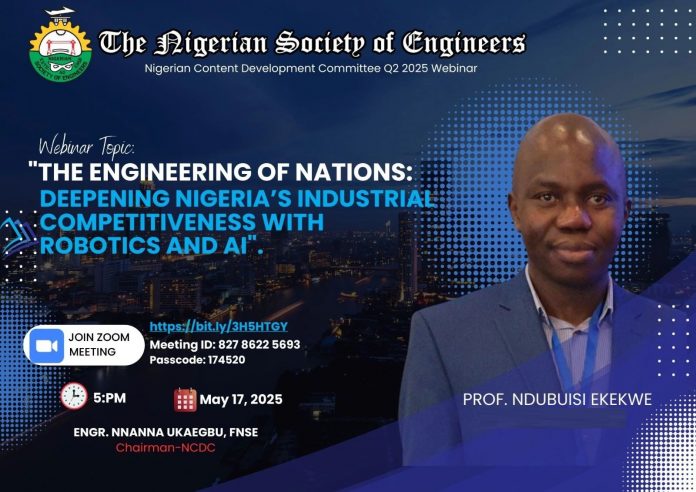

Good People, let us have a conversation on engineering, national development and industrial competitiveness. The Engineering of Nation is the Wealth of Nations because all market frictions are resolved through products and services. The time and zoom link noted in the banner from the Nigerian Society of Engineers.

Beijing Hails Trade Deal as a Victory — and Some U.S. Business Leaders Agree

Chinese officials, influencers, and state-run media on Monday cast the new trade agreement with the United States — including a 90-day suspension of tariffs — as a major diplomatic and strategic win for Beijing, praising what they describe as the effectiveness of China’s firm stance and refusal to capitulate to pressure from the administration of President Donald Trump.

Framing the deal as a vindication of their hardline negotiation strategy, Chinese state media outlets said the breakthrough came not from compromise, but from Beijing’s defiance. A social media account affiliated with China’s national broadcaster, CCTV, declared, “China’s firm countermeasures and resolute stance have been highly effective.”

In concrete terms, the agreement, hammered out over the weekend in Geneva, Switzerland, will see the U.S. roll back tariffs from a punishing 145% to 30% on Chinese goods, while China will cut its own retaliatory tariffs from 125% to 10% on U.S. products. The tariff relief is set to last for 90 days but could be extended if further progress is made.

The news immediately fueled a surge in global stock markets, lifting investor sentiment across Asia, Europe, and the U.S. But behind the optimism is a growing recognition, even in Washington and on Wall Street, that the short-term truce may actually favor China more than it does the United States.

Chinese Public Celebrates, Beijing Spins It as Proof of Strength

On Chinese social media, the response was jubilant. According to CNBC, Hashtags related to the trade deal trended heavily on Weibo, China’s largest microblogging site. One particular hashtag, #USChinaSuspending24%TariffsWithin90Days, attracted more than 420 million views by Monday afternoon. The “24%” figure referred to a net reduction in average tariffs noted in the joint statement issued by both countries.

Nationalistic sentiment was also apparent. One user, writing under the name Chun Feng Yi Ran, posted: “Our ancestors didn’t cave in, why should we give up what we have?” That single post attracted thousands of likes, echoing the widespread view that Beijing outmaneuvered Washington without backing down.

The trade ministry in Beijing used the moment to polish China’s image globally, calling the deal an “important step” and emphasizing that China remains a responsible and cooperative trading partner. However, in a sharp jab, the ministry also called on Washington to “completely correct its unilateral tariff practices,” reiterating that the U.S. was to blame for the trade escalation.

Exemptions and Quiet Concessions Behind the Curtain

While Beijing touts its strategic firmness, it has already begun granting exemptions to some local businesses ahead of the formal agreement. Analysts say this signals that China may have been more eager than it let on to ease the economic strain of the trade war, which had been squeezing manufacturers and exporters across the country.

