Since Dogecoin and Shiba Inu took center stage as meme-driven assets, investors have been gearing up to find other cryptocurrencies with practical use cases and exceptional development prospects. Rexas Finance (RXS) stands out as one of the most promising opportunities, revolutionizing the tokenization of real-world assets. Alongside RXS, Stellar, XRP, and Cardano also show significant upside potential, making them top contenders to outperform DOGE and SHIB by at least 1,000% in the coming weeks.

Rexas Finance (RXS): The Future of Real-World Asset Tokenization

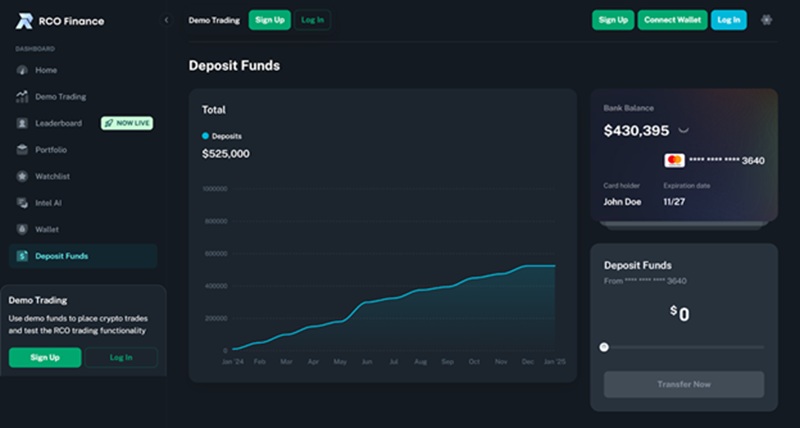

By providing a venue for the tokenization of real-world assets (RWAs), Rexas Finance (RXS) is boldly entering the blockchain scene. Investors in this project can buy fractional ownership of valuable assets, including intellectual property, luxury goods, and real estate. For example, a $100 million hotel can be divided into 100 million RXS tokens, opening small investors’ access to markets once held for the privileged. With 458 million tokens sold in the presale, RXS’s presale has been quite successful, raising $47,776,122 thus far. The presale price shows great investor interest, a startling 567% rise from the original $0.03 per token. With a projected listing price of $0.25, Rexas Finance will debut on elite exchanges in June 2025. Forecasts indicate that by the end of July 2025, RXS will have seen a tremendous rise in value, ranging from $2 to $5. Should this prognosis be accurate, RXS might generate a significant comeback, outrunning DOGE and SHIB by at least 1,000%, making it a unique prospect for investors seeking a phenomenal increase.

Stellar (XLM): Facilitating Efficient Cross-Border Transactions

Established in 2014, Stellar is a blockchain technology that allows seamless, low-cost payments worldwide. The native cryptocurrency, XLM, boosts liquidity and mediates transactions with other fiat currencies. On March 29, 2025, XLM’s valuation stood at $0.265. XLM has recently traded within an ascending triangle pattern known for bullish runs. Over the years, XLM has consolidated into an upward breakout formation, so if it breaks resistance around $0.30, it would trigger a tremendous surge of 1000%. With Stellar’s continued relationships with corporations and their constant support in cross-border transactions, there is a potential for XLM gains that can outperform SHIB and DOGE.

XRP (XRP): Gaining Momentum Amid Legal Clarity

On March 29, 2025, XRP was valued at around $2.12. Recent legal wins and partnerships have increased investor sentiment toward XRP. Technical indicators suggest XRP has completed a ‘golden cross’; this means the 50-day moving average has crossed above the 200-day moving average. This crossover is a bullish signal that “strong upside price movement” is likely. In 2025, analysts anticipate XRP to reach $5, which is over double its value today and would make XRP surpass DOGE and SHIB by 1,000%. XRP’s growth puts it in a position to significantly surge ahead of DOGE and SHIB since Ripple is broadening its payment solution services worldwide.

Cardano (ADA): Advancing Through Technological Innovation

Cardano trades at $0.667 at the time of writing. Based on technical analysis, a descending wedge formation is being formed by ADA, which is generally characterized by a bullish reversal. Predictions state that the price for ADA in 2025 would range approximately from $0.81 to $1.93 with a possible high of $2.42, providing a rise of at least 1000%. With increased adoption and technological advancement, ADA may surpass meme coins like DOGE and SHIB in performance.

Conclusion: Where to Invest for Maximum Returns?

Although Dogecoin and Shiba Inu have built reputable, strong communities, their future growth capabilities are not on par with those of other assets with real-world applications. Of the top four cryptocurrencies singled out, Rexas Finance (RXS) is positioned as the most attractive opportunity. Investing in RXS means tokenizing real-world assets through blockchain technology, an investment thesis that has never been seen before—those who participated in its presale stand to benefit the most. With the scheduled exchange listing at $0.25 and the predicted price increase of $5, the time to act is now. Rexas Finance is undoubtedly the next best option for investors seeking alternatives to DOGE and SHIB. Participating in the presale will be the best choice before the price hikes to unprecedented numbers

.For more information about Rexas Finance (RXS) visit the links below:

Website: https://rexas.com

Win $1 Million Giveaway: https://bit.ly/Rexas1M

Whitepaper: https://rexas.com/rexas-whitepaper.pdf

Twitter/X: https://x.com/rexasfinance

Telegram: https://t.me/rexasfinance