Comment: ‘Guys, I agree that we can panel beat and brandish figures anyhow in Nigeria but National Bureau of Statistics (NBS) in its CPI April 2025 included this disclaimer “In analyzing price movements under this section, it should be noted that CPI is weighted by consumption expenditure patterns that differ across States and locations. Accordingly, the weight as-signed to a particular Food or Non-Food item may differ from State to State, making interstate comparisons of consumption baskets inadvisable and potentially misleading.”‘ This was a response on the piece where I asked the National Bureau of Statistics to check its latest inflation data.

My Response: The absence of evidence is not the evidence of absence. A disclaimer does not solve the issue because the very fact these states are published together, most readers will think the baseline benchmark is the same. But where they are not, it is the job of NBS to re-weigh everything, to compensate for variances in baselines, if those states would be put on the same table.

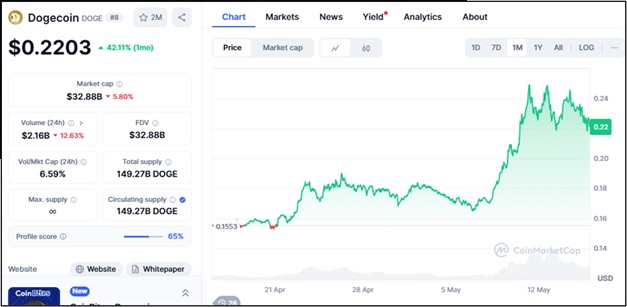

Simply, you need to explain why Ekiti (34% inflation) and Ogun (~10%) states have that level of deviation with or without disclaimers. Understand that economics is a social science, but it is “science” nonetheless. So, putting a disclaimer does not fix the issue. I do not buy into your explanation until someone can explain how homogenous economic states like Ekiti and Ogun could be attributed to have the deviation noted.

Respectfully, you cannot use “disclaimer” to cover laziness. It is like the JAMB mess. When the results were published, I noted that I did not believe the results and avoided castigating our young people. Why? In the last two decades, Lagos, Anambra, Imo and Abia states have always outperformed in JAMB. So, when JAMB published what that mess, I rejected it because it made no sense, looking at historical data!

Later, I argued that while JAMB could have technical glitches or poor software, as it claimed, the fact that its statisticians approved those results is a validation that they did not apply statistics, post-exam. In other words, when a center within the University of Nigeria Nsukka recorded 100% failure, despite its previous great records, no human there in JAMB cared to understand why?

So, in the grand scheme, the biggest failure of JAMB is not the software problem, but the fact they approved garbage as “results” without anyone knowing it was garbage. It is in that spirit I want someone to explain how Ekiti and Ogun states could record the inflation data being paraded right now with both published together, making the citizens assume similar baselines. A disclaimer is not an answer!

RESPONSE on Feed: I think NBS has made it clear that the baseline is not the same. And if that is the case, comparing them will not be fine. My position is this: if the baseline is not uniform, why put them in the same table without adjustment? I have put another piece on this. My position is that if you must publish all the states in one table, adjust the baseline to compensate for any variation.

Example, if you use Ekiti baseline to be 30 and Ogun 2, and you end up with whatever, and you did not adjust for the different baselines, while putting them in one table, that is not fair for the readers. Your pricing case does not matter because the baselines according to the disclaimer makes it so. But I can assure that if the baselines are adjusted, the variation between Ogun and Ekiti will not be up to the 25% as we have now. You can have 10%.

Nigeria’s National Bureau of Statistics, Check Your Inflation Computation Again