Is crypto finally getting its own cheat code?

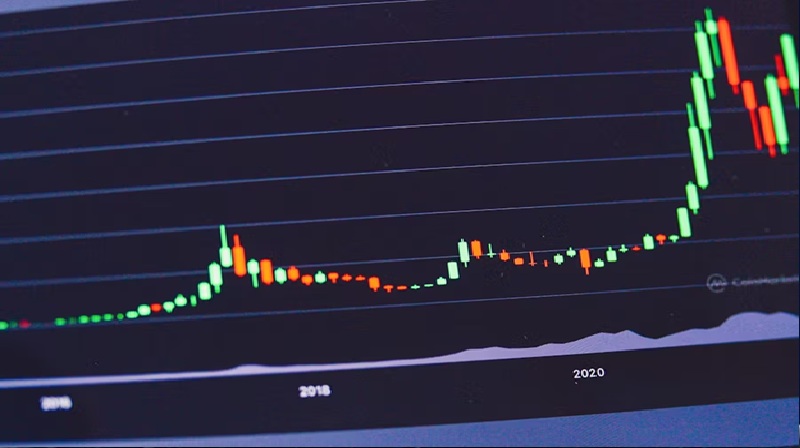

The Solana Price just bounced back above $110 after dipping to a 14-month low, boosted by PayPal adding SOL to its crypto lineup. Meanwhile, ADA technical analysis shows Cardano flirting with a “death cross” setup as prices hold just under $0.60. These moves are turning heads, but the real surprise this week isn’t coming from the big names—it’s from BlockDAG. While most people are watching charts, BlockDAG quietly dropped a feature that feels like a secret unlock in a game.

BlockDAG’s CHEST5X: The Crypto Cheat Code No One Saw Coming. Gamers have cheat codes, now crypto does too. BlockDAG’s CHEST5X boost gives first-time buyers a 5X head start—no strings attached, no code needed. It’s the ultimate edge before the listings drop. For anyone hunting a high ROI crypto, this might be the easiest win of the year.

CHEST5X Unlocks: BlockDAG’s No-Effort Crypto Advantage

Gamers have cheat codes, now crypto does too. BlockDAG’s CHEST5X boost gives first-time buyers a 5X head start—no strings attached, no code needed. It’s automatic. As soon as you make your first purchase, the system rewards you with five times the value. No buttons to press, no form to fill. It just happens. And in a presale where every batch sells out fast, that edge matters.

Right now, BlockDAG is in Batch 27 of its presale, with the coin priced at $0.0248. That’s a 2,380% jump from its starting price of $0.001. Over 19.1 billion BDAG coins have been sold, and more than $212.5 million has been raised. The CHEST5X boost stacks right on top of this momentum, helping buyers maximize value before listings even begin.

BlockDAG’s presale isn’t just about hype—it’s backed by real progress. The beta testnet is live, processing over 1.2 million transactions across 100+ global nodes. There’s a new explorer, a token/NFT builder, and a $60K reward pool for the top testnet users. With plans to launch on 10 CEXs and support for DeFi, staking, and bridges, BlockDAG is building a complete ecosystem.

For anyone looking for a high ROI crypto, this is one of the most no-brainer opportunities out there. Add in the CHEST5X boost and it’s even harder to ignore. It’s a hidden cheat code for early buyers—and it’s still active.

Solana Price Bounces Back After PayPal Boost

The Solana price has rebounded to around $110 after dipping to a 14-month low, helped by PayPal’s recent move to support SOL on both its main app and Venmo. That boost came right when market sentiment was shaky, especially with a $200 million token unlock approaching. While some traders are still cautious, the PayPal news gave SOL some much-needed support.

On the ecosystem side, Solana’s DeFi activity is showing strength again. Its total value locked (TVL) has hit $56 million, the highest in almost three years. This adds another layer of confidence, especially as more users jump into its DeFi platforms. If this trend holds, the Solana price could break higher, though analysts say it depends on how the unlock plays out and how long the market holds this bullish momentum.

ADA Technical Analysis Flags Warning Signs for Cardano

The ADA technical analysis shows some caution ahead. Cardano is trading just under $0.60 and is close to forming a “death cross,” where the 50-day moving average drops below the 200-day. That pattern often signals bearish momentum, especially when combined with weak market support. Some traders see a potential dip if buyers don’t step in soon.

Still, there’s confidence coming from inside the Cardano community. Developer Sebastien Guillemot just took a $400,000 loan to buy over 686,000 ADA tokens, adding $60,000 in interest—all to support the Cardano treasury. That move has sparked attention across the space. While ADA technical analysis points to caution, the long-term outlook depends on whether the network can continue to build support and if buyers react to insider moves like this one.

Key Insights

Solana price is climbing again with help from PayPal, while ADA technical analysis points to some risk as Cardano nears a bearish cross. Both networks are showing mixed signals, with strong ecosystems but uncertain short-term momentum. For those tracking the charts, it’s a waiting game.

BlockDAG, on the other hand, is skipping the noise and handing out real value. The CHEST5X boost gives first-time buyers a 5X multiplier automatically—no codes, no steps, just instant rewards. It’s being called the cheat code of crypto for a reason. With over $212.5 million raised, 19.1 billion coins sold, and listings coming soon, BlockDAG is putting itself on the radar for anyone chasing a high ROI crypto. For buyers who want more than just speculation, BlockDAG’s early rewards and expanding ecosystem make it the high ROI crypto play to watch right now.

Presale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: https://discord.gg/Q7BxghMVyu