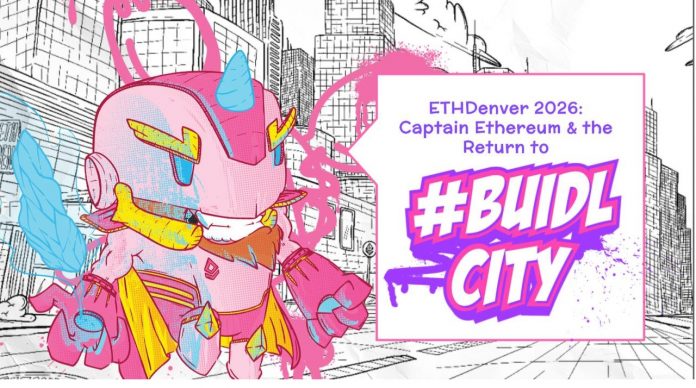

John Paller, the Founder and Executive Steward of ETHDenver, has indeed announced the theme for the 2026 festival as “Captain Ethereum & The Return to #BuidlCity.” This was revealed following the conclusion of ETHDenver 2025, with the announcement generating excitement for the upcoming event.

ETHDenver, known as the world’s largest Web3 and Ethereum-based festival, continues to evolve under Paller’s leadership, and this theme suggests a focus on celebrating Ethereum’s role in the blockchain community while emphasizing the collaborative, innovative spirit of “BuidlCity”—a nod to the event’s hackathon roots and its community-driven ethos.

The origins of #BUIDL trace back to the cryptocurrency and blockchain community, particularly within the Ethereum ecosystem, as a playful yet purposeful riff on the term “HODL.” To understand #BUIDL, it’s worth starting with its predecessor. “HODL” emerged in 2013 from a typo-ridden Bitcoin Forum post by a user named GameKyuubi, who drunkenly declared they were “HODLING” their Bitcoin despite a price crash, meaning “hold on for dear life.” It became a meme and a mantra for crypto enthusiasts advocating long-term holding over selling during market volatility.

By 2017-2018, as the crypto space matured beyond Bitcoin’s dominance and Ethereum’s smart contract capabilities gained traction, a new sentiment arose. The speculative frenzy of the 2017 ICO (Initial Coin Offering) boom had left many disillusioned with hype-driven projects that promised much but delivered little. Enter #BUIDL—a deliberate misspelling of “build”—which flipped the script from passive holding to active creation. It’s widely credited to the Ethereum community, where developers were increasingly focused on writing code, deploying dApps (decentralized applications), and expanding the blockchain’s utility.

The exact moment of #BUIDL’s birth is fuzzy, as it evolved organically through memes and social media, but it gained significant traction around 2018. One early catalyst was Vitalik Buterin, Ethereum’s co-founder, who tweeted in March 2018 about moving “beyond the hodling phase” to focus on building infrastructure—a sentiment echoed by others like Brian Armstrong of Coinbase, who later that year emphasized “building” over speculating. The hashtag #BUIDL soon took off on Twitter (now X), with influencers, developers, and projects like ConsenSys and Gitcoin amplifying it.

The term also carried a satirical edge, poking fun at HODL’s simplicity while asserting a more proactive ethos: don’t just sit on your coins, do something with them. It aligned with Ethereum’s identity as a platform for builders—think smart contracts, DeFi, and NFTs—versus Bitcoin’s store-of-value narrative. By 2019, #BUIDL had cemented itself as a rallying cry, especially at events like ETHDenver, where the focus on hackathons and real-world projects gave it physical form.

The concept of #BuidlCity, as tied to ETHDenver and the newly announced 2026 festival theme “Captain Ethereum & The Return to #BuidlCity,” is a playful and symbolic evolution of the Ethereum community’s ethos. It builds on the term “#BUIDL,” a meme-inspired misspelling of “build” that emerged within the crypto and blockchain space around 2018.

#BUIDL represents a call to action for developers, creators, and innovators to focus on constructing real, functional solutions—particularly on Ethereum—rather than just speculating or “hodling” (holding) cryptocurrencies.

#BuidlCity extends this idea into a metaphorical “city” or ecosystem where this building happens collaboratively.

It encapsulates the spirit of ETHDenver, which is not just a conference but a hub for hackers, builders, and Web3 enthusiasts to come together, create decentralized applications (dApps), and push blockchain technology forward. The hashathon (a hybrid hackathon) at ETHDenver is a key feature, where participants “buidl” projects over the event’s duration, often resulting in innovative prototypes or even viable startups.

The “Return to #BuidlCity” in the 2026 theme suggests a narrative of revisiting or reinforcing this creative, community-driven space, possibly with a superhero twist via “Captain Ethereum,” symbolizing Ethereum as a guiding force or protector of this builder-centric world. It’s a celebration of practical innovation, resilience, and the collective effort to advance the Ethereum ecosystem—think of it as a digital metropolis where every participant is an architect.