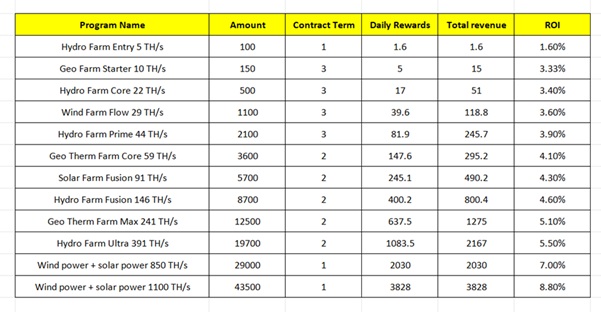

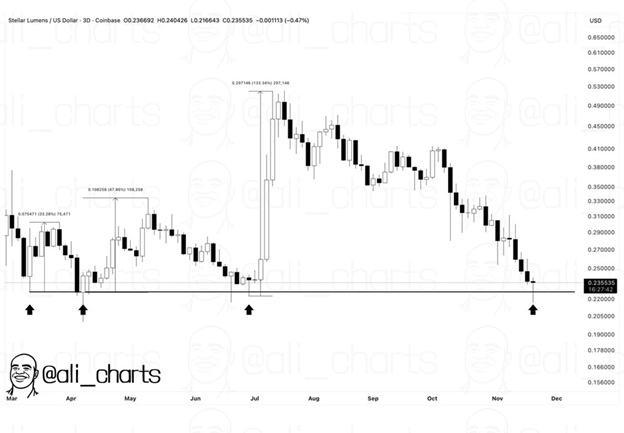

Stellar (XLM) is trading close to a price zone that has influenced its trend several times this year. The token sits near $0.243, showing a mild recovery after a broader decline. Traders are watching the $0.23 area again as past reactions from this level produced sharp moves.

Meanwhile, Mono Protocol is attracting attention in the crypto presale market as its Black Friday promotion doubles every token purchase.

XLM Returns to a Level That Has Repeatedly Triggered Rallies

Analyst Ali Martinez noted that XLM has reacted strongly each time it touched the $0.23 zone in 2024. During earlier visits to this level, the token climbed 33% in March, 48% in April, and 133% in July. With the price now back in the same area, traders are comparing the current structure with those earlier rebounds.

Source: Ali Martinez/X

The chart shows XLM approaching support after declining from the $0.40 region. Conditions differ from those earlier tests, as momentum is weaker this time. Even so, the level remains intact, and traders are tracking how the market behaves around it. The past reactions provide a reference, but no new trend has formed.

Analyst Elite Crypto pointed out a falling wedge on the daily chart. A similar structure appeared earlier in the year and led to a breakout. The current pattern shows lower highs moving toward the same support that has held multiple times. He noted that a breakout, if confirmed, could open the door to a strong move. For now, XLM remains inside the wedge without a clear signal.

These technical factors have made the support zone the main focus. Market activity over the next sessions will reveal whether a bounce forms or if the market continues to test the range.

Mono Protocol Sees Rising Activity During Black Friday Week

While XLM holds support, Mono Protocol is gaining steady traction in the presale crypto market. The project has now raised $3.51M of its $3.60M Stage 18 target. The MONO token is priced at $0.0525, and the projected launch value remains $0.500. Interest continues to grow as the platform rolls out updates for users and builders.

Mono Protocol launched a Black Friday promotion that runs from 24–30 November. Every purchase during this window receives a 100% bonus, doubling all token allocations automatically. The event has brought increased activity from users exploring web3 crypto presale opportunities, especially those seeking larger holdings before the next stage begins.

Every presale purchase of $MONO receives a 100% bonus. Your allocation doubles instantly – no extra steps or conditions.

? Double your MONO: https://t.co/obFjr3OHouBlack Friday Week runs 24–30 November.

Buy during the promo window to secure the boosted allocation and… pic.twitter.com/3cYPpIQjXw— Mono Protocol (@mono_protocol) November 24, 2025

The promotion arrives alongside several performance updates. The dashboard has been adjusted for smoother navigation, and additional improvements were released to support the higher traffic. These updates support the project’s plan to expand its toolkit for Web3 teams.

Mono’s approach continues to draw interest from users comparing new crypto presale options in the market. The bonus window, combined with the near-complete Stage 18 raise, has placed the project on the radar of those tracking cryptocurrency presales heading into 2025.

Engagement Builds Through Mono Protocol’s Rewards Hub

Mono Protocol’s Rewards Hub remains active throughout the pre sale cryptocurrency campaign. Users earn bonus MONO through tasks, referrals, and activity goals. The dashboard updates as tasks are completed, offering a clear record of progress.

The Hub includes welcome bonuses, promo codes, and a rotating set of daily and weekly tasks. This setup allows participants to increase their token count through activity rather than relying only on purchases. It also keeps users engaged during the raise, which has supported consistent traffic across the platform.

This structure, combined with Stage 18 progress and the Black Friday promotion, keeps Mono Protocol visible in the presale coin market. The project continues to build toward the next phase as interest grows across both users and builders.

Learn More about Mono Protocol

Website: https://www.monoprotocol.com/

X: https://x.com/mono_protocol

Telegram: https://t.me/monoprotocol_official