Baidu took a significant step toward AI self-reliance in China on Thursday, unveiling two new semiconductors and two supernode products designed to provide domestic companies with powerful, cost-effective computing resources.

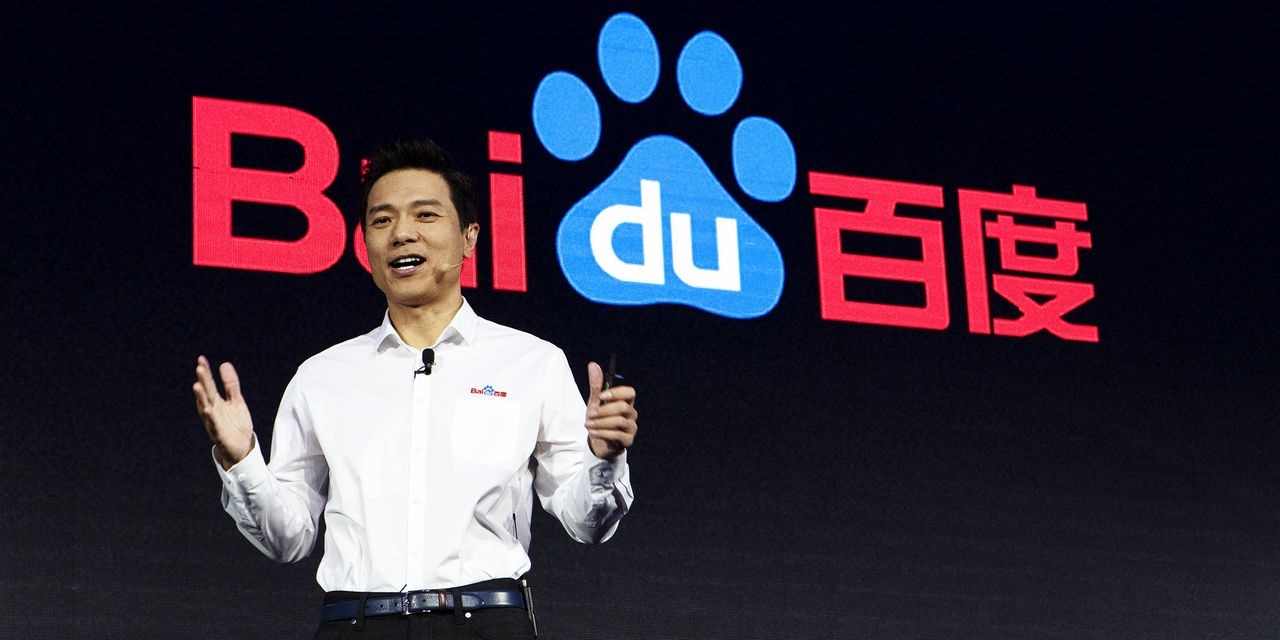

The announcement, made at the company’s annual Baidu World technology conference, underscores Beijing’s broader push to reduce dependence on U.S. AI technology amid escalating geopolitical tensions.

The newly announced chips, the M100 and M300, are aimed at addressing distinct AI workloads. The M100, optimized for inference tasks—where trained models are used to process user queries and make predictions—is set for launch in early 2026. The M300, capable of both training large AI models and performing inference, will be released in early 2027.

Training is a computationally intensive process that teaches AI models to recognize patterns in vast datasets, while inference applies these models to real-world tasks such as language understanding, image recognition, or predictive analytics.

To further enhance performance, Baidu revealed two supernode products, which link multiple chips through advanced networking, compensating for the limitations of single-chip performance. The Tianchi 256, which integrates 256 P800 chips, is expected to become available in the first half of next year, while a larger 512-chip version will launch in the second half of 2026. Supernodes, in essence, allow for scalable, high-throughput AI processing, enabling faster training and inference across complex models.

Baidu’s supernode strategy mirrors similar developments from other Chinese technology giants. Huawei, for example, deployed the CloudMatrix 384, which comprises 384 Ascend 910C chips. Analysts note that this system outperforms Nvidia’s GB200 NVL72, one of the U.S. company’s most advanced system-level AI products. Huawei has also announced plans to release more powerful supernodes in the coming years, reflecting a growing trend among Chinese firms to build domestic alternatives to U.S.-based AI hardware.

Beyond hardware, Baidu also introduced a new iteration of its Ernie large language model, capable not only of text processing but also image and video analysis, signaling the company’s ambition to compete with leading AI platforms on multiple fronts. This advancement highlights a growing emphasis on multimodal AI capabilities, where a single model can understand and generate insights across text, visual, and audiovisual data.

Baidu has been developing proprietary chips since 2011, but the recent announcements underline an accelerated push toward domestic AI independence, particularly as U.S. restrictions on exporting advanced AI chips to Chinese firms continue. These restrictions, part of a broader strategy to maintain technological leverage, have pushed companies like Baidu to innovate internally or rely on domestic alternatives to maintain their competitive edge in AI research and deployment.

The unveiling of the M100, M300, and Tianchi supernodes represents a critical step in China’s AI infrastructure development, providing companies with powerful, low-cost, and locally controlled computing power. Baidu is believed to be positioning itself to strengthen China’s autonomy in AI technology while challenging the dominance of U.S. firms such as Nvidia in the global AI chip market by combining advanced chip design with networked supernodes and sophisticated AI models like Ernie.