Under an erratic crypto market, Cardano (ADA) has dropped 27% of its value in the past week. At $0.72 right now, ADA is trying to rebound somewhat and shows a 5.33% rise following five straight losing days. As of writing, ADA bounced back slightly after retesting a critical support level at $0.64, a crucial zone that has historically acted as a reversal point. Technical indicators, however, show continuous bearish momentum even with this little comeback. ADA is still declining as seen by the Relative Strength Index (RSI), which at 44 is below the neutral level of 50. The RSI has to break above 50 if Cardano is to maintain a positive rebound; this would give an urgently needed boost for an increasing trend.

Source: TradingView

On-Chain Metrics Suggest a Possible Recovery for ADA

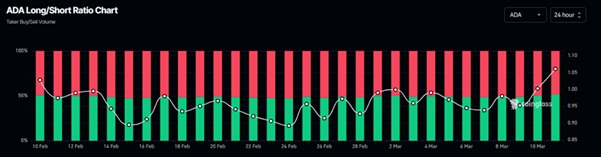

Notwithstanding its challenges, some on-chain indicators point to a probable revival. With a long-to-short ratio of 1.06, ADA marks its highest level in more than a month, according to Coinglass data. A ratio higher than 1.0 indicates that, in spite of recent dips, more traders are betting on a price rise, hence showing a positive attitude.

ADA long-to-short ratio chart. Source: Coinglass

Coinglass’s OI-Weighted Funding Rate also indicates fewer traders expect ADA’s price to keep decreasing, thus strengthening this perspective. Currently standing at 0.0007%, this statistic—based on futures contract yields weighted by Open Interest (OI) rates—showcases a positive number indicating a bullish future. Long traders are paying short traders, so a positive funding rate often indicates fresh confidence in the asset.

Cardano OI-Weighted Funding Rate chart. Source: Coinglass

ADA’s hopeful case is still delicate, though. Should the price fall short of $0.64 and show a daily closing below $0.57, a more severe downturn may be set in motion, guiding ADA toward $0.50 support. Although ADA’s short-term technical view is still unknown, investors are looking elsewhere—especially toward Rexas Finance (RXS), a new high-growth asset outperforming the larger market.

Rexas Finance (RXS) Outshines ADA with a 14,700% Rally Projection

While Cardano struggles, another cryptocurrency is capturing the spotlight—Rexas Finance (RXS). Leading the Real-World Asset (RWA) tokenizing movement, RXS has been fast acquiring popularity as investors swarm the project ahead of its much-awaited release. The RWA tokenization sector is projected to reach $30 trillion, and Rexas Finance is leading this transformation. RXS is closing the distance between conventional banking and blockchain technologies by letting consumers tokenize and exchange real estate, commodities, and other valuable assets.

In this area, RXS is revolutionary since it allows one to fractionalize ownership and improve liquidity. The market’s response has been overwhelmingly positive, producing explosive presale performance. With RXS exploding 567% from its initial presale price of $0.03 to its current price of $0.20, Stage 12—the last presale stage—is 91.28% sold out. One of the most successful crypto presales of 2025, with 56,388,392 RXS tokens sold, has raised $47,278,136.

RXS Rejects VC Funding, Ensuring Sustainable Growth

RXS’s dedication to natural market expansion is one of the main factors inspiring trust among investors. Rexas Finance has deliberately eschewed venture capital (VC) financing, unlike many crypto companies, depending on them, which usually results in significant post-launch sell-offs. This ensures a community-driven ecosystem, preventing sudden price crashes caused by early investors dumping their holdings. Consequently, real demand drives RXS’s expansion instead of speculation, which makes it more steady and sustainable than other newly developed altcoins. This strategy has reassured investors that RXS will continue increasing even following its official exchange listing.

June 19 Exchange Debut: The Catalyst for RXS’s 14,700% Surge

The biggest upcoming catalyst for RXS’s explosive growth is its official exchange launch on June 19. The project verified that it would be listed on at least three top-tier worldwide exchanges, greatly enhancing its liquidity, availability, and market presence. Analysts project a significant post-launch surge in RXS based on an initial listing price of $0.25. Given an incredible 14,700% increase, many early investors think RXS might fly as high as $29.40. The increased institutional interest and the growing need for actual asset tokenizing solutions drive this expectation. Many investors are paying attention to Rexas Finance (RXS) as the next major crypto prospect while ADA is still trying to pick up momentum. Should analyst forecasts come true, RXS may become one of the most popular altcoins in 2025, surpassing Cardano in performance.

For more information about Rexas Finance (RXS) visit the links below:

Website: https://rexas.com

Win $1 Million Giveaway: https://bit.ly/Rexas1M

Whitepaper: https://rexas.com/rexas-whitepaper.pdf

Twitter/X: https://x.com/rexasfinance

Telegram: https://t.me/rexasfinance