The cryptocurrency market is experiencing a significant pullback, with exchange-traded products (ETPs) seeing their largest weekly outflows since February—totaling approximately $2 billion for the week ending November 15, 2025.

This marks the third consecutive week of net withdrawals, bringing cumulative outflows to $3.2 billion over the past three weeks. The trend reflects heightened investor caution amid macroeconomic uncertainties, including U.S. monetary policy ambiguity and heavy selling from large “whale” holders.

Total assets under management (AUM) in crypto ETPs have now declined 27% from their early-October peak of $264 billion, settling at around $191 billion. Uncertainty surrounding potential U.S. Federal Reserve rate decisions has prompted a broader “risk-off” shift, with investors favoring safer assets like bonds over volatile crypto exposure.

Large crypto holders have offloaded positions, exacerbating the downturn and contributing to price weakness across major assets. The U.S. dominated the exodus, accounting for 97% of outflows ($1.97 billion). Switzerland and Hong Kong followed with $39.9 million and $12.3 million in withdrawals, respectively, while German investors bucked the trend with $13.2 million in inflows.

Bitcoin and Ethereum bore the brunt of the redemptions, highlighting concentrated pressure on the market’s blue-chip tokens. Largest absolute hit; U.S. spot BTC ETFs saw $1.1 billion in outflows, the fourth-largest weekly withdrawal on record. BlackRock’s IBIT ETF alone recorded a one-day outflow of $463 million on November 14.

Proportionally steeper losses than BTC, amid broader ETH price declines of ~11% last week. Smaller redemptions despite a 15% price drop. Modest pullback in dedicated products. In contrast, diversified strategies showed resilience. Multi-asset ETPs attracted $69 million in inflows over the past three weeks, as investors sought broader exposure to mitigate single-asset risks.

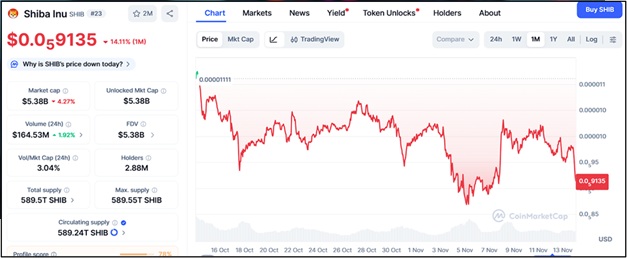

Short-Bitcoin products gained $18.1 million, indicating bearish hedging bets. This outflow streak coincides with sharp price corrections: Bitcoin dipped below $92,000 last week erasing some 2025 gains before rebounding to around $95,000, while Ethereum touched $3,000.

Analysts like CoinShares’ James Butterfill warn of potential sustained pressure if no positive catalysts emerge, such as clearer Fed signals or improved liquidity. However, some see this as a healthy correction after 2024’s $44.5 billion in record inflows.

On X, discussions echo this sentiment, with users debating if the bull run is over or merely pausing amid volatility. Longer-term, institutional interest persists—Harvard recently tripled its stake in BlackRock’s IBIT to 6.8 million shares—suggesting the outflows may be tactical rather than a full retreat.

Watch for upcoming U.S. economic data and crypto policy updates, including Japan’s plans to reclassify crypto as financial products with a 20% flat tax rate, which could influence global flows. If you’re holding ETPs, consider diversifying into multi-asset funds for now.

IBIT has rapidly become the largest and most successful product in its category, amassing over $72 billion in assets under management (AUM) by November 17, 2025. It tracks the CME CF Bitcoin Reference Rate – New York Variant benchmark, holding physical Bitcoin in cold storage via Coinbase Prime as custodian.

This structure simplifies access for traditional investors, bridging cryptocurrency with conventional finance. However, recent outflows amid Bitcoin’s price volatility highlight short-term pressures, even as long-term institutional adoption signals strength.

IBIT operates as a grantor trust, issuing shares that represent fractional ownership of Bitcoin. Authorized participants (APs) create or redeem shares in-kind by exchanging Bitcoin baskets currently 22.69 BTC per basket, valued at ~$2.08 million. This minimizes cash drag and enhances tracking efficiency.

