The 2025 Kentucky Derby is upon us, and the most famous race of them all is scheduled to take place on Saturday, May 3rd in Louisville.

Residents of Illinois can get in on the betting action with TwinSpires, but there are other options in the sportsbook market that are featuring big bonus bets this year. Offshore sportsbooks to bet on the Kentucky Derby like BetOnline have more than $5,000 in free bets available to new users, who can place wagers straight from the comfort of their own homes no matter where the location.

Read below and learn how to bet on the 2025 Kentucky Derby in Illinois, and claim up to $5,000 in promotional bets.

How To Bet On Kentucky Derby 2025 in Illinois

- Click here to get $250 in free bets at BetOnline

- Sign up and deposit $50 or more

- Get your free bets

- Place wagers on the 2025 Kentucky Derby

Best Kentucky Derby 2025 Betting Offers In Illinois

- BetOnline — $250 in free bets for Kentucky Derby 2025

- BetUS — 125% bonus, up to $2,625 on your first 3 deposits

- BetWhale — $1,250 Kentucky Derby betting offer

- MyBookie — $1,000 horse racing betting offer

- BetNow — $500 Kentucky Derby bonus

1. BetOnline — $250 in free bets for Kentucky Derby 2025

One of the best and longest running betting options for the 2025 Kentucky Derby is BetOnline. This year, new users can earn up to $250 in free bets upon enrollment, and without any hidden rollover requirements. All it takes is a minimum of a $50 initial deposit. They are also featuring Kentucky Derby betting contests with over $20,000 in prize money set to be given away.

Why Sign Up For BetOnline?

- Available in all 50 U.S. states

- Better Kentucky Derby odds

- Sign-up bonus has 1x rollover requirement

- Fast payouts and secure payment methods

Join BetOnline Now!

2. BetUS — 125% bonus, up to $2,625 on your first 3 deposits

BetUS has been a mainstay in the industry, and are featuring arguably the best promotions for this year’s Kentucky Derby. They not only have a 125% deposit match bonus, but the offer is eligible for your first three deposits, worth up to $2,625 in free bets. A crypto bonus is available as well, which gives users of the currency a 200% boost upon deposit. It doesn’t stop there, though, as there is also a 300% bonus for referring a friend.

Why Sign Up For BetUS?

- Huge welcome bonus offer on first 3 deposits

- Competitive Kentucky Derby odds

- 200% crypto deposit bonus

- 300% refer-a-friend bonus

Join BetUS Now!

3. BetWhale — $1,250 Kentucky Derby betting offer

BetWhale has one of the easiest to use mobile platforms of the available options, and have an extensive betting menu for the 2025 Kentucky Derby. But it is their deposit bonus for this year’s big event that make them a solid choice, as they are offering a promotion of free bets that is worth up to $1,250. They also feature fast and secure payouts, which is an important aspect when deciding on which option to select.

Why Sign Up For BetWhale?

- Up to $1,250 in welcome bonuses

- Full range of Derby betting options

- Fast, secure payouts

- Mobile-friendly platform

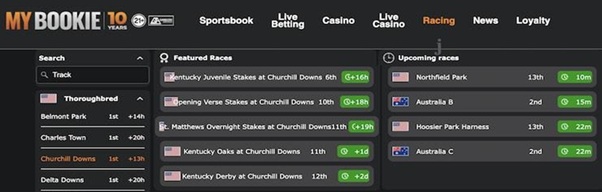

4. MyBookie — $1,000 sports betting offer

MyBookie is one of the most trusted sites when it comes to sports wagering of any kind, and hose racing fans in Illinois should take advantage this weekend. New members can earn a 100% welcome bonus on their first deposit, which is worth up to $1,000 in free bets. They have one of the deepest betting menus, which include bets like exatcas, trifectas, and more for this year’s Run for the Roses.

Why Sign Up For MyBookie?

- Trusted betting site for U.S. players

- $1,000 welcome bonus offer

- Wide variety of horse racing bets

- Better odds for top contenders

5. BetNow — $500 bonus for Kentucky Derby

BetNow has a wide variety of sign-up bonuses. The betting boost for new users is valued at 150% for initial deposits, and there is a 200% bonus for those funding their accounts with cryptocurrency. There is another 200% boost that BetNow is offering, which is available for those who refer a friend to the site.

Why Sign Up For BetNow?

- 150% deposit bonus up to $500

- Registration is quick and easy

- Competitive Derby odds

- Reliable customer support

Is It Legal To Bet On Kentucky Derby 2025 In Illinois?

The best Kentucky Derby betting sites according to businessinsider.com is legal in the state of Illinois at a Federal level, and has been since 2020. There are more than a handful of physical locations throughout the state, as well as online betting being available as well. But there are plenty of limitations when it comes to legalized gambling, and bettors may find the offshore sportsbook options to be more advantageous to them.

Potential users of offshore options typically only need to be 18 years old as opposed to 21. There is also the factor of the aforementioned promotions and bonus bets that are available via the non-local options, which are offering more than $5,000 in free wagers this year for the 2025 Kentucky Derby.

Who Can Bet On the Kentucky Derby In Illinois?

- Must be at least 18 years old

- Sign up for your sports betting without ssn account with a valid email address

- Fund your account with an accepted deposit method

Kentucky Derby 2025 Odds

The 2025 Kentucky Derby odds are set following the post position draw. Journalism is currently listed as the overall favorite, featuring +285 odds to nab the first leg of a potential Triple Crown. The favorite hasn’t won the race since 2015, but it is hard to ignore the gap between Journalism and the next horse on the board. Sovereignty is second on the list at +600, with Sandman rounding out the top three while sitting at +1000. Neoequos and Render Judgment are brining up the rear when it comes to the betting odds, as they share the designation of being the biggest long shots at 80-to-1.

| Horse | Odds |

| Journalism | +285 |

| Sovereignty | +600 |

| Sandman | +1000 |

| Luxor Cafe | +1100 |

| Rodriguez | +1400 |

| Burnham Square | +1400 |

| Baeza | +1400 |

| Final Gambit | +1600 |

| Citizen Bull | +1800 |

| American Promise | +1800 |

| East Avenue | +1800 |

| Grande | +2000 |

| Tiztastic | +2500 |

| Coal Battle | +2500 |

| Publisher | +3300 |

| Admire Daytona | +4000 |

| Flying Mohawk | +5000 |

| Chunk of Gold | +5000 |

| Owen Almighty | +5000 |

| Neoequos | +8000 |

| Render Judgement | +8000 |

Kentucky Derby 2025 Picks and Predictions

Sandman is listed at +1000 odds and is third on the betting board this year, and might hold the most value despite others having larger numbers attached. The colt was foaled in 2022, and has started 8 races in its career. All of them have features finishes in the top-5, including three first place finishes, one of them being the Arkansas Derby back in late March. In its five races run since September 2024, Sandman has finished in the top-3 in each.

The value is hard to pass up, as a $100 winning wager on Sandman would net bettors $1,000.

Kentucky Derby 2025 Prediction: Sandman (+1000)

What Is The Best Betting Site In Illinois For Kentucky Derby 2025?

All in all, potential Kentucky Derby bettors in Illinois are best off using a site like BetUS. The total of over $5,000 in promotions and Kentucky Derby free bets available from the offshore sportsbooks makes going non-local a solid option. These outlets make it easy and fun for Illinois residents to boost their bankroll and maximize profits when betting on free horse racing tips.

Claim $250 in free Kentucky Derby bets!