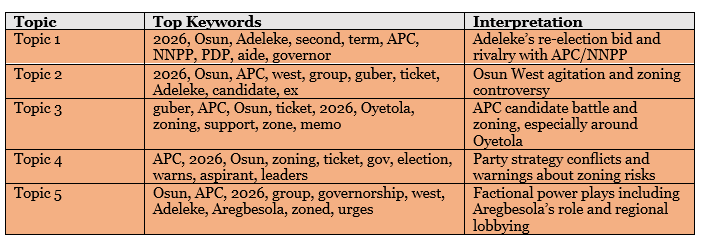

As the political calendar inches towards 2026, Osun State finds itself in the throes of a high-stakes governorship race that promises to reshape the political landscape of southwest Nigeria. At the heart of this unfolding drama are three main forces: the incumbent governor, Ademola Adeleke and his PDP allies; a divided but resolute APC, struggling with internal coherence; and a growing chorus from Osun West, demanding political equity through zoning. What emerges from the headlines is not just a contest for a seat, but a clash of ambitions, ideologies, and regional interests.

Governor Adeleke: The Incumbent Holding the Fort

Governor Ademola Adeleke remains the most visible figure ahead of 2026. Fresh off a significant 2022 win, his camp is projecting confidence. Various groups, from PDP’s Osun West chapter to market leaders and religious figures like Primate Ayodele, have openly endorsed his bid for a second term. These endorsements paint a picture of a governor consolidating support, even as he faces relentless attacks from opposition forces.

Exhibit 1: Topics from the headlines

Adeleke’s team has been strategic, dismissing rumors of defection to the APC and actively reinforcing PDP loyalty. His aides and allies frame him as the victim of destabilization plots, pointing fingers at figures like APC National Chairman Abdullahi Ganduje and framing opposition maneuvers as external interference. The core of Adeleke’s interest is clear: secure a second term and entrench PDP’s influence in a region traditionally swung between parties.

APC: Fractured Dominance and the Oyetola Factor

The All Progressives Congress (APC), though out of power in the state, remains a potent force, albeit one riddled with factional conflict. Former governor Gboyega Oyetola has emerged as the most talked-about figure in the APC, with repeated calls from party groups and local leaders urging him to return to the ballot. A significant part of the APC establishment views him as the party’s best chance at reclaiming Osun.

Exhibit 2: Top keywords for each of the 5 identified topics

However, the road is not clear. APC is embroiled in a zoning controversy, whether to retain the governorship candidacy in Oyetola’s central zone or shift it westward. This has created visible rifts among APC chieftains. While some insist on the principle of the “right of first refusal” for Oyetola, others reject candidate imposition and call for an open field. The party’s former Secretary, Iyiola Omisore, and now-defector Rauf Aregbesola further complicate the internal arithmetic, as their support bases could sway margins in a close election.

Osun West: A Zoning Crusade

Perhaps the most coherent and determined voice in the race comes from Osun West. After more than three decades without producing a governor, stakeholders from this zone are intensifying demands for zoning the ticket in their favor. Monarchs, grassroots groups, and professional unions have launched coordinated campaigns urging both major parties to give them a shot.

The West sees 2026 as a historical reckoning. For them, it’s not just about representation, it’s about fairness. Prominent names like Bola Oyebamiji, the National Inland Waterways Authority boss have been floated, supported by agitation groups pressing both President Tinubu and Alhaji Abdullah Ganduje, chairman of the All Progressives Congress, to weigh in on the zoning issue. If the APC or PDP fails to align with these aspirations, it risks alienating a vital bloc of voters.

Third Forces and Political Realignment

While PDP and APC dominate the headlines, third-party actors like the NNPP are actively positioning themselves as viable alternatives. Their rhetoric, “Osun deserves better than Adeleke”, signals an attempt to ride the waves of public dissatisfaction and elite squabbles. Aregbesola’s defection, alongside his group’s public disavowal of APC direction, also hints at possible alliances that could reshape party loyalties.

Osun 2026 is shaping up to be more than a two-horse race. It’s a contest between continuity and disruption, central dominance and westward agitation, internal party loyalty and elite defection. Governor Adeleke seeks validation for his first-term efforts. Oyetola and APC strategists want redemption. Osun West demands justice. And fringe actors smell opportunity.

The outcome will not only determine who governs Osun but also signal the political temperament of the southwest in a post-Tinubu era. Stakeholders ignore the underlying regional currents and party fissures at their peril.