Meta-backed artificial intelligence training firm Scale AI is suing the U.S. Department of Defense in a case that could involve classified information, according to court filings.

The complaint, filed on January 30 in the U.S. Court of Federal Claims, is largely under seal. One of the few publicly available documents indicates that materials in the case are expected to include information classified at the “secret/no foreign” level. The United States is the only named defendant.

Another AI company, Enabled Intelligence, has joined the case as an intervenor defendant, a third party that voluntarily enters litigation to protect its interests.

Scale declined to comment directly on the litigation, saying only that it “relates to a recent procurement decision.”

“Scale AI stands firmly with Secretary Hegseth and the Department of War in their mission to get frontier AI capabilities into the hands of warfighters. We are committed to ensuring the procurement process reflects the high standards required for our nation’s most critical AI initiatives,” a spokesperson said.

Attorneys for Enabled Intelligence and the Defense Department did not respond to requests for comment.

Disputed $708 Million Contract

The lawsuit follows Scale’s unsuccessful bid for a contract worth up to $708 million from the National Geospatial-Intelligence Agency, a DoD component. The contract, awarded to Enabled Intelligence, could span up to seven years and represents the agency’s largest data-training agreement to date.

The award includes work supporting Maven, the Pentagon’s flagship AI initiative aimed at improving analysis of imagery and geospatial intelligence.

Scale filed a bid protest with the Government Accountability Office in late December, challenging the procurement decision. The GAO dismissed the protest in late January, two days before Scale filed its lawsuit in federal court. The GAO typically does not publish detailed information about routine dismissals.

In 2024, Scale had secured a separate $24 million, one-year contract from the same agency for data labeling services tied to Maven. The loss of the larger follow-on contract appears to have triggered the dispute.

Because most filings remain sealed, it is unclear whether Scale is seeking to overturn the contract award, obtain monetary damages, or compel a new procurement review.

Scale’s Expanding Defense Footprint

Scale has signed multiple multimillion-dollar agreements with the Defense Department since 2020, positioning itself as a key supplier of AI training data and related services.

In March, the company announced a collaboration with defense technology firm Anduril Industries and Microsoft to deploy AI agents within the U.S. military under a DoD initiative known as “Thunderforge.” In August, Scale disclosed a $99 million Army contract to develop AI tools.

The company built its reputation through data labeling services that train large language models and computer vision systems, supporting technology firms such as Google and Meta Platforms.

In June, Meta invested $14.3 billion in Scale in exchange for a 49% stake, marking one of the largest single investments in an AI infrastructure provider.

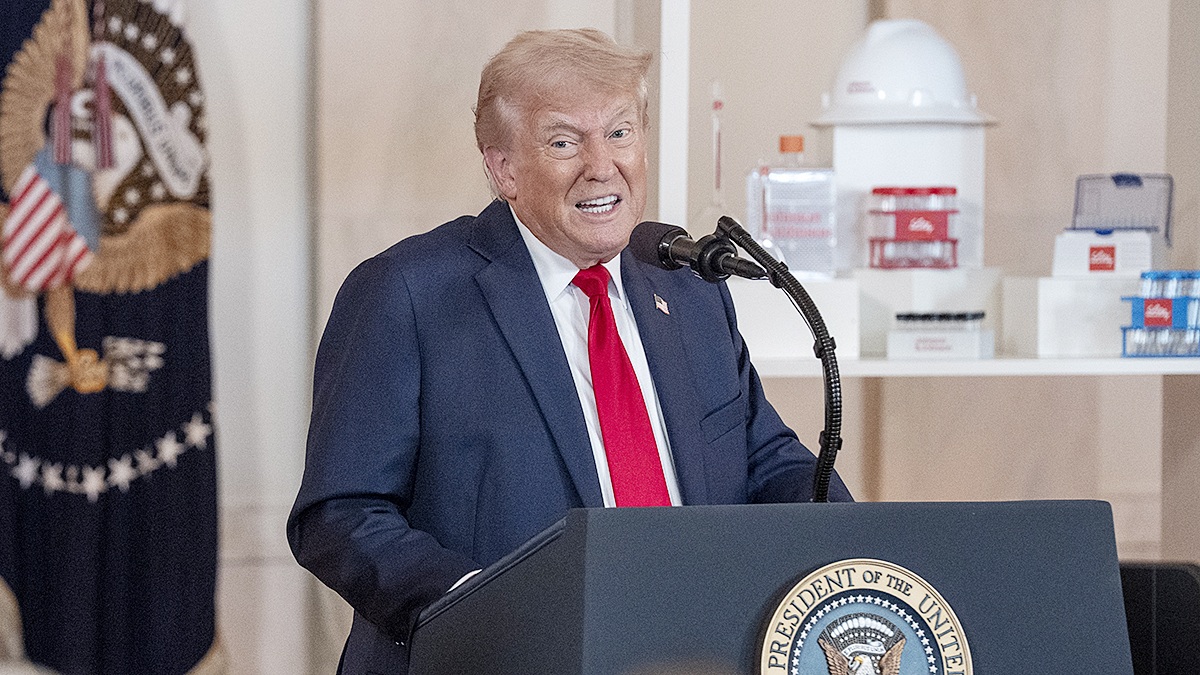

Scale’s former chief executive, Alexandr Wang, wrote an open letter to President Donald Trump after his second inauguration outlining policy recommendations to accelerate U.S. AI development. In the letter, Wang urged greater federal spending on data and computing infrastructure and highlighted Scale’s defense work.

Wang later left Scale to join Meta’s Superintelligence Labs as chief AI officer and attended the president’s AI-focused dinner at the White House in September.

The lawsuit places Scale in a delicate position. The company is both a contractor seeking expanded defense work and a litigant challenging a procurement decision tied to a highly sensitive national security program.

The dispute comes at a time of transition for Scale. Since Meta’s investment, the company has laid off approximately 200 employees, or about 14% of its workforce. It has also lost major clients, including Google and xAI, while facing intensified competition from newer AI data providers seeking to capture market share.

The outcome of the case could carry implications beyond the companies directly involved. Defense-related AI contracts are increasingly lucrative and strategically important as the Pentagon accelerates deployment of machine learning systems in intelligence analysis, logistics, and battlefield operations.

A court ruling that scrutinizes the procurement process for high-value AI contracts could shape how future awards are evaluated, particularly in programs involving classified capabilities.

For now, key details remain sealed, leaving unanswered questions about the legal arguments at the center of the dispute and the potential impact on one of the Pentagon’s largest AI data initiatives.