The 2025 Kentucky Derby takes place on Saturday 3 May and here is how you can bet on the horses from Kentucky. In the article below, we introduce you to the best US offshore betting sites, including our top favorite sportsbook, BETWHALE

Best Kentucky Sports Betting Sites for the Kentucky Derby

Here are the 5 top Kentucky Derby 2025 offshore betting sites to use when placing a bet on the big race on Saturday 3 May. You will find a detailed review of each of those sites.

- BetWhale – Newer racebook with $1,250 welcome offer

- BetOnline – $250 sign-up offer for Kentucky Derby

- BUSR – Horse racing specialist racebook with $1,000 in bonuses

- Bovada – $750 bonus for horse racing betting

- BetNow – 200% deposit joining offer for Kentucky Derby

How to Bet on the Kentucky Derby in Kentucky

Place bets on the 2025 Kentucky Derby in three simple steps.

- Open a BetWhale account

- Deposit up to $1,000 (Get 125% bonus up to $1,250)

- Place your 2025 Kentucky Derby bets

Kentucky Sports Betting Latest – Can I Bet on the Kentucky Derby in Kentucky?

Yes, you can bet on horse racing at the track in Kentucky or via some apps (TVG and TwinSpires), however, it’s ‘pools betting only’.

In 2023, the state legalized sports betting in the home of the Kentucky Derby but the bad news is their sportsbooks don’t do horse racing.

FanDuel bought over TVG and so they have an app – however, many bettors still prefer to use the offshore sportsbooks and racebooks.

Why? This is because these have more markets, top bonuses, fixed odds, offers and better prices than even the track – which is all possible as they have lower overall margins.

Most of the best Kentucky offshore racebooks we recommend on this page also have over 20 years of operating online via offshore licenses – so are perfectly safe, legal and secure to bet with in Kentucky, or ANY US state.

Plus there are no KYC checks on sign-up – which means opening a new account to placing your 2024 Kentucky Derby bets can be done in a few moments.

The 5 Top Kentucky Derby Sports Betting Sites Reviewed

1. BetWhale (125% Deposit Bonus, up to $1,250)

BetWhale is our top-ranked sportsbook if you want to bet on the 2025 Kentucky Derby in Kentucky.

Their extensive horse racing offering is one of the best around and despite being one of the newer betting sites – don’t let this put you off as they are already the go-to site for thousands of punters.

BetWhale are based offshore, so any set US State betting rules don’t apply to them – meaning their customers can bet ANYWHERE across America.

Plus, being a newer betting site means that most won’t have taken up their generous welcome offer – which is a 125% deposit bonus of up to $1,250.

Why Join BetWhale for Horse Racing?

- Newer Racebook Generous Welcome Offer To Claim

- Existing Customer Free Bets and Offers

- Competitive Horse Racing Odds

Sign up with BetWhale Now!

2. BetOnline (50% Deposit Bonus, up to $250)

BetOnline is another top option for those looking to bet on the 2025 Kentucky Derby in Kentucky – the home of the first leg of the US Triple Crown.

Being based offshore – like all the featured sportsbooks on this page – means customers can use BetOnline to bet in ANY US State – as they don’t abide by any set state gambling rules.

There is also a $250 free bet offer in place for new joiners with their 50% opening deposit bonus. While horse racing fans can also cash-in on their 9% daily horse racing rebate too and $25 risk-free bet to look out for.

At BetOnline players have a wide range of payment options too, including Bitcoin, and should you find the big Churchill Downs winner on Saturday they also have quick payouts on withdrawals.

Why Join BetOnline for Horse Racing?

- Competitive Odds & $250 Sign-Up Offer

- $25 Horse Racing Risk-Free Bet

- 9% Daily Horse Racing Rebate

- Many Horse Racing Bets Supported (Inc, Win, Place, Show, Exacta & Trifecta)

Sign up with BetOnline Now!

3. BUSR (100% Deposit Bonus, up to $1,000)

BUSR means ‘Bet US Racing’, and has been in operation since 2014 and has always had horse racing at the forefront of its business – making it another popular pick for many wanting to bet on the 2025 Kentucky Derby if living in Kentucky.

Users are rewarded with competitive fixed odds betting on all the main horse racing markets that include win, place, show, plus the popular exacta and trifecta bets.

BUSR will also offer new players up to $1,000 in free bets with their opening 20% deposit bonus – which can be used on the 2025 Kentucky Derby.

Then, once signed-up there is a daily 10% horse racing rebate to look out for as well as a $100 money back special on certain races for 2nds and 3rds.

