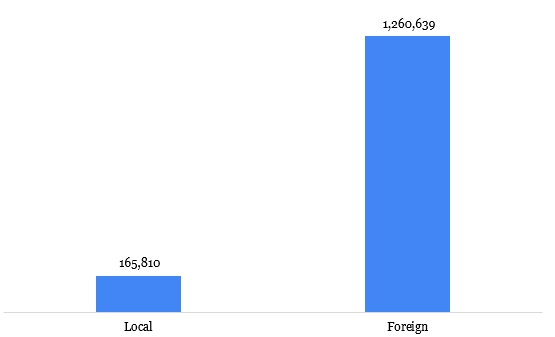

Bitcoin dominance, which measures BTC’s share of the total cryptocurrency market cap, is reportedly nearing a 4-year high, approaching 64%, a level not seen since January 2021. This comes as Bitcoin’s price has shown resilience, climbing close to $86,000 despite global economic uncertainty, including concerns over U.S. trade policies and market volatility. The surge in dominance suggests capital is consolidating into Bitcoin, with altcoins underperforming—some, like Ethereum, have seen sharp declines, with ETH/BTC ratios hitting multi-year lows.

Historically, high Bitcoin dominance can signal a market top or precede an altcoin rally if sentiment shifts, but current macro conditions, like tariffs and a strong U.S. dollar, are driving risk-off behavior, favoring BTC’s relative stability. Bitcoin’s strength absorbing capital, with dominance hitting 63.7% recently, while others warn of a potential peak, citing resistance at 64-65% and patterns like a bearish rising wedge. However, these posts are speculative and not definitive. The broader crypto market cap has contracted, dropping to around $2.79 trillion, underscoring Bitcoin’s outperformance.

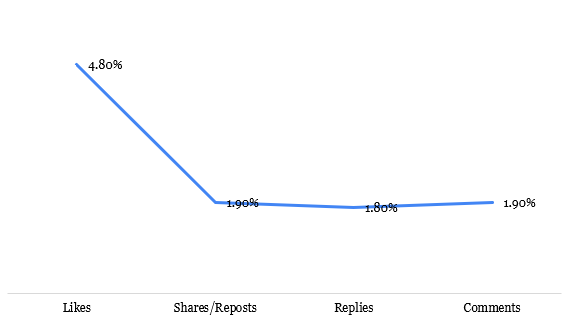

Still, dominance alone doesn’t predict price direction—Bitcoin could face resistance at $90,000, and altcoins might recover if macro fears ease. Always approach such trends with skepticism; markets are fickle, and narratives can flip fast. Bitcoin’s rising dominance near a 4-year high has several implications for the crypto market and investors. Higher dominance nearing 64% indicates investors are favoring Bitcoin over altcoins, likely due to its perceived stability amid global economic uncertainty e.g., U.S. trade policy fears, tariff concerns. This flight to Bitcoin can starve altcoins of capital, leading to declining price as seen with Ethereum’s ETH/BTC ratio hitting multi-year lows.

Altcoins, including major ones like ETHEREUM, may continue to lag until market sentiment shifts. Historically, prolonged Bitcoin dominance can suppress altcoin rallies, but a peak in dominance e.g., at 64-65% often precedes an “altseason” if capital flows back to smaller coins. This pivot isn’t guaranteed, especially with macro headwinds like a strong U.S. dollar. Rising dominance reflects risk-off behavior, with Bitcoin acting as a crypto “safe haven.” If global jitters e.g., trade wars, inflation fears persist, BTC could maintain its edge.

Conversely, easing macro pressures might spark altcoin recovery, diluting dominance. High dominance can hint at a Bitcoin price top, as seen in past cycles (e.g., 2021), where capital concentrates in BTC before a broader market correction. Alternatively, it could signal strength, with BTC testing new highs (e.g., $90,000 resistance). Some speculate on both outcomes, citing technicals like resistance or bearish patterns, but these are noisy and inconclusive.

Investors might lean toward Bitcoin for stability but risk missing altcoin upside if dominance reverses. Diversifying cautiously while monitoring macro trends (e.g., dollar strength, tariff impacts) is key. Over-relying on dominance as a signal can mislead—market dynamics are complex, and BTC’s price isn’t tied solely to its market share. A shrinking total market cap ($2.79 trillion) alongside BTC’s dominance suggests overall crypto enthusiasm is waning. If Bitcoin fails to break key resistance or macro conditions worsen, the entire market could face downward pressure.