Down from ~$99.4B peak in early October due to sustained outflows; still dwarfs peers. High liquidity with 30-day avg. volume of 62.55 million shares. Fell 2.57% on Nov 17 to ~$52.10, mirroring Bitcoin’s dip below $92,000.

Trades at -0.70% premium/discount, indicating slight undervaluation. Competitive; generates ~$245 million in annual fees for BlackRock, making IBIT its most profitable ETF.

IBIT’s low fees and seamless integration into brokerage accounts (e.g., IRAs, 401(k)s) have driven its dominance, capturing ~50% of total U.S. spot Bitcoin ETF inflows since launch.Performance OverviewIBIT’s returns closely track Bitcoin, with minimal tracking error (~0.3% lag since inception).

As a young fund, it lacks long-term history, but its performance has outpaced traditional assets like the S&P 500 YTD +22.5% vs. IBIT’s +22.53% and gold. A $10,000 investment at launch would now be worth ~$19,870, nearly doubling the Nasdaq 100’s gains.

Underperforms 2024’s +150% peak but resilient amid macro headwinds. Rebound from October’s -15.51% drawdown. Volatility annualized at ~38% down from 45% earlier in 2025. Captures Bitcoin’s mid-year surge to $112,000.

Outshines equities; cumulative since inception: +160.52%. Bitcoin’s correlation to equities has hovered near zero during stress events (e.g., +30% during 2023 SVB crisis), positioning IBIT as a diversifier rather than a “risk-on” tech play. However, recent equity-like dips (e.g., -10% YTD for BTC) have tested this narrative.

These outflows reflect profit-taking post-Bitcoin’s 2025 highs ~$120,000 equivalent for IBIT entry and rotation to bonds/equities. Analysts view it as a “healthy correction” rather than capitulation, with 71% of BTC supply still in profit and hedge fund exposure at 55%.

Fidelity’s self-custody option; similar performance but lower inflows. High fees deter inflows; legacy Grayscale product with $25B redemptions since 2024. Cheaper fees; smaller scale limits liquidity. IBIT outperforms on inflows and AUM growth, with $37.48 billion cumulative vs. FBTC’s $12.17 billion.

Grayscale’s outflows highlight fee sensitivity. Bitcoin’s 38% annualized volatility could amplify losses; recent equity correlations (~0.4) question its hedge status. Custody risks Coinbase hack potential, fork resolution sponsors vote the “valid” chain, and tax treatment capital gains on sales.

ETFs now hold 6.3% of BTC supply, raising centralization concerns—e.g., on-chain volume down 15% as holdings migrate to vaults. Fed ambiguity, potential rate hikes, and U.S. shutdown risks could prolong outflows.

No distributions; redemptions may trigger gains. In-kind transfers enable tax deferral but tie investors to ETF structure. BlackRock emphasizes: Past performance isn’t indicative; shares may trade at premiums/discounts.

Harvard’s Bet: Q3 filings show a tripling to $443 million in IBIT—now Harvard’s largest U.S. equity position, surpassing Microsoft/Amazon. Signals “FOMO” from endowments. Record $463 million redemption on Nov 14 amid BTC’s sub-$92,000 dip; X users call it “capitulation” or “rotation” to safer assets. Broader ETFs saw $867 million exodus that day.

Mixed—bearish on short-term pain “tail wagging the dog” via shorts, bullish on long-term “buying opportunity” post-flush. Threads highlight IBIT’s profitability for BlackRock and institutional stacking (e.g., Metaplanet +$600M BTC).

CME gap filled at $91-92K; Fear & Greed at 21 extreme fear. Stablecoin volumes $2.82T in Oct suggest dry powder. Bitcoin integration, with BlackRock’s Robbie Mitchnick noting low correlations as key to allocation aiming 2-5% portfolios. Short-term: Outflows may persist if BTC tests $80,000 support, but Fed cuts 70% odds Dec and QT end could spark relief.

Projections eye $170,000 BTC by 2026, pushing IBIT AUM to $100B+ via $60B annual flows. Hybrid strategies 50% self-custody, 50% ETF balance sovereignty and liquidity. For investors: IBIT suits diversified portfolios seeking BTC exposure; monitor correlation and custody risks. The bull engine is ON—but patience rewards the conviction holders.