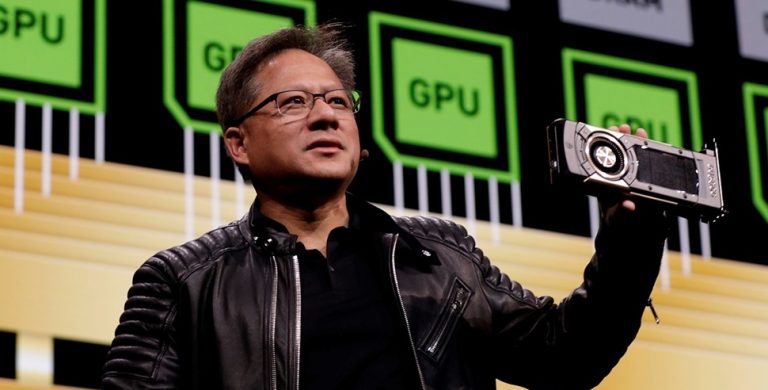

Nvidia Corp. CEO Jensen Huang robustly pushed back against escalating fears that artificial intelligence will supplant traditional software tools, labeling the notion “the most illogical thing in the world” during a keynote at Cisco Systems’ AI conference in San Francisco on Wednesday.

His remarks arrived amid a deepening global selloff in software, data analytics, and professional services stocks, triggered by Anthropic’s recent release of advanced AI plug-ins that amplified investor anxieties over potential industry-wide disruption. Huang argued that AI’s evolution hinges on leveraging existing software infrastructure rather than reinventing it from the ground up.

“There’s this notion that the tool in the software industry is in decline, and will be replaced by AI… It is the most illogical thing in the world, and time will prove itself,” he stated.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026).

Register for Tekedia AI in Business Masterclass.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab.

Drawing an analogy to human and robotic behavior, Huang emphasized: “If you were a human or robot, artificial general robotics, would you use tools or reinvent tools? The answer, obviously, is to use tools… That’s why the latest breakthroughs in AI are about tool use, because the tools are designed to be explicit.”

He positioned AI as an enhancer of software efficiency, not its destroyer, underscoring Nvidia’s role in powering systems that integrate with established frameworks like those from ServiceNow or SAP. The comments provided a counterpoint to the market turmoil, which began intensifying after Anthropic unveiled plug-ins for its Claude Cowork agent on Friday.

These open-source tools automate tasks across legal, sales, marketing, customer support, and data analysis—such as contract reviews, NDA triage, compliance workflows, and templated responses—prompting traders to dump shares in companies perceived as vulnerable to AI automation. Anthropic clarified that the legal plug-in is not intended to provide legal advice and requires attorney oversight, but the release nonetheless reignited debates on AI’s potential to erode pricing power in routine, high-margin services.

The fallout was swift and severe, erasing approximately $285 billion in market value from software, financial services, and asset management sectors on Tuesday alone, according to Bloomberg estimates. A Goldman Sachs basket tracking U.S. software stocks plummeted 6%—its largest single-day drop since April 2025’s tariff-induced selloff—extending a six-day losing streak with cumulative losses exceeding 14%. The iShares Expanded Tech-Software Sector ETF (IGV) hit new intraday lows, down 5.6% at one point, marking its worst monthly performance since 2008 with a 15% January decline.

The contagion spread globally. In Europe, RELX (parent of LexisNexis) tumbled 14-15%, erasing over £6 billion ($7.8 billion) in value; Thomson Reuters plunged 18-20%; Wolters Kluwer dropped 12.7-13%; and the London Stock Exchange Group (LSEG) fell 12.8%. Analytics firms like Gartner and S&P Global declined 20% and 10%, respectively, while Experian and Sage lost 6.75% and 10%. The UBS basket of European AI-exposed stocks sank nearly 7%. Asia felt the ripple effects on Wednesday. India’s NIFTY IT index slumped 6.3-7%, with Infosys plunging 7.3% amid fears AI could erode outsourcing demand. China’s CSI Software Services Index fell 3%, Hong Kong’s Kingdee International Software Group tumbled over 13%, and in Japan, Recruit Holdings and Nomura Research Institute dropped 9% and 8%.

Analysts dubbed the event a “SaaSpocalypse”—an apocalypse for software-as-a-service (SaaS) models—warning that AI agents like Claude could automate routine tasks underpinning industry margins, potentially disintermediating firms entirely. IG chief markets strategist Chris Beauchamp described trading as “‘get me out’ style selling.”

Jefferies’ Jeffrey Favuzza noted the panic stemmed from uncertainty over AI agents’ capabilities, leading investors to “shun the software market altogether.” eMarketer’s Jacob Bourne added that inflation-fatigued consumers and AI shortages would pressure hardware margins, making high-margin services vital.

The selloff dragged broader indexes: the Nasdaq 100 fell up to 2.4% before closing down 1.6%, with the S&P 500 and Dow Jones following suit. Yet Huang’s reassurance may stem the tide, as he highlighted AI’s reliance on explicit, human-designed tools, aligning with recent breakthroughs in “tool use” that integrate rather than replace software.

This episode echoes prior AI-driven market jitters, such as reactions to OpenAI’s GPT releases, but the scale—wiping billions in a day highlights growing sensitivity to disruption risks. While software giants like Salesforce, DocuSign, Atlassian, Adobe, Workday, and ServiceNow bore the brunt, the contagion to financial data (Experian, LSEG) and publishing suggests broader implications for knowledge-based industries.