Major U.S. banks, including JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo, are in early discussions to launch a joint stablecoin venture to counter growing competition from the cryptocurrency industry. The talks involve bank-owned payment companies like Early Warning Services (operator of Zelle) and The Clearing House (a real-time payments network). The initiative aims to protect banks’ payment and deposit bases, especially against potential moves by big tech or retailers into digital currencies. A proposed model would allow both large and regional banks to use the stablecoin.

Discussions are conceptual and depend on forthcoming U.S. legislation, notably the GENIUS Act, which recently advanced in the Senate and aims to create a regulatory framework for stablecoin issuance. Stablecoins, pegged to assets like the U.S. dollar, are seen as a way to streamline transactions, particularly cross-border payments, which can take days in traditional systems. However, concerns about security, regulatory compliance, and market demand remain. Some regional and community banks are also exploring separate stablecoin consortia.

The joint venture signals a strategic move by traditional banks to counter the growing influence of decentralized cryptocurrencies and stablecoins like USDT and USDC, which are issued by non-bank entities like Tether and Circle. By launching their own stablecoin, banks aim to retain control over payment systems and customer deposits, which are threatened by crypto platforms offering faster, cheaper transactions.

This could accelerate mainstream adoption of stablecoins, as bank-backed stablecoins would likely carry greater trust and regulatory compliance, appealing to institutional and retail clients wary of existing crypto volatility. Stablecoins could streamline cross-border payments, which currently take days and incur high fees through systems like SWIFT. A bank-backed stablecoin could reduce costs and settlement times, enhancing efficiency for global trade, remittances, and B2B transactions. Domestic payments could also benefit, with real-time settlement capabilities challenging existing bank-controlled networks like Zelle or ACH.

The venture’s success hinges on clear U.S. regulations, particularly the GENIUS Act, which aims to establish a framework for stablecoin issuance. Favorable legislation could legitimize and accelerate bank-backed stablecoins, but delays or restrictive rules could stall progress. Regulatory compliance would give bank-issued stablecoins an edge over crypto-native stablecoins, which face scrutiny over reserve transparency and money laundering risks.

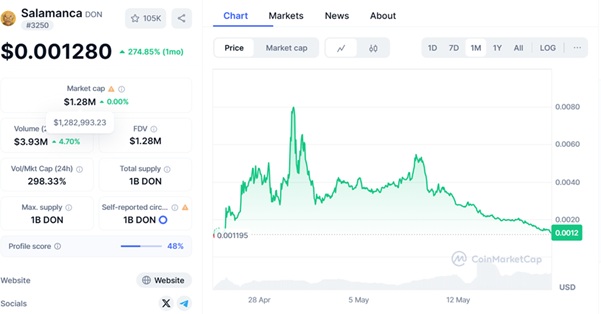

A bank-backed stablecoin could capture significant market share in the $200 billion+ stablecoin market (as of 2025), potentially reducing the dominance of Tether and Circle. It could also pressure big tech like PayPal, which issues its own stablecoin and retailers exploring digital currencies, forcing them to compete on trust and integration. However, banks risk cannibalizing their own fee-based payment systems, and widespread adoption could reduce deposit bases if customers shift funds to stablecoin wallets.

Stablecoins, even bank-backed ones, face risks like cyberattacks, smart contract vulnerabilities, or reserve mismanagement. Banks’ involvement could mitigate some concerns due to their experience with financial security, but any failure could damage trust in the banking sector. Stablecoin adoption could introduce systemic risks if not properly regulated, especially if they become integral to global payments.

A bank-backed stablecoin would be centralized, tightly regulated, and integrated into existing financial systems. It would prioritize compliance, security, and interoperability with bank infrastructure, appealing to traditional customers and institutions. Decentralized stablecoins like USDC or algorithmic stablecoins like DAI operate on public blockchains, emphasizing permissionless access, global reach, and innovation. They appeal to crypto-native users but face regulatory uncertainty and trust issues due to past scandals (e.g., Tether’s reserve controversies).

Banks reputation and regulatory oversight could make their stablecoin more trusted by mainstream users, governments, and corporations. However, banks’ slow innovation and profit-driven models may limit flexibility and accessibility compared to crypto alternatives. Crypto stablecoins benefit from rapid innovation and global accessibility but struggle with regulatory scrutiny, volatility risks in underlying blockchains, and skepticism from traditional finance. Adoption is strong among crypto users but limited in mainstream commerce.

A joint venture could consolidate power among major banks, potentially marginalizing smaller institutions or crypto startups. Regional banks forming separate consortia (as noted) suggest a divide even within the banking sector, with smaller players seeking to avoid domination by giants like JPMorgan or Citigroup. The crypto industry could face existential competition from banks, especially if bank stablecoins integrate with existing payment rails like Zelle or The Clearing House. However, crypto’s decentralized nature allows it to serve unbanked populations and bypass traditional gatekeepers, maintaining a niche.

Banks lobbying power and established relationships with regulators give them an edge in shaping stablecoin legislation (e.g., the GENIUS Act). A bank-friendly regulatory environment could stifle crypto-native stablecoins. Crypto firms face stricter scrutiny and may struggle to comply with evolving rules, but their global, decentralized nature makes them harder to regulate fully, allowing continued innovation outside U.S. jurisdiction.

Banks stablecoin would likely prioritize stability over experimentation, potentially lagging in features like DeFi integration or cross-chain compatibility. Collaboration among banks could also slow decision-making. The crypto space moves faster, with constant experimentation in DeFi, NFTs, and tokenized assets. However, this speed often comes with instability, as seen in past stablecoin failures (e.g., TerraUSD).

Banks’ Advantage could bridge traditional finance and crypto, offering a regulated alternative that integrates with existing systems. This could pull crypto users into the banking fold but risks alienating those who value decentralization. The crypto ecosystem thrives on its ability to operate outside traditional systems, serving unbanked populations and enabling novel use cases (e.g., smart contracts). However, it must overcome regulatory hurdles and prove reserve stability to compete with banks.

Users may benefit from faster, cheaper payments but face a choice between bank-controlled stablecoins (safer, less innovative) and crypto-native ones (riskier, more versatile). The divide could fragment the market, with banks dominating institutional use and crypto retaining retail and niche applications. If U.S. banks succeed, other countries’ financial institutions may follow, potentially creating a global network of regulated stablecoins. This could challenge crypto’s borderless ethos but also spur innovation as crypto firms adapt to compete.

Like this:

Like Loading...