Why Join BUSR for Horse Racing?

- Dedicated Offshore Horse Racing Site

- 10% Horse Racing Rebates (Daily)

- Moneyback Special Offers

Sign up with BUSR Now!

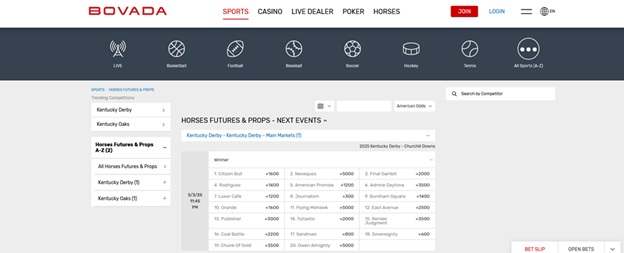

4. Bovada (75% Deposit Bonus, up to $750)

You can also learn how to bet on the Kentucky Derby 2025 with Bovada, who have been supplying their customers with the best horse racing odds since 2011.

They have a dedicated racebook section which makes betting on the 2025 Kentucky Derby markets easier—including popular win, place, and show options—and even allow users to bet online without SSN, adding convenience and privacy to the experience.

There is a $750 free bet to claim too for new joiners of this trusted site with their 75% deposit welcome bonus. Therefore, to max-out the full amount you will need to deposit $1,000 (but smaller amounts still qualify for this offer).

Why Join Bovada for Horse Racing?

- Rewards Loyalty Program & Refer a Friend Bonus

- Competitive Horse Racing Betting Odds

- Wide Range Of Horse Racing Bets Supported

Sign up with Bovada Now!

5. BetNow (Up To 200% Deposit Bonus)

BetNow is the last of our best Kentucky Derby betting sites according to businessinsider.com to use ahead of this Saturday’s big Churchill Downs race – with a deposit bonus of up to 200% to claim on opening deposits.

- 200% deposit bonus – up to $200

- 150% deposit bonus – up to $225

- 100% deposit bonus – up to $500

Having started in 2005, BetNow are a well-established name in the world of US sports betting, so it’s no shock that thousands of US horse racing predictor fans turn to them to wager on the Kentucky Derby each year.

In addition to their competitive welcome offer, once joined horse racing bettors can also take advantage of their 10% horse racing rebate offer, plus they even have a 200% cash bonus for referring a friend.

Why Join BetNow for Horse Racing?

- 10% Horse Racing Rebate (Weekly)

- Reup Bonuses (up to 30%)

- Competitive Horse Racing Odds

- Bet in ANY US State

Sign up with BetNow Now!

Kentucky Derby Odds 2025

Listed below are the latest odds with our top US offshore betting site BetWhale, where this season’s Santa Anita Derby winning horse Journalism tops the market.

This Michael McCarthy-trained 3 year-old will be looking to give the barn their first ‘Run For The Roses’ win and could become the first Kentucky Derby winning favorite since Justify in 2018.

Next best in the market is the Florida Derby runner-up Sovereignty and this season’s Arkansas Derby hero Sandman, who has been handed the dreaded gate 17 – where no winner is yet to come from – is also prominent in the market.

On a plus for Sandman he’ll be looking to take a similar path to last year’s Kentucky Derby winner Mystik Dan, who was third in that Oaklawn Park race before landing the 2024 ‘Run For The Roses’

Japan, who came close with Forever Young in 2024 (3rd), also look to have a leading chance with Luxor Cafe. He’s been handed gate 7 and comes here off the back of a facile win in the Fukuryu Stakes.

- Win Bet: You horse must win the race

- Place Bet: Your horse must finish in the first two

- Show Bet: Your horse must finish in the first three

- Trifecta: Pick the first three horses in the correct order (this can also be permed)

2025 Kentucky Derby Runners, Post Positions and Betting Odds

- 1 Citizen Bull 20-1

- 2 Neoequos 30-1

- 3 Final Gambit 30-1

- 4 Rodriguez 12-1

- 5 American Promise 30-1

- 6 Admire Daytona 30-1

- 7 Luxor Cafe 15-1

- 8 Journalism 3-1

- 9 Burnham Square 12-1

- 10 Grande 20-1

- 11 Flying Mohawk 30-1

- 12 East Avenue 20-1

- 13 Publisher 20-1

- 14 Tiztastic 20-1

- 15 Render Judgement 30-1

- 16 Coal Battle 30-1

- 17 Sandman 6-1

- 18 Sovereignty 5-1

- 19 Chunk of Gold 30-1

- 20 Owen Almighty 30-1

Note: Odds are subject to change