Under the terms of the agreement, China also pledged to remove or suspend its non-tariff countermeasures. This includes tighter export restrictions on rare earth minerals, critical inputs for the U.S. tech and defense sectors, which Beijing had threatened to weaponize during the peak of tensions.

However, even as China made this commitment, the Ministry of Commerce released a statement on Monday reaffirming its crackdown on rare earth smuggling for “national security reasons,” subtly shifting blame to “foreign entities” for driving the illegal trade. The mixed messages underscore China’s tendency to leave interpretive room for policy shifts without openly breaching its agreements.

U.S. Officials Call It a Win — But Not Everyone Is Buying It

Back in Washington, the Trump administration has branded the agreement a “historic trade win.” Treasury Secretary Scott Bessent, speaking Monday on CNBC’s Squawk Box, said the two countries would begin work on a more comprehensive follow-up agreement over the “next few weeks.” He insisted that the tariff pause would create space for “a reset” in trade relations.

However, skepticism is mounting among U.S. economists and some business leaders. Some note that Trump’s administration entered the trade war without a coherent long-term strategy and has now exited without securing major structural concessions from Beijing.

“Now that Trump has surrendered in the China trade war he never had the cards to win, what’s next?” said Peter Schiff, Chief Economist and Global Strategist at Euro Pacific Capital. “I think the news is as good as it gets and can only get worse if the war re-escalates. Now, focus may return to the deficit-exploding budget that’s working its way through Congress.”

Others in the business community have echoed similar views. While the tariff rollback brings temporary relief to American importers and manufacturers, it leaves in place the fundamental structural issues — including forced technology transfers, industrial subsidies, and market access restrictions — that originally provoked the trade war.

Promise Fatigue and a Familiar Playbook

For many longtime observers of China’s negotiation tactics, the latest deal follows a familiar script: pledges of reform and cooperation with few immediate changes on the ground. Foreign executives often speak of “promise fatigue” — a term used to describe the gap between Beijing’s declarations and its domestic enforcement.

The new “consultation mechanism” proposed in the deal is designed to sustain regular talks between the U.S. and China on trade and economic matters. However, analysts warn that this mechanism, like others before it, could quickly devolve into a symbolic forum lacking real enforcement power.

The agreement does not resolve the core disputes between the world’s two largest economies. The 90-day reprieve is more of a timeout than a truce, and if negotiations break down again, both sides retain the option to reimpose tariffs.

The World Has Abundance – Pursue Knowledge to Unlock It

Good People, there should be no panic due to the expected displacement of jobs as AI and robotic systems move into production phases at scale. Here is the fact: across human history, most new technologies have always created more jobs, over time, even as they distort and displace some in the short-term.

Indeed, more jobs have been created by computers and Microsoft Word even though Isaac Pitman shorthand experts lost their jobs. Technology makes societies better, but it is not guaranteed that everyone will benefit at the same level.

During the industrial revolution, workers demonstrated that machines would take over their jobs. But their panics did not come to pass when you examine the big picture. Everything will change as AI moves at scale into products. I have noted that Microsoft Word now seems like Microsoft Phrase with its expanded ability to suggest phrases and clauses, not just words.

Knowledge has always defined empires, and it remains the most important factor of production. We The People must continue to seek new knowledge, through continuous learning, for assured career resilience and employability.

The last line: the world has abundance. Any scarcity we may feel is due to limited knowledge to unlock that abundance. But if AI does scale knowledge, there is that possibility that scarcity will disappear. I experienced financial abundance today: an AI company we invested in Nov 2024 just raised $36 million this evening, making our members richer on paper!

America Opens the Gates For $5m As Musk Reveals Trump’s “Gold Card” is Being Tested

The “gold card” immigration visa plan of U.S. President Donald Trump, designed to offer permanent residency at the cost of $5 million, is being tested, according to tech billionaire Elon Musk.

Unveiled aboard Air Force One, the cash-backed path to citizenship is already stirring up global buzz and elite wallets. The card, branded the “Trump Card,” doesn’t just promise U.S. residency, it also offers tax breaks, elite status, and a promise: no quotas, no waitlists, and certainly no “woke” bureaucracy.

