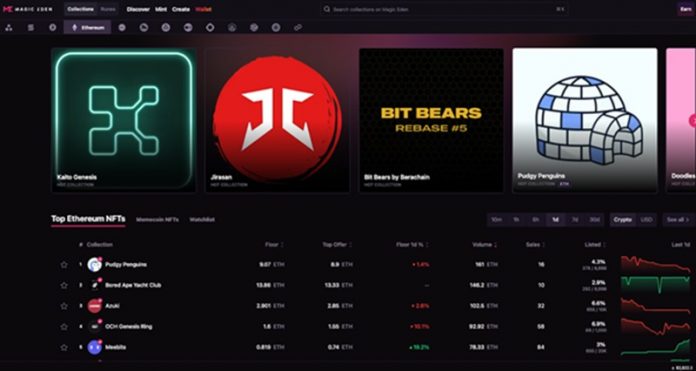

Magic Eden is a market-leading, multi-chain NFT marketplace for creating, minting, collecting, and trading unique digital assets across various blockchains. The NFT platform stands out for its broad range of features targeting both creators and collectors, as well as the long list of supported blockchains.

Read on to learn what Magic Eden is, how it works, what features it offers, and how it compares against other NFT marketplaces.

What Is Magic Eden?

Founded in 2021, San Francisco-based Magic Eden is an NFT trading ecosystem that allows users to buy, mint, sell, and trade NFTs across several blockchains, such as Ethereum, Polygon, and Solana.

Although initially launched to support NFT trading on the Solana network, Magic Eden expanded to accommodate numerous blockchains, giving users the flexibility to create and trade digital assets across multiple blockchains.

Magic Eden has a low-fee structure and a user-friendly interface that makes it easy for users to trade tokens.

Besides the low-fee structure, the platform features a suite of tools for creators and collectors. Some of the tools include analytics and trading tools, a creator’s dashboard, a cross-chain marketplace, a launchpad, a Mint Terminal, and a Web3 wallet.

As the leading NFT marketplace on Solana, Magic Eden has a 0% NFT listing fee, making it attractive to creators.

How Does Magic Eden Work?

As a non-custodial platform, you don’t need to sign up for an account to trade NFTs on Magic Eden. To use the platform, visit the Magic Eden website and connect your crypto wallet.

Besides its own Web3 wallet, Magic Eden also supports several other wallets, including Bitget Wallet, Coinbase, Exodus, MetaMask, Trust Wallet, and WalletConnect, among others.

Once your wallet has been successfully connected, you can browse through the various fungible tokens and NFT collections available on the platform. Moreover, you can also improve your search by applying different filters to get the most relevant results.

When you find an NFT you’d like to purchase, either place a bid or buy it immediately if the listing allows. The platform accepts several digital currencies, such as BNB, BTC, ETH, SOL, and more.

Alternatively, if you want to sell NFTs, simply list them on Magic Eden and either list them for auction or set a price. The platform has a launchpad that enables creators to mint and launch their projects.

Now that we know how Magic Eden works, let’s take a look at some of its key features.

Magic Eden’s Key Features

Below are some key features of the Magic Eden platform:

Mint Terminal

Magic Eden’s mint terminal allows users to discover and mint new fungible and non-fungible tokens. As a live aggregator, the mint terminal collects real-time live mints from various blockchain networks supported by Magic Eden, providing users with a huge pool of assets.

Launchpad

Magic Eden’s launchpad is designed to help creators mint and launch their NFT projects. However, creators looking to launch their projects using Magic Eden’s launchpad platform have to undergo a meticulous application, screening, and approval process to ensure project quality and safety.

Creator Dashboard

Magic Eden’s creator dashboard is the go-to platform for creators looking to list and manage their NFT collections. Creators can sign in/sign up to the creator dashboard, create a new collection, select the blockchain they want to mint their collection on and follow the prompts to list it.

