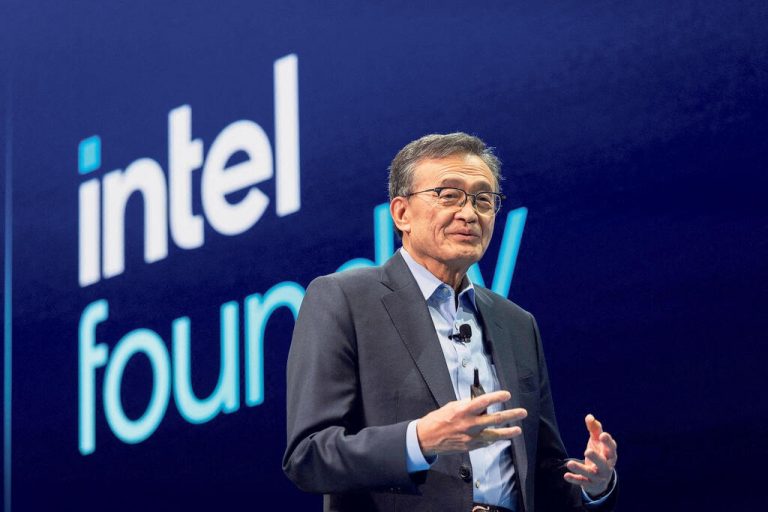

The Nvidia deal is as much about strategy as symbolism. Intel’s new chief executive, Lip-Bu Tan, took the helm in March but quickly drew criticism over his ties to China. Trump publicly called for his resignation, leading to an emergency meeting in Washington and a White House-brokered deal that left the federal government with a significant ownership stake.

Now, Nvidia’s involvement bolsters Intel’s credibility and aligns with the Trump administration’s broader push to build up domestic chipmaking. Nvidia CEO Jensen Huang told reporters that the White House was not involved in shaping the pact but said the administration would almost certainly welcome it. Huang was seen alongside Trump and other business leaders earlier the same day during the president’s state visit to the U.K.

What the Partnership Covers

At the heart of the deal is a plan to jointly develop PC and data center chips. Nvidia will not outsource its graphics processors to Intel’s contract manufacturing business — known as its “foundry” — but Intel will supply central processors and advanced packaging to combine with Nvidia’s AI-focused GPUs. Huang confirmed that Nvidia has been testing Intel’s foundry technology for nearly a year, though no long-term shift away from Taiwan’s TSMC has been made.

For Intel, which has long lagged in AI, the pact is a breakthrough. “This is a massive game-changer for Intel and effectively resets its position of AI-laggard into a cog in future AI infrastructure,” said Gadjo Sevilla, senior AI and tech analyst at eMarketer.

Financial details of the collaboration were not disclosed, but the companies confirmed they will produce “multiple generations” of joint products. Nvidia said it would pay $23.28 per share for Intel stock, just below Intel’s $24.90 Wednesday close but comfortably higher than the $20.47 that Washington paid. Nvidia’s stock rose 3.8% after the announcement.

Intel’s Cash Reserve Grows

The fresh $5 billion injection adds to Intel’s war chest, which has been swelled by $2 billion from SoftBank and $5.7 billion from the U.S. government. CEO Tan has promised a leaner Intel, vowing to build factory capacity only in response to firm customer demand.

“This may be the first step of an acquisition or breakup of the company (Intel) among U.S. chip makers, though it is entirely possible the company will remain a shadow of its former self but will survive,” said Nancy Tengler, CEO of Laffer Tengler Investments.

Risks for Competitors

The partnership carries big implications for the industry’s competitive balance, according to an analyst who spoke to Reuters.

TSMC, which currently produces Nvidia’s flagship processors, faces the looming risk of losing a critical customer. AMD, Intel’s traditional rival in PCs and data centers, may also see its recent market share gains eroded.

“AMD has been seizing market share in desktops and laptops for quite some time and this will help Nvidia out against its closest domestic peers, but I think TSMC may have the bigger risk to its operation over the long term,” said David Wagner, portfolio manager at Aptus Capital Advisors.

Intel will design custom data center CPUs for Nvidia’s GPUs, linked by a proprietary Nvidia interconnect that dramatically speeds communication between chips. That feature has made Nvidia’s AI servers the gold standard in the industry. The new arrangement allows Intel to capture part of that lucrative business for the first time.

The combined chips could also pose challenges for AMD, which is developing rival AI servers, and Broadcom, which supplies chip-to-chip links for companies like Google. AMD’s shares fell 2.3% after the announcement, while Broadcom gained 0.4%.

In consumer markets, Nvidia will provide Intel with custom graphics processors for PCs. Coupled with Intel CPUs and Nvidia’s high-speed links, that could give Intel new leverage against AMD in the desktop and laptop segment.

Revival or Realignment?

While the companies offered no timeline for their first joint products, the alliance underscores how Intel’s future now rests on outside partners. For some analysts, Nvidia’s investment is a prelude to something bigger.

It is believed that this deal could set up three very different futures for Intel. In the first, Intel becomes a core U.S. player in AI hardware, stabilized by government and corporate backers. In the second, it is slowly absorbed into Nvidia or another chipmaker, effectively broken up. And in the third, Intel never fully regains its old dominance but survives as a junior partner in the new AI ecosystem.