These implications hinge on volatile factors—macro events, sentiment shifts, and technical levels. Nothing’s certain, so weigh decisions carefully and don’t bet the farm on any single trend. Altcoin recovery refers to a period when alternative cryptocurrencies (altcoins) like Ethereum, Cardano, or Solana experience significant price increases, often outpacing Bitcoin, after a phase of underperformance. In the context of Bitcoin dominance nearing a 4-year high (around 64%), altcoin recovery would mean a reversal where capital flows back into altcoins, boosting their prices and market share relative to Bitcoin.

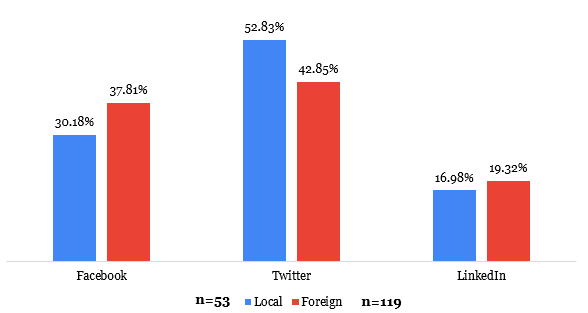

High Bitcoin dominance often signals a concentration of capital in BTC, leaving altcoins undervalued. When dominance hits resistance (e.g., 64-65%, as seen historically), it can plateau or decline, prompting investors to rotate profits into altcoins, sparking rallies. Altcoins thrive in risk-on environments. If global economic fears (e.g., trade tariffs, dollar strength) ease, or positive crypto catalysts emerge (e.g., regulatory clarity, tech upgrades like Ethereum’s scaling), investors may chase higher-risk, higher-reward altcoins over Bitcoin’s relative stability. Once a few start rallying—often fueled by hype, project updates, or whale activity—FOMO (fear of missing out) can drive broader market enthusiasm, amplifying gains across altcoin markets.

How Altcoin Recovery Happens

Investors sell Bitcoin (or stablecoins) to buy altcoins, increasing their prices and reducing Bitcoin’s dominance. For example, if BTC stabilizes near $86,000, traders might diversify into ETH, expecting it to catch up after lagging. Project milestones (e.g., network upgrades, DeFi or NFT booms) can trigger rallies in specific coins, spreading optimism to others. For instance, Ethereum’s past upgrades often ignited broader altcoin runs. A rising total crypto market cap (currently ~$2.79 trillion) signals fresh capital entering the space. Altcoins, being more sensitive to inflows, often see outsized gains compared to Bitcoin.

Altcoins breaking key resistance levels or showing bullish patterns (e.g., higher lows) can attract technical traders, accelerating price surges. A drop below key levels (e.g., 60%) would suggest capital is flowing back to altcoins. Major altcoins like ETH or BNB gaining faster than BTC, with rising altcoin/BTC ratios. Increased trading volume in altcoin markets, especially on exchanges, signals growing interest. Persistent global uncertainty (e.g., U.S. trade policies, inflation) could keep investors risk-averse, delaying altcoin recovery as capital stays in Bitcoin or exits crypto entirely.

Altcoin rallies can fizzle if Bitcoin suddenly corrects or dominance climbs further, as seen in past cycles when BTC hit 70%+ dominance. Not all altcoins recover equally—many lack strong fundamentals and may stay suppressed even if majors like ETH rally. Historically, altcoin recoveries follow dominance peaks, but timing is tricky. For example, in 2020-2021, dominance fell from 70% to 40% as altcoins soared, but macro conditions today (e.g., tariff risks) are less favorable.

Altcoin recovery hinges on capital rotating from Bitcoin to altcoins, driven by peaking dominance, better sentiment, or project catalysts. It’s a high-reward opportunity but unpredictable—macro risks and Bitcoin’s momentum could delay it. Watch dominance trends and market cap shifts, but don’t expect every altcoin to moon. Pick projects with solid fundamentals, and brace for volatility. Markets love to fake out the impatient.

Like this:

Like Loading...