Cross-Chain Marketplace

Magic Eden is not just another NFT marketplace. It’s a cross-chain marketplace that enables users to buy, sell, swap, and trade assets across multiple blockchain networks under one platform. The cross-chain functionality allows users access to a wider pool of tokens and buyers without the need to switch between several marketplaces on single chains.

Analytics and Trading Tools

The platform offers a suite of tools and resources for creators and collectors, including an analytics dashboard to help them track various trading activities, trends, and asset prices. This way, users get insights on top-performing and trending NFT collections.

Magic Eden Wallet

Magic Eden has its own Web3 wallet that allows users to send, receive, and swap digital assets. Additionally, users can manage several digital assets and connect to numerous dApps across multiple blockchains.

Magic Eden’s Supported Blockchains

Magic Eden supports several blockchains. As a multi-chain platform, it enables users to seamlessly trade and manage their digital collectibles across these different networks.

Below is a list of the blockchain networks that Magic Eden supports:

- Abstract

- ApeChain

- Arbitrum

- Base

- Berachain

- Bitcoin Ordinals

- BNB Chain

- Ethereum

- Polygon

- Sei

- Solana

Magic Eden’s multi-chain support sets it apart as a leading NFT ecosystem. By supporting several blockchains, users have access to NFT collections across various blockchain ecosystems, which gives them more trading opportunities. Magic Eden users can also enjoy lower fees and faster transactions, as different protocols have varying cost structures.

Moreover, the multi-chain support functionality offers creators a broader reach as they can launch their non-fungible tokens on their preferred chain.

Magic Eden Rewards Program and the $ME Token

Magic Eden’s reward program is built for everyone; from traders to collectors and creators. Users can earn rewards paid out in $ME.

There are two ways users can earn rewards on Magic Eden: by completing tasks and staking $ME tokens.

Users can complete different quests on Magic Eden to earn rewards in $ME tokens. Completing tasks also allows users to improve their staking power on the platform.

Besides completing tasks, users can stake their $ME tokens to increase their rewards. $ME holders can stake their tokens by locking them up for a specific period. To stake your $ME tokens, simply connect your wallet, click on the ‘Earn’ tab, key in the amount you want to stake, add a lock period, and confirm the stake.

User Experience

Magic Eden is a platform that was built with the end user in mind. The platform is user-centric, intuitive, and easy to navigate. This makes it ideal for creators and collectors of all levels. The inclusion of a Web3 wallet also makes cross-chain trading fast and seamless.

Security

Magic Eden takes user security seriously. The platform uses multi-signature security for its Web3 wallet, which offers increased security against cyberattacks. Since its launch, there has been no major security breach that has been reported.

Moreover, all smart contracts used on the Magic Eden platform undergo regular audits by reputable third-party firms, and it integrates with trusted wallets such as Ledger, MetaMask, and Phantom.

Pros and Cons of Magic Eden

Now, let’s take a look at Magic Eden’s pros and cons.

Pros

- A comprehensive suite of tools for creators and collectors

- Low fee structure

- Offers multi-chain support

- 0% listing fee for NFTs

Cons

- The mobile wallet doesn’t support all chains available on the marketplace

Magic Eden vs. OpenSea vs. Blur vs. Rarible: A Comparison

Below is a table highlighting how Magic Eden compares to other NFT marketplaces available in the market.

| Feature | Magic Eden | OpenSea | Blur | Rarible |

| User interface | Beginner-friendly | User-friendly | Advanced | User-friendly |

| Listing fees | 0% | 2.5% | 0.5% | 2% |

| Transaction fees | 2% | 2.5% | 0% | 0.5% – 7.5% |

| Multi-chain functionality | Yes | Yes | No | Yes |

| Launch year | 2021 | 2017 | 2022 | 2020 |

Final Verdict: Is Magic Eden Worth Using?

Magic Eden is a great platform for anyone looking to create, mint, collect, or trade non-fungible tokens across multiple blockchains.

The platform is suitable for NFT traders looking for a platform with low fees, a smooth user experience, and plenty of collections to choose from. For creators, Magic Eden offers a suite of tools to make it easier to get NFTs out into the world and on its marketplace.