Strategy chairman and Bitcoin advocate Michael Saylor has pushed back against critics who argue that companies holding Bitcoin are acting recklessly.

In a recent podcast, he compared corporate treasury Strategies to individual investing, arguing that ownership levels vary, but the underlying decision to hold BTC is rational regardless of company size or business model.

According to Saylor, companies today face limited attractive options for idle funds. Traditional instruments such as government treasuries offer low returns, while stock buybacks can fail to create value if the underlying business is struggling. He therefore argues that Bitcoin represents one of several possible alternatives, particularly for firms that can tolerate sharp price swings.

The Bitcoin advocate further stated that a company running at a loss could still improve its overall financial position if the value of its Bitcoin holdings rises faster than its operating losses. “If you’re losing $10 million a year but making $30 million in Bitcoin gains, didn’t I just save the company?”, he added.

“The Bitcoin community tends to eat its young,” Saylor said, adding that companies that hold Bitcoin are often held to a different standard than those that avoid the asset altogether.

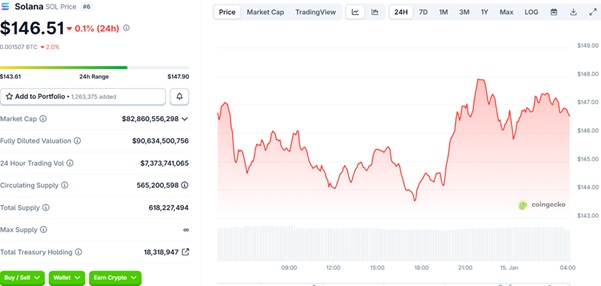

His comment comes as CoinGecko’s annual report revealed that crypto treasury companies were among the year’s biggest buyers even as prices fell. Their balance sheets grew sharply, and their actions left a clear mark on supply and markets.

Reports disclose that these treasury firms deployed close to $50 billion into Bitcoin, Ethereum, and other tokens during 2025. At the start of the year, treasuries held more than $56 billion in crypto. By January one, 2026, that figure had risen to $134 billion, a gain of 137%. This buying helped push institutional ownership higher, with treasuries holding more than 5% of both Bitcoin and Ethereum supply by year-end.

94-Year-Old Fast Food Chain Steak ‘n Shake, stated on Saturday that it increased its Bitcoin (BTC) exposure and reiterated that its same-store sales have risen “dramatically” ever since it began accepting Bitcoin payments about eight months ago. In its post on X on Friday, the company said all Bitcoin sales are directed into its Strategic Bitcoin Reserve (SBR) and that it has now increased its Bitcoin stack by $10,000,000.

Data from public disclosures shows that listed companies collectively hold about 1.1 million BTC, representing roughly 5.5% of the 19.97 million coins currently in circulation. Strategy remains the largest public holder, with 687,410 BTC, according to Bitcoin Treasuries.

These figures help explain why corporate Bitcoin purchases draw significant attention from both markets and regulators. When companies accumulate large positions, the move is no longer seen as experimental; it becomes a material part of how their financial health is assessed.

Market observers remain divided. Some view large Bitcoin positions as a sign of strong conviction and long-term thinking. Others see them as a concentration risk that introduces additional volatility into corporate earnings and valuations.

As more firms adopt Bitcoin as a treasury asset, scrutiny is likely to increase. Once holdings reach the hundreds of thousands, the choice becomes central to how investors judge a company’s financial strategy.

Outlook

Looking ahead, corporate Bitcoin adoption is likely to remain a polarizing but increasingly influential trend. As more companies allocate meaningful portions of their treasuries to digital assets, the debate will shift from whether firms should hold Bitcoin to how they manage the risks associated with it.

Regulatory scrutiny is also expected to intensify. With treasuries now controlling over 5% of Bitcoin and Ethereum’s circulating supply, policymakers may view corporate accumulation not just as a financial decision, but as a systemic factor capable of influencing markets.