Musk let the cat out of the bag, announcing on X: “Once it is fully tested, it will be rolled out to the public with an announcement by the president.” The response came as a nod to a thread by blockchain entrepreneur Mario Nawfal, who had already dug up a federal website and digital backend built by none other than the Department of Government Efficiency—DOGE.

The program is changing the trajectory – proving that the fastest route to American soil is no longer through asylum, talent, or hardship—it’s through wire transfer.

“Over 1,000 gold cards have already been sold,” Commerce Secretary Howard Lutnick said in April.

That’s $5 billion in one day—enough to light up Washington’s accounting books. With an estimated 37 million people globally who can afford the price tag, the Trump administration believes this scheme could help chip away at the country’s towering $36.5 trillion debt.

While the details are still sketchy, the plan so far is this simple: no job creation requirement, no background of innovation or achievement necessary. Just five million dollars and a taste for exclusivity.

EB-5, Meet Your Replacement

For years, the EB-5 investor visa served as the go-to route for high-net-worth individuals to secure U.S. green cards, particularly Indians wary of H-1B bottlenecks and green card purgatory. That program demanded a lower investment, $800,000 in targeted areas, and came with strings attached: job creation, bureaucratic scrutiny, and fees nearing $200,000.

By contrast, the Trump Card ditches the red tape for a red carpet.

Nawfal calls it what it is: “a high-roller fast lane to U.S. residency.” He touts it as having “no woke quotas, no endless backlogs—just cash, credentials, and country club-level vetting.” Critics might call it plutocracy by another name.

Tax-Free Paradise for the Ultra-Rich

One of the card’s more startling perks is a possible exemption from U.S. global taxation, allowing holders to earn abroad without Uncle Sam’s gaze. For many billionaires, that’s not just a perk—it’s a dealmaker.

“If Trump gives golden visa holders an exemption on their worldwide income outside of the U.S., it will make the $5-million price tag look like chaar anna for rich people,” said Russell A. Stamets of Circle of Counsels, comparing the price tag to pocket change in India’s old currency.

He also pointed to another dimension of the appeal: the easing of anti-bribery and anti-corruption oversight under Trump’s second term.

“The golden visa may prove very attractive for a certain set of the global wealthy,” he noted.

India’s Shortcut Just Got Shut

For many Indian investors, the EB-5 visa has been the lifeboat out of America’s labyrinthine immigration process. That lifeboat might now be gone.

Varun Singh, managing director at XIPHIAS Immigration, warns that it could lead to serious consequences.

“The removal of the EB-5 visa programme would be a severe blow to Indian investors, the U.S. economy, and bilateral ties,” he said. “It has been an economic driver, with Indian investors contributing billions of dollars to real estate, infrastructure, and technology sectors in the U.S.”

The risk isn’t just economic—it’s reputational. The U.S. has long framed its immigration system as merit-based. Now, many believe it is leaning uncomfortably close to selling citizenship to the highest bidder.

“The shift signals a philosophical break,” Singh added. “Indian investors may now turn to other global residency programmes such as Greece’s Golden Visa, Portugal’s Golden Visa, and schemes in the UAE and Canada. These provide faster routes, with less political theater.”

The American Dream—Repriced

For many around the world, the American dream has always been aspirational. But with the Trump Card, the dream is now transactional.

Time will tell if the program succeeds in helping cut the U.S. debt, or simply becomes a collector’s item for oligarchs. However, for a growing class of ultra-wealthy global citizens, the border is no longer a barrier. It’s a velvet rope, and Trump just handed them the VIP pass.

U.S Treasury Department to Meet Key Crypto Players Starting From Today

The U.S. Treasury Department is reportedly hosting a series of private roundtables with key players in the cryptocurrency industry this week, starting around May 12, 2025. These closed-door meetings will focus on various aspects of the crypto ecosystem, including decentralized finance (DeFi), banking, and cybersecurity.

