Currently, the cryptocurrency market feels like it’s stuck in a sluggish limbo. Prices wobble, trading volumes stutter and investors are left wondering how to get value out of their digital assets in a more unpredictable crypto world. But amidst all this uncertainty, a quiet revolution is happening. European and American institutions like banks, hedge funds, and even pension schemes are doubling down on staking crypto, a strategy that’s proving to be low-risk, high-return. Why? Because crypto staking rewards offer a steady stream of passive income, turning idle assets into profit machines without the rollercoaster of active trading. Crypto staking platforms like UNITED STAKING are leading the charge and catching the attention of institutional players and everyday investors alike. Let’s dive into why staking crypto is the preferred move and how UNITED STAKING is driving this trend.

Maximize Your Earnings with UNITED STAKING

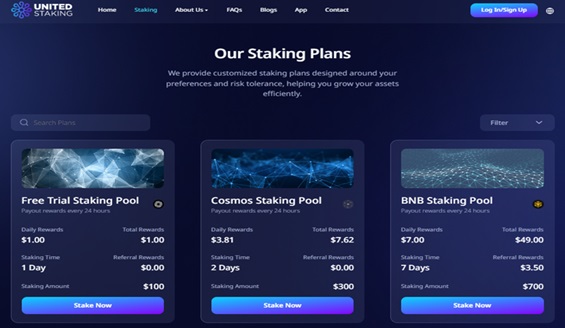

The figures below show the power of crypto staking rewards—daily payouts that compound over time plus referral bonuses that add to your initial amount. A $100 trial earns you a dollar a day, and a $200,000 Polkadot stake can earn you over $800,000. Add the 5% referral commission and you have a system that rewards both participation and promotion.

| Staking Plan | Investment | Duration | Daily Earnings | Referral Rewards | Total Earnings |

| Stake Free Trial | $100 | 1 day | $1.00 | $0.00 | $1.00 |

| Stake Cosmos | $300 | 2 days | $3.81 | $0.00 | $7.62 |

| Stake BNB | $700 | 7 days | $7.00 | $3.50 | $49.00 |

| Stake Sui | $2,000 | 10 days | $24.00 | $14.00 | $240.00 |

| Stake Ethereum | $100,000 | 58 days | $2,700.00 | $2,500.00 | $156,600.00 |

| Stake Polkadot | $200,000 | 120 days | $6,740.00 | $8,000.00 | $808,800.00 |

Download the app (available on iOS and Android) and start growing your wealth today.

UNITED STAKING: Simplifying Wealth Generation

Imagine a platform that takes the complexity out of crypto investing and gives you a simple, secure way to grow your assets. That’s UNITED STAKING in a nutshell. Launched in 2021, this global staking platform now has over 300,000 active users, supports 176+ assets, and has paid out over $40 million in rewards. It’s professionally designed for everyone—from beginners into staking crypto to institutions managing multi-million dollar portfolios.

UNITED STAKING has a seamless sign-up process, daily profit payouts, and top-tier security all wrapped in a user-friendly interface. Whether you’re in London, New York, or one of the 125+ countries it serves, this platform promises a hassle-free way to earn crypto staking rewards. So, what makes it stand out among the best crypto staking platforms? Let’s break it down.

UNITED STAKING’s Standout Features: Security, Flexibility and Lucrative Perks

These are the features that have institutions across Europe and America flocking to UNITED STAKING. In a world where volatility reigns, the platform’s combination of reliability and rewards is a beacon for those who want stability without sacrificing growth. Here’s what makes it stand out:

Easy Start: All you need is just an email, username, password, and a referral code if you have one. Within minutes you’re staking and earning. No complicated steps, no tech wizardry required.

Quick Staking: With one click on “Stake Now” UNITED STAKING does the work for you. Perfect for those who want to get into staking crypto without getting bogged down in blockchain jargon or node management.

Generous Incentives: New users get a $100 sign-up bonus, the affiliate program gives a 5% commission on every referral order, and the Million Bounty Plan rewards community builders with bonuses from $1 to $1,000 for promoting the platform on social media.

Daily Profit Claims: Unlike platforms that make you wait weeks or months; UNITED STAKING pays out crypto staking rewards every 24 hours. Your earnings are deposited into your account and you can withdraw or re-invest.

Security: The platform uses TLS encryption and 2FA to lock down your funds and data so that only you have access.

Flexible Investment Options: From Bitcoin to Dogecoin, UNITED STAKING supports a wide range of assets. You can comfortably tailor your staking portfolio to your risk tolerance—whether you’re going for the $100 trial or a $300,000 Uniswap stake.

Why Institutions Are Staking More

The 2025 crypto market is sluggish and institutions are rethinking their approach. Trading is a gamble when prices stagnate, holding assets without action feels like watching paint dry. But staking crypto gives them a way to put those idle coins to work. For institutions, it’s about securing consistent returns and supporting blockchain networks they believe in. UNITED STAKING intensifies this with low entry points and high reward potential, making it one of the best crypto staking platforms for corporate giants and individual enthusiasts.

But it’s not just about the money. Staking is part of a broader shift towards sustainable crypto practices. Unlike energy-hungry mining, staking crypto is eco-friendly as it uses locked assets rather than computational power. This resonates with European regulators pushing green finance and American firms eyeing ESG (Environmental, Social, Governance) credentials. UNITED STAKING’s transparent and secure setup only makes crypto staking sweeter, offering a platform that institutions trust and retail investors can easily use.

Conclusion

In a crypto market that’s dragging its feet, staking crypto is the smart play—offering low risk, high return, and the ability to thrive while others wait. European and American institutions see the writing on the wall: staking isn’t just a trend; it’s the modern crypto investing. So why wait? Stake today and turn the market’s sluggishness into your golden opportunity.