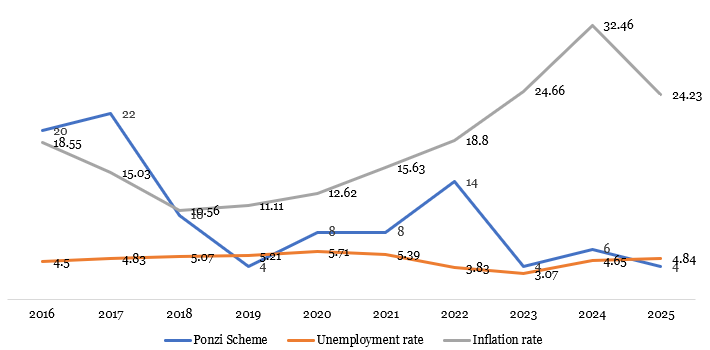

From the early crash of MMM Nigeria in 2016 to the collapse of CBEX in 2025, Ponzi schemes have become an unsettling fixture in Nigeria’s economic landscape. With over 50 major schemes recorded since 2016, our analyst notes that their growth appears to mirror the nation’s economic turbulence, but a closer look reveals a more layered reality.

While inflation and unemployment are often cited as triggers for financial desperation, recent data shows that inflation, more than joblessness, has a stronger correlation with Ponzi activity. Between 2020 and 2022, inflation reached multi-year highs. That same period saw the emergence and collapse of schemes like Racksterli, 86FB, InksNation, and Baraza Multipurpose Cooperative, which attracted thousands of participants before eventually defaulting.

Analysis of macroeconomic indicators from 2016 to 2024 points to a pattern: as the cost-of-living soars and the naira weakens, Nigerians increasingly seek out risky alternatives to preserve purchasing power. While unemployment also peaked in 2020, Ponzi scheme proliferation more closely followed inflationary surges. According to our analyst, this suggests that the erosion of real income may be a more immediate driver of fraudulent investment activity.

Exhibit 1: Ponzi schemes and selected macroeconomic indicators

However, macroeconomic conditions alone do not fully explain the pattern. Only 14% of the variation in Ponzi scheme operations between 2016 and 2024 can be attributed to inflation and unemployment combined. Our analyst points out that this implies that while economic pressure is a factor, it is not the primary determinant of Ponzi participation.

Further predictions extending from 2026 to 2030, based on constant inflation and unemployment rates, suggest minimal change in Ponzi scheme activity. These projections highlight the limits of macroeconomic indicators in forecasting fraudulent investment trends. Real-world complexities such as digital access, information flow, and community behaviour play a far more significant role.

One of the most persistent drivers of Ponzi scheme participation in Nigeria is low financial literacy. Many individuals, especially in low-income and semi-urban areas, struggle to distinguish between legitimate investment opportunities and schemes designed to collapse. Operators of these scams often present themselves as investment experts, leveraging buzzwords such as cryptocurrency, forex trading, and digital arbitrage to lend false credibility.

Weak regulatory enforcement continues to be a challenge. Many schemes operate for months before being investigated or sanctioned. In some cases, warnings from regulatory agencies come after significant public losses have already occurred. Delays in enforcement create an enabling environment for fraudulent actors to expand operations, recruit more victims, and siphon off larger sums.

Another critical issue is the deep-seated distrust of formal financial institutions. Years of banking collapses, inaccessible pension funds, and opaque government-backed financial schemes have eroded public confidence. In such an environment, informal investment groups, often promoted by friends, family, or community leaders, appear more trustworthy than official channels. Ponzi schemes exploit this trust, embedding themselves in everyday social networks.

The role of social media and instant messaging platforms cannot be understated. These digital spaces allow schemes to spread rapidly through viral marketing, fake testimonials, and exaggerated success stories. With limited fact-checking and a high emotional appeal, these platforms have become the primary launchpads for many recent schemes.

Periods of Ponzi decline also deserve attention. In 2019 and 2023, there was a noticeable reduction in fraudulent scheme activity. These declines may be attributed to a combination of regulatory crackdowns, increased public awareness, and growing digital financial literacy. Expanded financial inclusion initiatives and youth-targeted education campaigns during those periods likely played a role in lowering public susceptibility.

Despite the link between economic instability and Ponzi activity, socioeconomic desperation is a broader and more persistent issue. The desire for financial relief, regardless of inflation levels or employment status, fuels risky behaviour. As formal job opportunities shrink and the gap between income and living costs widens, more Nigerians turn to unregulated alternatives, despite the repeated collapses of such schemes.

Going forward, our analyst says Nigeria faces a choice. Without systemic improvements in financial education, rapid-response regulation, and public trust in formal systems, Ponzi schemes will continue to evolve and resurface under new names and models. Inflation and unemployment may set the stage, but it is the absence of strong financial safeguards that allows the performance to continue.