The discussions aim to address regulatory and policy challenges in the digital asset space, reflecting the Treasury’s ongoing engagement with industry stakeholders to balance innovation with financial system integrity. Specific details about attendees or outcomes remain limited due to the private nature of the meetings.

The U.S. Treasury’s closed-door meetings with key crypto players signal a pivotal moment for the cryptocurrency industry, with significant implications and a clear divide in perspectives. The meetings could lead to clearer regulatory frameworks, addressing ambiguities around DeFi, stablecoins, and crypto exchanges. This might foster innovation by providing guardrails that legitimize the industry, attracting institutional investment. The Treasury may push for stricter oversight, potentially imposing rules that stifle smaller players or DeFi projects. Measures could include enhanced KYC/AML requirements or limits on decentralized protocols, raising compliance costs.

Cybersecurity and Financial Stability

The focus on cybersecurity suggests concerns about crypto’s role in ransomware, money laundering, or systemic risks (e.g., stablecoin collapses). Outcomes might include mandates for robust security standards or stress tests for major platforms. Overemphasis on risks could lead to policies that unfairly target crypto, ignoring its benefits or resilience compared to traditional finance.

Discussions with banks indicate efforts to bridge crypto and traditional finance, potentially easing access to banking services for crypto firms. This could stabilize the industry by reducing reliance on offshore or fringe financial institutions. Banks may resist due to perceived risks, or the Treasury could impose conditions that favor centralized players, marginalizing DeFi.

The U.S. risks falling behind jurisdictions like the EU or Singapore, which have clearer crypto regulations. These meetings could shape policies to keep the U.S. competitive, retaining talent and capital. Heavy-handed regulation could drive innovation offshore, as seen with firms relocating to crypto-friendly regions.

Positive signals from the meetings (e.g., pro-innovation policies) could boost crypto markets, particularly for projects aligned with regulatory priorities. Conversely, hints of crackdowns could trigger sell-offs, especially in privacy-focused or DeFi tokens. Short-term volatility is likely as markets react to leaks or speculation.

The meetings highlight deep divides among stakeholders, reflecting competing visions for crypto’s future. Many crypto firms and advocates push for light-touch regulation, arguing that overreach stifles innovation and undermines decentralization. They emphasize crypto’s potential to democratize finance and enhance efficiency.

The Treasury prioritizes financial stability, consumer protection, and preventing illicit activity. Officials may view crypto as a risk to the dollar’s dominance or a vector for crime, favoring strict oversight. Centralized Entities (e.g., Coinbase, Circle), these firms often welcome regulation to gain legitimacy and market share, as they can afford compliance. They may advocate for rules that entrench their dominance.

Decentralized projects fear regulations designed for centralized models, which could outlaw anonymous wallets or smart contracts. Their exclusion from invite-only meetings risks unrepresented interests. Traditional financial institutions want crypto to fit within existing frameworks, potentially limiting its disruptive potential. They may lobby for policies that protect their turf.

Innovators argue for a new paradigm, resisting rules that force crypto to mimic traditional finance. This tension shapes debates on custody, stablecoins, and banking access. The U.S. seeks to maintain financial hegemony, wary of crypto’s potential to bypass sanctions or empower adversaries. This contrasts with global players advocating for open, borderless systems.

The divide could lead to fragmented regulations, complicating cross-border operations. Pro-Crypto Advocates (visible on platforms like X) many view the meetings skeptically, fearing regulatory capture or bias toward Wall Street. Others, including policymakers, argue that crypto’s risks justify secrecy and caution, prioritizing national security over industry demands.

The Treasury’s meetings could set the tone for U.S. crypto policy, with outcomes ranging from innovation-friendly frameworks to restrictive measures that reshape the industry. The divides—between regulators and innovators, centralized and decentralized players, and U.S. and global priorities—will likely persist, influencing which voices dominate.

While regulatory clarity could unlock growth, the risk of overreach or exclusion of key stakeholders looms large. Monitoring leaks or public statements post-meetings will be crucial for gauging the direction, as will sentiment on platforms like X, where crypto communities are vocal.