Cardano’s (ADA) recent inclusion in the US Security Reserve sparked optimism among investors, hinting at a potential breakout for the crypto. However, despite the hype, Cardano still struggles to maintain an upward trend.

Meanwhile, a rising crypto, RCO Finance (RCOF), is making headlines with a promise to deliver 1000x ROI in 15 days. With advanced AI and blockchain technology, this crypto is attracting more investors to its presale, overshadowing Cardano.

Cardano (ADA) Price Movement: Bull Run or Short-Term Rally?

Cardano (ADA) has shown signs of a bull run, after gaining 1.5% in the past 24 hours to trade at $0.7692 at press time. This marks its fourth consecutive bullish candle, which has built optimism among investors.

On the daily chart, Cardano trends indicate a bullish reversal after crossing above the 200-day EMA line. This could push the crypto towards the $0.9216 mark, which aligns with the 78.60% Fibonacci level.

Despite the bullish momentum, Cardano faces challenges in maintaining long-term price stability. Compared to competitors like Ethereum and Solana, Cardano’s ecosystem growth has been slow, making it hard for sustained price movements.

Investors looking for innovation, utility, and high growth potential are now shifting focus to emerging crypto like RCOF. This crypto provides cutting-edge technology that will transform how we trade in the crypto market.

RCO Finance: The Crypto Benefitting from Cardano’s Struggles

As Cardano continues to battle price stability, investors are turning to an emerging crypto that offers utility and high growth potential. RCO Finance incorporates AI and blockchain technology to transform trading and investing in crypto.

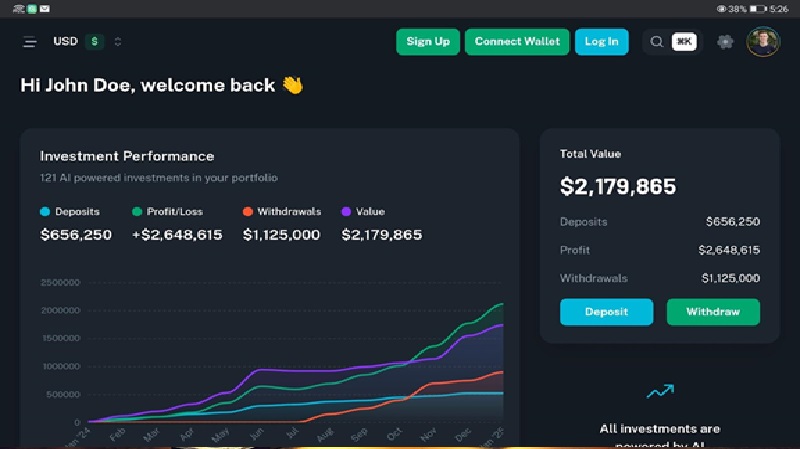

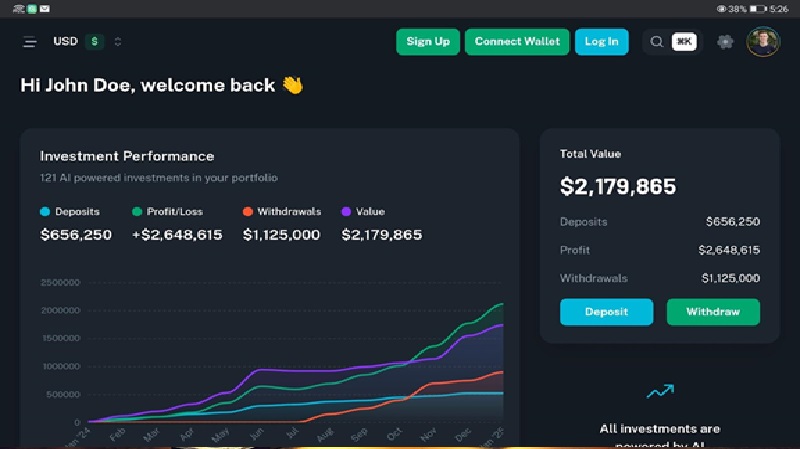

The platform incorporates AI and machine learning to create solutions for investors without prior knowledge of the crypto market or trading parameters. RCOF allows users to access professional-grade investment strategies, thus removing the need for middlemen.

At the heart of RCO Finance is its AI-powered Robo-advisor that customizes investment strategies tailored to a user’s financial goals, risk tolerance and market preferences. This makes the crypto ideal for investors of all experience levels.

The Robo-advisor can analyze vast market data, and based on the insights, the tool can monitor and adjust your investment portfolio in real-time.

Again, the Robo-advisor can monitor market trends and conditions to provide investors with personalization that was previously unavailable to retail investors. Through its AI predictive analytics, the Robo-advisor identifies high-growth assets before major price upswings or downswings.

For instance, the recent LIBRA token collapse, when it plummeted from $4 to almost zero in a single day, wiped out over $4.4 billion in investors’ funds. If investors had access to a tool like the RCOF Robo-advisor, they could have had a chance to exit the position before the disaster unfolded.

Unlike Cardano, RCOF expands its offering to more than 120,000 tradable assets, including stocks, bonds, crypto, FX, and tokenized real-world assets like real estate and commodities. This diversification enables investors to spread their risks while maximizing their returns.

RCOF offers investors a leverage option of up to 1000x on select assets, allowing traders to maximize profits with minimal stakes. This feature is rare, making RCOF a game changer in the volatile crypto market.

Investors who prefer privacy and anonymity will find the RCO Finance platform ideal due to its KYC-free ecosystem. Unlike legacy platforms with cumbersome onboarding processes, RCOF guarantees instant access to its DeFi products while maintaining high-security standards.

RCOF has undergone rigorous audits by SolidProof, which confirms robust asset safety, as its smart contracts are free from vulnerabilities. This offers investors a safe and secure trading environment that boosts investor confidence.

Are you ready to experience the Robo-advisor firsthand? RCOF recently launched its AI Beta platform, which is a rare occurrence as many crypto projects wait until the official token launch. Over 10,000 active users are on board, showing growing confidence in the crypto.

Investors can expect more enhancements in the alpha phase, which is currently under internal development. Try it out here.

RCOF Presale Shines with Potential 1000x ROI in 15 Days

Cardano’s slowed price growth has left many investors shifting focus to an emerging altcoin, whose presale is a hot topic in the crypto market.

The RCOF presale is in stage 5, with tokens available at just $0.10. The next stage kicks off with token price at $0.13. The token has had a successful presale, with stage 1 investors boasting over 500% ROI, since the prices continue to rise with every stage.

If you invest now, you can still reap big with RCOF, as analysts predict that the crypto’s listing price will be between $0.4 and $0.6. Analysts also predict that the crypto will surge by 1000x in 15 days, outperforming Cardano’s price movements.

The presale is heating up as over 51% of the allocated tokens in stage 5 are sold out. Investors can also maximize their gain with the ongoing bonus discount of up to 40% using the code WELCOME40.

For more information about the RCO Finance (RCOF) Presale:

Visit RCO Finance Presale

Join The RCO Finance Community

Like this:

Like Loading...