Bitcoin’s sharp retreat this month has become one of the defining stories in global markets, with the world’s most valuable cryptocurrency slipping deeper into a downturn that reflects a wider wave of investor caution.

Binance Chief Executive Richard Teng said on Friday that the latest slump is being driven largely by investors unwinding leveraged positions and pulling back from risk—a pattern now visible across most major asset classes.

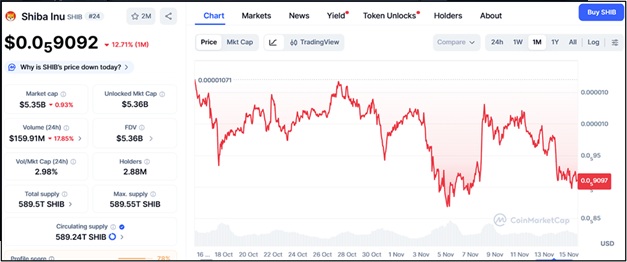

Bitcoin has fallen 21.2% in November alone, putting its three-month decline at 23.2%. The pullback has raised the odds that the token could end the year below $90,000, a symbolic threshold traders once considered a floor after it surged past $126,000 in early October to set an all-time high. The reversal since then has been swift and bruising, creating anxiety among momentum traders who piled in during the autumn rally.

Speaking during a media roundtable in Sydney, Teng said the recent turbulence should not be seen as isolated to crypto markets.

“As with any asset class, there are always different cycles and volatility. What you’re seeing is not only happening to crypto prices,” he said. “At this point in time, there’s a bit of risk (off) and deleveraging happening as well.”

That risk aversion has been evident throughout global markets this week. Investors have been unnerved by fears that an AI-driven valuation bubble—particularly around Big Tech—may be approaching a breaking point. Even Nvidia’s stronger-than-expected results have not done much to calm nerves, a sign of how deeply the unease has spread.

Bitcoin’s downturn comes after a remarkable stretch of gains stretching back roughly a year and a half. Teng emphasized that even with the recent decline, bitcoin is still trading at more than twice its level in 2024, when institutional giants like BlackRock began launching crypto-focused investment products that helped pull new capital into the sector.

“Over the past 1.5 years, the crypto sector has performed very, very well, so it’s not unexpected that people do take profit,” he said.

He argued that the present lull may ultimately be constructive. “Any consolidation is actually healthy for the industry, for the industry to take a breather, find its feet.”

Teng also addressed renewed attention on Binance founder Changpeng Zhao, known globally as CZ. Zhao, a Canadian citizen born in China, was pardoned by U.S. President Donald Trump in October after serving nearly four months in prison and paying a $50 million fine for pleading guilty to violations of U.S. money-laundering laws. His legal saga prompted a leadership transition in 2023, when Teng replaced him as chief executive.

When asked whether Zhao might return to the company, Teng said no decision had been taken.

“CZ has always been a controlling shareholder. As controlling shareholder he has more shareholder rights associated with that,” he said. “On the day-to-day basis, I work very closely with the board directors that comprise seven members, three independent directors, including an independent chairman, so we continue to chart the future strategy of the company.”

The combination of bitcoin’s rapid pullback, equity-market jitters, and lingering questions around Binance’s future leadership has created a tense backdrop for crypto traders. But Teng insisted the sector remains fundamentally stronger than it was in previous downturns. While in sum, he said the market is pausing, not collapsing—the coming weeks, with mounting pressure across global assets, are expected to test that confidence.