Ripple Battles Regulatory Waves

Ripple, the entity behind XRP, recently experienced a legal setback as a U.S. federal judge declined a joint proposal by Ripple and the SEC to reduce Ripple’s civil penalty from $125 million to $50 million and to lift the injunction on institutional XRP sales. The judge upheld the original injunction and full penalty, signaling a firm regulatory stance. Ripple now faces an obligation totaling $122 million, comprising a $102.6 million penalty plus $19.4 million in accrued interest. Appeals are suspended until mid-August, pending further court actions.

XRP’s market response was immediate but measured, with prices hovering around $2.19–$2.20, reflecting cautious investor sentiment. Despite these challenges, market experts and crypto influencers like Teo Mercer remain optimistic. Mercer noted on X (formerly Twitter) that XRP is exhibiting significant signs of potential growth, with targets ranging from $3 to $4 due to improving regulatory conditions and increasing institutional attention.

Dogecoin Shifts Narrative Away from Musk

In contrast, Dogecoin (DOGE) has recently maintained resilience by successfully defending its critical $0.16 support level, surging approximately 17% from recent lows. Intriguingly, DOGE appears less sensitive to Elon Musk’s influence, increasingly aligning its price movement with Bitcoin. Despite losing some of its Musk-driven volatility, DOGE is carving out a new niche through DeFi opportunities, exemplified by Coinbase’s recent launch of wrapped DOGE on its Base Layer 2 solution.

Analysts offer mixed forecasts, with near-term targets varying between $0.193 and $0.39, depending on broader market dynamics and DeFi adoption. DOGE’s inflationary tokenomics continue to be a point of contention, raising questions about its long-term valuation sustainability.

Coinbase Broadens XRP & DOGE Utility

Further enhancing XRP and DOGE’s functionality, Coinbase recently integrated wrapped versions of both tokens onto its Base network, significantly enhancing their DeFi capabilities. Cloud-mining platforms such as AIXA and PFMCrypto have also begun offering XRP and DOGE mining contracts, attracting passive-income seekers and expanding the tokens’ appeal beyond traditional trading.

Neo Pepe Coin ($NEOP) Gains Traction

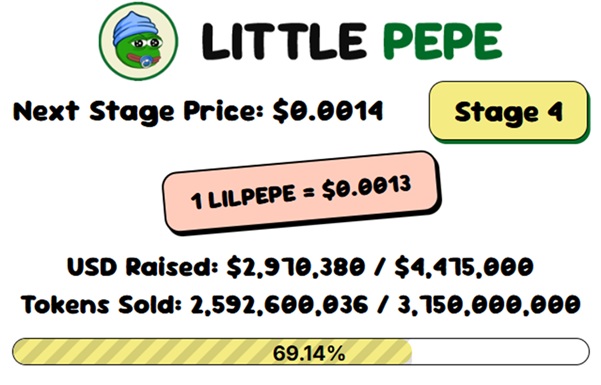

In an unexpected twist within the meme coin ecosystem, attention is pivoting toward Neo Pepe Coin ($NEOP), touted as the best pepe coin. Neo Pepe Coin’s presale is attracting significant attention, approaching Stage 4, where the token price will soon rise from approximately $0.07 to $0.08. This current presale phase positions Neo Pepe as an attractive entry point for crypto enthusiasts.

Why Crypto Investors Are Eyeing Neo Pepe

Neo Pepe’s momentum hinges on its structured presale stages, innovative auto-liquidity mechanisms, and governance features that empower token holders. Industry influencers have spotlighted Neo Pepe Coin as a top pepe coin, recognizing its potential for significant community-driven impact.

Gems Booster Examines Presale Closely

Crypto commentator Gems Booster dives deeply into Neo Pepe Coin’s presale strategy, meticulously assessing its carefully segmented pricing model and advanced liquidity protocol. Their analysis underscores Neo Pepe’s genuine community-oriented governance and thoughtfully structured token economics. Gems Booster’s precise insights provide crypto participants with a valuable and thorough perspective on Neo Pepe Coin’s competitive strengths and distinctive attributes.

What Makes Neo Pepe This Year’s Best Crypto Presale?

- Structured Presale: Each stage incrementally enhances demand.

- Real-World Utility: Combines meme coin popularity with robust DeFi use-cases.

- Influencer Endorsements: Influential crypto figures increasingly highlight Neo Pepe as a promising newcomer.

As Neo Pepe Coin positions itself as a unique meme coin with genuine utility, the crypto community is beginning to take notice. Given the presale’s imminent move to a higher pricing stage, you might want to get a little Neo Pepe now, capturing the last moments of this competitive entry price.

Market Takeaway

XRP continues navigating challenging regulatory waters, with substantial upside potential pending clarity, while DOGE adapts beyond Musk-driven dynamics. Meanwhile, Neo Pepe Coin emerges as an innovative contender in the meme coin market, gaining rapid momentum as it approaches its critical Stage 4 presale milestone. This evolving meme landscape offers diverse opportunities for investors attuned to both institutional developments and grassroots community potential.

Join Neo Pepe & Unplug from Centralization

The Memetrix is calling—Neo Pepe Coin is not just another meme token; it’s a movement symbolizing decentralization and financial liberation. By choosing Neo Pepe, you’re aligning yourself with a powerful community dedicated to challenging centralized financial control and championing economic freedom. Don’t let centralized structures dictate your financial reality; unplug from the mainstream and seize control with Neo Pepe. The revolution is digital, decentralized, and distinctly Neo Pepe. Take the red pill today—your future awaits in the Memetrix.

Get Started with $NEOP